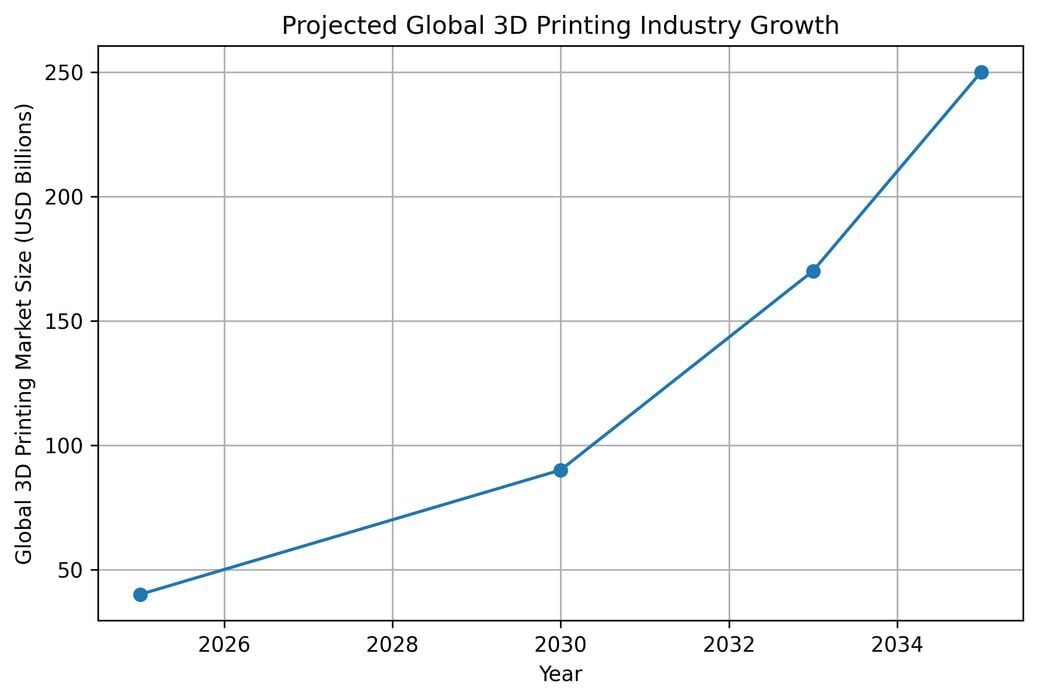

Projected global 3D printing market growth based on aggregated industry forecasts [Source: ChatGPT]

Projected global 3D printing market growth based on aggregated industry forecasts [Source: ChatGPT]

Charles R. Goulding and Preeti Sulibhavi argue that after years of uneven progress, 3D printing’s animal spirits have returned, driving rapid adoption across aerospace, medical, and emerging high-growth sectors.

Economists use the term animal spirits to describe the confidence and energy that push industries forward. It’s not just about data or forecasts. It’s about belief, willingness to invest, and the sense that something is finally breaking loose.

After years of uneven progress, the 3D printing industry is showing clear signs that those animal spirits have returned.

From our vantage point—researching…

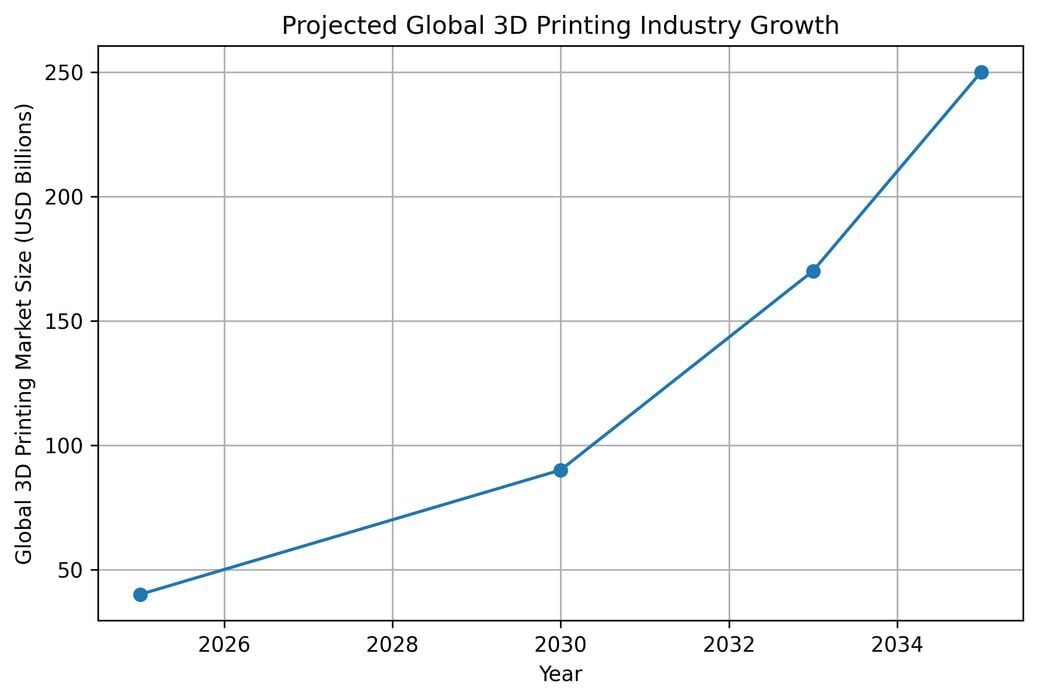

Projected global 3D printing market growth based on aggregated industry forecasts [Source: ChatGPT]

Projected global 3D printing market growth based on aggregated industry forecasts [Source: ChatGPT]

Charles R. Goulding and Preeti Sulibhavi argue that after years of uneven progress, 3D printing’s animal spirits have returned, driving rapid adoption across aerospace, medical, and emerging high-growth sectors.

