Happy Monday!

UK energy regulator Ofgem just dropped a £28bn blueprint for the UK’s net-zero grid, and it reflects the politics of power, prices, and who pays for the energy transition. Our deep dive below.

In deals, $2.2bn for lithium extraction**, $800m** for nuclear project development across two deals, and $300m for solar and battery development.

In other news, blue hydrogen project cancellations, automaker fuel efficiency standard rollbacks, and some Colorado and Texas state energy legislation.

****Don’t miss out: ****Take our

! Give us your takes on next year’s climate long shots and table stakes for the chance to win a $50 gift card.

Thanks for reading!

**Not a subscriber …

Happy Monday!

UK energy regulator Ofgem just dropped a £28bn blueprint for the UK’s net-zero grid, and it reflects the politics of power, prices, and who pays for the energy transition. Our deep dive below.

In deals, $2.2bn for lithium extraction**, $800m** for nuclear project development across two deals, and $300m for solar and battery development.

In other news, blue hydrogen project cancellations, automaker fuel efficiency standard rollbacks, and some Colorado and Texas state energy legislation.

****Don’t miss out: ****Take our

! Give us your takes on next year’s climate long shots and table stakes for the chance to win a $50 gift card.

Thanks for reading!

Not a subscriber yet?

📩 Submit* deals and announcements for the newsletter at [email protected].*

💼 Find or share roles on our job board here.

CTVC*** is powered by Sightline, the tactical market intelligence platform for energy and investment decision-makers.***

Ofgem’s offering

The UK wants to be the first major economy to run a net-zero power system. Last week, energy watchdog Ofgem laid out what that takes in its next 5-year price-control plan, RIIO-3, which sets funding and performance rules for Britain’s gas and high-voltage electricity networks from 2026 to 2031. The decision previews the politics of grid buildout, affordability, and investor returns that electrifying economies now face.

What happened

Ofgem approved an initial £28bn ($37.3bn) package: £17.8bn ($23.7bn) for gas networks and £10.3bn ($13.7bn) for electricity transmission. It’s the opening tranche of a buildout that could reach £90bn as additional projects come up for review.

RIIO-3 also resets investor terms, setting a 6.1% real cost of equity at 60% gearing for transmission. Plus, electricity transmission owners get funding to advance ~80 projects, from new lines and HVDC cables to substations and early-stage work for offshore wind, storage, and hydrogen-ready infrastructure.

There’s a household impact: Ofgem expects bills to rise by ~£108 by 2031, though system benefits should narrow the long-run effect to £30/year as imported gas falls and constraint costs ease.

Why it matters

The UK’s aggressive decarbonization plans need to come with an aggressive grid plan. Shuttering coal plants plus high imported gas costs mean grid operators need to rapidly find better ways to incorporate the country’s DERs and leverage commercial and industrial demand response to provide stable, clean power.

Normally, this calls for massive grid infrastructure investment, but the UK already faces a budget shortfall and rising taxes. It needs **private capital and novel technologies to allow it to do more with less. **Return levels shape this: Too low, capital stays on the sidelines, slowing the £90bn transmission buildout. Too high, households pay more.

Ofgem’s last 5-year plan, RIIO-2, aggressively cut the cost of equity for network companies and the investors backing them. RIIO-3 shifts closer to market reality: a 6.1% real cost of equity at 60% gearing for transmission. Investors still call it light, but it’s an adjustment to higher base rates and greater perceived risk.

