Wearable (Watch) MicroLED Display Usage Set to Double Annually

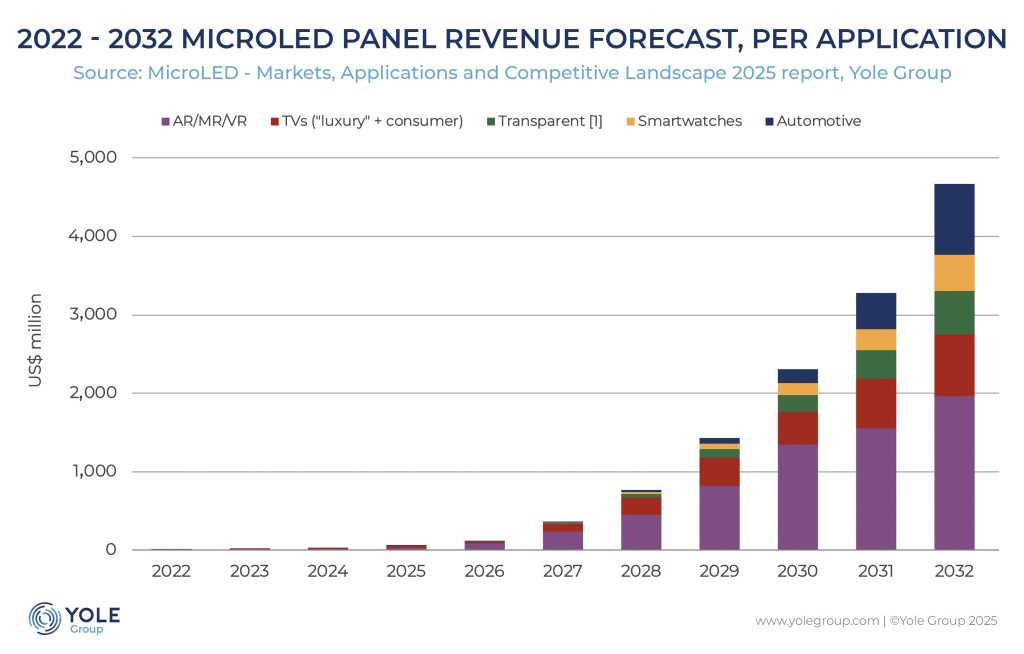

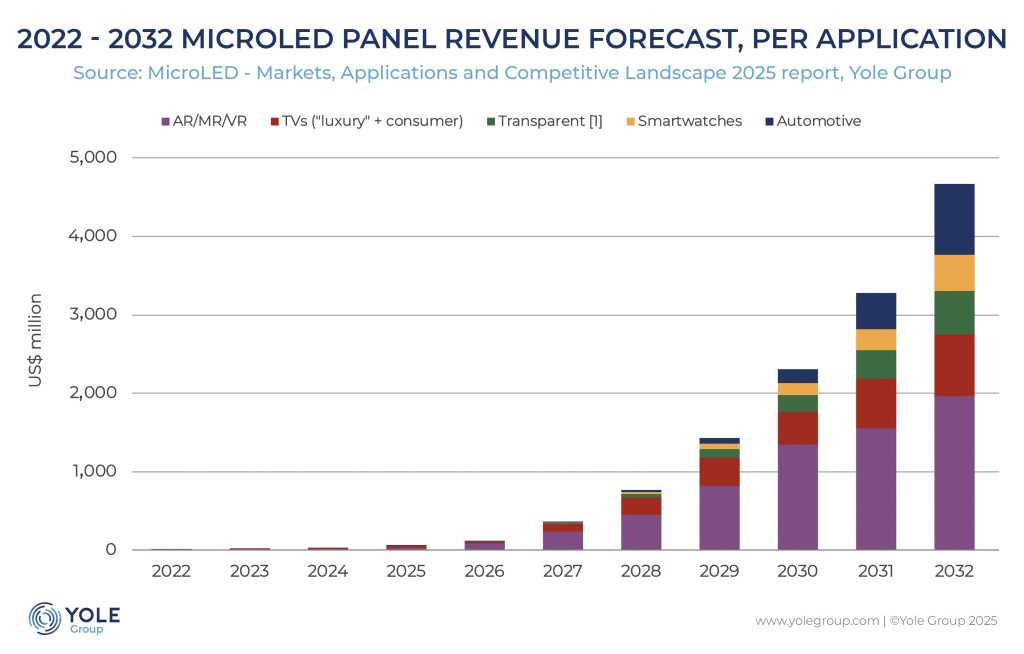

The next five years will see a significant shift in display technology as microLED moves from experimental development into mass-market commercialisation. According to the latest forecasts from the Yole Group, total annual revenue for microLED panels is projected to climb towards $5 billion by 2032.

AR and Wearables Leading the Charge

Initial growth is heavily focused on miniaturised applications where traditional OLED technology faces limitations. Smartwatc…

Wearable (Watch) MicroLED Display Usage Set to Double Annually

The next five years will see a significant shift in display technology as microLED moves from experimental development into mass-market commercialisation. According to the latest forecasts from the Yole Group, total annual revenue for microLED panels is projected to climb towards $5 billion by 2032.

AR and Wearables Leading the Charge

Initial growth is heavily focused on miniaturised applications where traditional OLED technology faces limitations. Smartwatches and AR/MR/VR microdisplays are the primary drivers, expected to account for well over half of all microLED revenue by 2032, with wearables comprising approximately $500 m.

The demand for these devices stems from several critical advantages offered by microLED:

- Superior brightness, contrast ratios, and shallow viewing angles for outdoor use.

- Enhanced energy efficiency (although not demonstrated by products released to date – Garmin Fenix 8 Pro microLED).

- Lightweight and compact design footprints.

While the market is currently in a pre-volume phase, industry experts like Yole Group predict that meaningful production volumes will begin between 2027 and 2028.

The Road to $5 Billion

The transition to high-volume manufacturing is not straightforward. Major industry players, including Samsung Electronics, Sony, and LG, are currently addressing challenges in yield rates for small-die sizes and the high production costs compared to established OLED panels.

