©(c) provided by Benzinga

Investors with a lot of money to spend have taken a bullish stance on AeroVironment (NASDAQ:AVAV).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AVAV, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga’s options scanner spotted 8 uncommon options trades for AeroVironment. …

©(c) provided by Benzinga

Investors with a lot of money to spend have taken a bullish stance on AeroVironment (NASDAQ:AVAV).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AVAV, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga’s options scanner spotted 8 uncommon options trades for AeroVironment.

This isn’t normal.

The overall sentiment of these big-money traders is split between 62% bullish and 25%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $71,850, and 6 are calls, for a total amount of $227,300.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $250.0 to $290.0 for AeroVironment during the past quarter.

Analyzing Volume & Open Interest

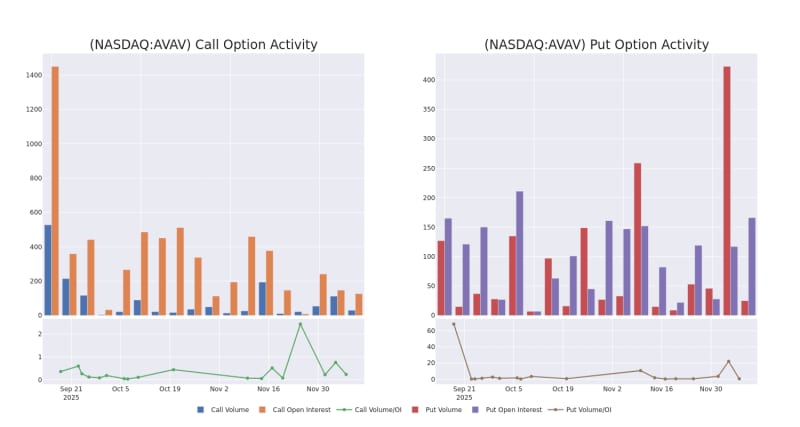

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AeroVironment’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AeroVironment’s significant trades, within a strike price range of $250.0 to $290.0, over the past month.

AeroVironment 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

About AeroVironment

AeroVironment Inc supplies unmanned aircraft systems, tactical missile systems, high-altitude pseudo-satellites, and other related services to government agencies within the United States Department of Defense as well as the United States allied international governments. The systems can help with security, surveillance, or sensing, and provide eyes in the sky without needing an actual person, or driver in the sky. The company is a defense technology provider delivering integrated capabilities across air, land, sea, space, and cyber. It develops and deploy autonomous systems, precision strike systems, counter-UAS technologies, space-based platforms, directed energy systems, and cyber and electronic warfare capabilities. Company operates in three segments: UxS, LMS, MW.

Following our analysis of the options activities associated with AeroVironment, we pivot to a closer look at the company’s own performance.

AeroVironment’s Current Market Status

- With a volume of 427,724, the price of AVAV is up 1.03% at $281.25.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 1 days.

Expert Opinions on AeroVironment

In the last month, 3 experts released ratings on this stock with an average target price of $402.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on AeroVironment with a target price of $400. * An analyst from Piper Sandler has revised its rating downward to Overweight, adjusting the price target to $391. * In a cautious move, an analyst from BTIG downgraded its rating to Buy, setting a price target of $415.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest AeroVironment options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.