Economists use the term animal spirits to describe the confidence and energy that push industries forward. It’s not just about data or forecasts. It’s about belief, willingness to invest, and the sense that something is finally breaking loose.

After years of uneven progress, the 3D printing industry is showing clear signs that those animal spirits have returned.

From our vantage point—researching and writing four 3D printing blogs each week and working closely with firms that actively deploy additive technologies—the shift is hard to miss. Clients are moving from experimentation to execution. Internal pilots are becoming production programs. Conversations that once centered on “if” are now focused on “how fast” and “how far.”

Market data supports what we are seeing in practice. Multiple industry forecasts project strong, sustained growth for 3D printing over the next decade. Estimates vary, but most point to compound annual growth rates above 20 percent, with the global market expected to expand from roughly US$40 billion today to anywhere from US$170 billion to more than US$250 billion by the mid-2030s. That level of expansion reflects more than enthusiasm—it reflects adoption.

Where Growth Is Concentrating

Not all sectors are moving at the same pace. The strongest growth continues to come from aerospace, automotive, and medical applications, where 3D printing has moved beyond prototyping and into qualified, repeatable production.

In aerospace, additive manufacturing enables lightweight, high-performance components that reduce part count and improve fuel efficiency. In automotive, it shortens development cycles and supports customization without the tooling costs of traditional manufacturing. In medical applications, 3D printed implants, surgical guides, and dental products are increasingly standard practice rather than novelty.

At the November 13, 2025, AM Investment Forum, Scott Durham highlighted three additional areas expected to experience outsized growth:

- Thermal systems for data centers, where 3D printed heat exchangers and fluid systems offer design flexibility and performance advantages that conventional manufacturing cannot easily match.

- Satellites, particularly small and low-Earth-orbit platforms, where additive manufacturing reduces weight, cost, and assembly complexity.

- Semiconductor capital equipment, a sector that demands extreme precision and benefits from complex internal geometries enabled by 3D printing.

These segments are important because they sit at the intersection of advanced manufacturing and strategic infrastructure. Their adoption of 3D printing signals long-term confidence, not short-term experimentation.

A Welcome Shift After Years of Flat Growth

This renewed momentum represents a welcome change for an industry that spent much of the past decade treading water. Despite early hype, 3D printing often struggled to translate technical promise into consistent revenue growth. Many companies survived, but few thrived.

What’s different now is not just better machines or materials, but a set of long-term structural trends that support sustained adoption.

One of the most important is the growing emphasis on STEM education. From K-12 programs to universities and technical colleges, students are gaining hands-on exposure to 3D printing as part of standard curricula. These students enter the workforce already comfortable with digital design and additive workflows, lowering the barrier for adoption inside organizations.

Another powerful driver is the widespread use of 3D printing across all branches of the U.S. military. Additive manufacturing is now routinely used for tooling, spare parts, and field-level problem solving. As today’s service members transition into civilian roles, they bring real-world 3D printing experience into manufacturing, engineering, and entrepreneurship.

Consumer Scale Is No Longer Theoretical

For years, critics argued that 3D printing could never scale economically for consumer products. That argument is becoming harder to sustain.

Large-volume applications such as dental aligners, eyeglass frames, customized footwear, and jewelry are already being produced in the millions using additive methods. These are not prototypes or boutique items. They are revenue-generating, repeatable production lines built around digital manufacturing.

This shift matters because it changes how executives think about the technology. When 3D printing proves itself at consumer scale, it becomes easier to justify investment across other parts of the organization.Top of Form

Bottom of Form

Media Attention and Public Understanding

Another sign of renewed animal spirits is increased attention from mainstream media. Publications like The New York Times, The Wall Street Journal, and The Financial Times now cover 3D printing regularly, often framing it as part of broader industrial and economic trends rather than a standalone novelty.

At the same time, high-quality YouTube content has made the technology more accessible. Detailed “how-to” videos and application walk-throughs use vivid visuals to explain concepts that once felt opaque. This visibility matters. Technologies gain traction faster when people understand not just what they are, but how they are used.

The Need to Stay Focused

Rapid growth brings its own risks. The challenge for the 3D printing industry now is to stay focused and maintain momentum. That means resisting the temptation to oversell capabilities, continuing to improve reliability and repeatability, and investing in workforce development alongside hardware and software.

This moment also aligns with a broader economic need. As the labor market pushes workers to upskill and many recent college graduates face a difficult job environment, 3D printing offers a practical path forward. It sits at the intersection of design, engineering, software, and manufacturing. Skills learned in this field are transferable, durable, and increasingly in demand.

The Research & Development Tax Credit

The now permanent Research & Development Tax Credit (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a strong indicator that R&D-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits

Looking Ahead

The return of animal spirits to 3D printing is not a fleeting trend. It reflects a maturing industry finding its footing across critical sectors of the economy. Aerospace, medical, data infrastructure, satellites, and semiconductor equipment are not speculative markets—they are foundational ones.

If the industry can remain disciplined, continue to build talent, and focus on delivering real production value rather than hype, the coming decade may finally deliver on the long-promised potential of additive manufacturing. For 3D printing, animal spirits have returned. The question now is how far they can charge the industry forward.