Expansion into Automotive and Luxury Tech

Beyond the wearable market, microLED is set to make a significant impact on the automotive industry. The technology’s high durability and brightness make it ideal for next-generation dashboards and heads-up displays (HUDs). Additionally, the luxury TV market remains a key segment for those seeking the pinnacle of home cinema performance.

As manufacturing processes standardise and costs reduce, the 2030s could see microLED dominate high-end displays.

A Concluding Thought

A Concluding Thought

Analyst Ming-Chi Kuo estimatedApple was quoted $150 per panel in 2024, which contributed to the pause of its microLED Watch project. While $150 sounds high for a single component, early manufacturing yields are notoriously low. However, even if costs fall to the projected $50 mark by 2032, a $500m smartwatch market size implies only 10 million units annually.

Given that Apple already sells roughly 7-10 million Watch Ultra models each year, these forecasts suggest that microLED won’t be an outright OLED-killer just yet. Instead, it may remain a boutique technology reserved for a new tier of absolute top-tier “Pro” and “Ultra” models, rather than becoming the new standard for the entire industry.

This is precisely how Garmin positioned the Fenix 8 Pro microLED in 2025!

Reader-Powered Content

This content is not sponsored. It’s mostly me behind the labour of love, which is this site, and I appreciate everyone who follows, subscribes or Buys Me A Coffee ❤️ All articles are written by real people, fact-checked, and verified for originality using Grammarly’s AI and plagiarism tools. See the Editorial Policy for details. FTC: Affiliate Disclosure: Some links pay commission. As an Amazon Associate, I earn from qualifying purchases.

With 20 years of testing Garmin wearables and competing in triathlons at an international age-group level, I provide expert insights into fitness tech, helping athletes and casual users make informed choices.