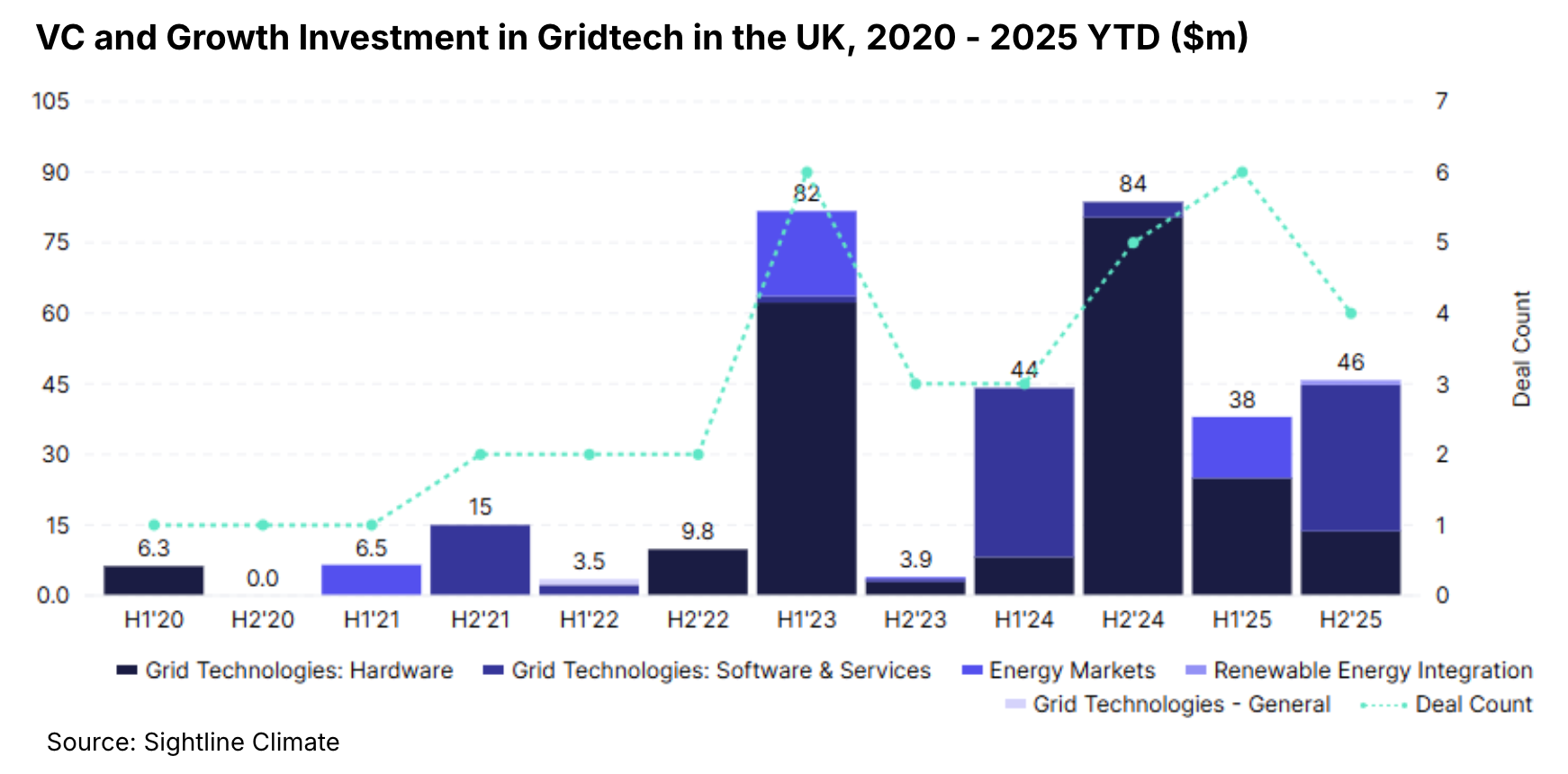

RIIO-3 also creates a proving ground for emerging gridtech. UK VC gridtech investment has stayed high. Startups want to pilot programs, proving cost savings and capacity increases. Which early-stage techs can compete at today’s cost of capital, and which remain too expensive for networks to justify? With the EU, US, and Australia facing similar dilemmas, many are watching for early benchmarks on structuring returns, managing affordability, and still securing the transmission buildout required for electrification.

Key takeaways

- Affordability vs. acceleration. RIIO-3 raises near-term bills to secure long-term system benefits, but the political headroom is thin. Regulators may need new cost-sharing tools to keep the buildout moving.

- **Return levels determine pace. **A 6.1% real equity return improves investability, but infrastructure funds, pension schemes, and sovereigns compare it with unregulated assets and other geographies. Undershoot, projects stall; overshoot, customers absorb costs.

- **Networks become climate actors. **Their choices determine connection queues, curtailment, and reliability. Higher allowed returns give operators room to adopt early-stage stability tools that can reshape system planning — if they compete on cost.

[Read a longer version of this newsletter here.]

Deals of the Week (12/01-12/08)

Late-Stage / Growth

⚡ Antares, a Los Angeles, CA-based compact nuclear microreactors developer, raised $71m in Series B funding from Shine Capital, Alt-Capital, Caffeinated Capital, and Industrious Ventures.

🔋 Modo Energy, a Birmingham, England-based battery analytics platform,raised $33m in Series B funding from Molten Ventures, ETF Partners, Fred Olsen Limited, and MMC Ventures.

⚒️ PH7 Technologies, a Vancouver, Canada-based sustainable extraction technology developer, raised $26m in Series B funding from Fine Structure Ventures, BASF Venture Capital, BHP Ventures, Calm Ventures, TDK Ventures, and other investors.

🔋 Mitra Chem, a Mountain View, CA-based li-ion battery manufacturer, raised $20m in Series B funding from GM Ventures and TechMet.

Early-Stage

⚡ Spark Cleantech, a Paris, France-based clean hydrogen producer, raised $35m in Series A funding from 360 Capital, Taranis, Asterion Ventures, and Île-de-France Reindustrialisation Fund.

🏭 Enerin, an Asker, Norway-based industrial heat pump manufacturer, raised $18m in Series A funding from Climentum Capital, Johnson Controls, Move Energy, The Footprint Firm, Momentum, and PSV Hafnium.

🏗 Modulus Housing, a Karachi, Pakistan-based modular affordable housing provider, raised $8m in Series A funding from Hero Enterprise, Sigma Partners, Srinath Ramakkrushnan, Kalaari Capital, Samarthya Investment Advisor, and other investors.

♻️ ScrapAd, a Madrid, Spain-based global metal recycling platform, raised $7m in Series A funding from Inclimo, Suma Capital, BStartup, and Faraday Venture Partners.

💨 Athian, an Indianapolis, IN-based carbon marketplace for livestock, raised $4m in Series A funding from Ajinomoto Co., Chipotle Mexican Grill, and Mondelēz International.

💨 Carbonova, a Calgary, Canada-based carbon nanofibers from CO2 developer, raised $4m in Seed funding.

Other

⚒️ Vulcan Energy Resources, a Perth, Australia-based geothermal lithium extraction service provider, raised a $2.2bn in PF Debt and PF Equity funding from KfW, ABN AMRO, BNP Paribas, European Investment Bank (EIB), Export Development Canada,and other investors.

⚡ Holtec Palisades, a Van Buren County, MI-based nuclear power operator, raised $400m in PF Equity funding from US Department of Energy (DOE).

⚡ Tennessee Valley Authority, a Knoxville, TN-based utility provider, raised $400m in PF Equity funding from US Department of Energy (DOE).

⚡ Ecoplexus, a San Francisco, CA-based utility-scale renewable energy developer, raised $300m in PF Debt funding from KKR and Sumitomo Mitsui Banking Corporation.

☀️ CSI Solar, a Guelph, Canada-based solar module manufacturer and energy storage developer, raised $50m in Asset Sale funding from Canadian Solar.

Exits

🔋 Stellar Energy Digital, a Jacksonville, FL-based custom energy solutions provider, was acquired by Trane Technologies for** an undisclosed amount**.

⚡ Resideo Grid Services, a Scottsdale, AZ-based grid reliability solutions provider, was acquired by EnergyHub for an undisclosed amount.

♻️ Filco Carting Corp, a Closter, NJ-based waste management services provider, was acquired by Interstate Waste Services for an undisclosed amount.

🥩 Stockeld Dreamery, a Solna, Sweden-based plant-based cheese producer, was acquired by Bettani Farms for an undisclosed amount.

⚒️ Tactical Resources, a Vancouver, Canada-based mineral explorator and developer, announced a SPAC merger with Plum Acquisition Corp. III.

Funds

💰 MKB Partners, a Montreal, Canada-based growth equity firm, closed **$225m **for MKB Partners Fund III from institutional and private investors, focusing on energy transition sectors including power, mobility, built environment, and industrial efficiency.

This is a sample of the deals available for Sightline Clients. Can’t get enough deals?

In the News

**Exxon cancelled its plan for a massive blue-hydrogen plant in Texas, amid a broader wave of setbacks **for blue hydrogen projects which have been hit especially hard by federal funding cuts and weak customer demand. These projects remain costly, about one-third higher than gray hydrogen, which also faces steep cost barriers. The green premium is disappearing as natural gas remains cheaper while innovation hasn’t significantly lowered production costs.

Following the repeal of federal EV tax credits, the Trump administration has rolled back Biden-era fuel efficiency standards, lowering the required average mileage for cars and light trucks to 34.5mpg by 2031, down from 50.4mpg, and eliminating fines for noncompliance. Now free to produce more pickups and SUVs, automakers that neglect smaller cars and electric vehicles could be vulnerable if oil prices rise and risk falling out of sync with global EV markets.

In state news, Colorado regulators have mandated that investor-owned gas utilities cut carbon emissions by 41% from 2015 levels by 2035, rejecting lower targets proposed by utilities and state agencies to better align with the state’s 2050 decarbonization goal. The rule encourages utilities to adopt heat pumps, electrification, geothermal heating pilots, and thermal energy networks. If achieved, the 2035 target could avoid 45.5m metric tons of greenhouse gases and generate nearly $1bn in economic benefits.

In more state news, Texas’ large-load queue has ballooned to 225GW (+30GW in just two months, more than double its 99GW in February), as the ERCOT Board prepares to vote next week on the eastern half of Texas’s first 765-kV transmission buildout and new PUC rules that would tighten large-load interconnection requirements, including repeat-request limits, proof of site control, backup-generation plans, and a $50,000/MW deposit. Data center load growth is forcing accelerated grid expansion and more stringent siting and financing rules that could both streamline the queue and reshape where large electrified loads ultimately locate.

Vulcan Energy Resources secured a $2.56bn financing package to begin construction of its Lionheart lithium and renewable energy project in Germany’s Upper Rhine Valley. The project, expected to be the largest DLE operation in the world, will supply lithium from 2028 for 10 years to companies including Stellantis, LG Corp, Umicore, and Glencore, as momentum for DLE continues.

Redwood Materials is pivoting from its large-scale battery recycling projects to refocus on repurposing EV batteries for grid-scale batteries, as the US EV market stalls and data centers become a market opportunity. The company recently raised $350m in Series E funding and began operations at a $3.5bn South Carolina plant to supply critical minerals, even as its planned cathode active material plant in Nevada remains incomplete.

Pop-up

LA says bye to coal’s toxic energy.

Innovate UK and partners launch an Advance Market Commitment (AMC) on low-carbon concrete, before the blocks even hit the ground.

Big fish in a dying pond: Sharks and rays finally receive global endangered species protections.

As global wine demand reaches new lows, France finds ways to keep spirits high.

Flood warnings were drying up sales, so Zillow quietly deleted climate risk scores from listings.

Electrify your house now, before the government pulls the plug on tax credits.

Self-driving cars slash vehicle-related deaths.

Green is the new gold: the global green economy just hit $5 trillion!

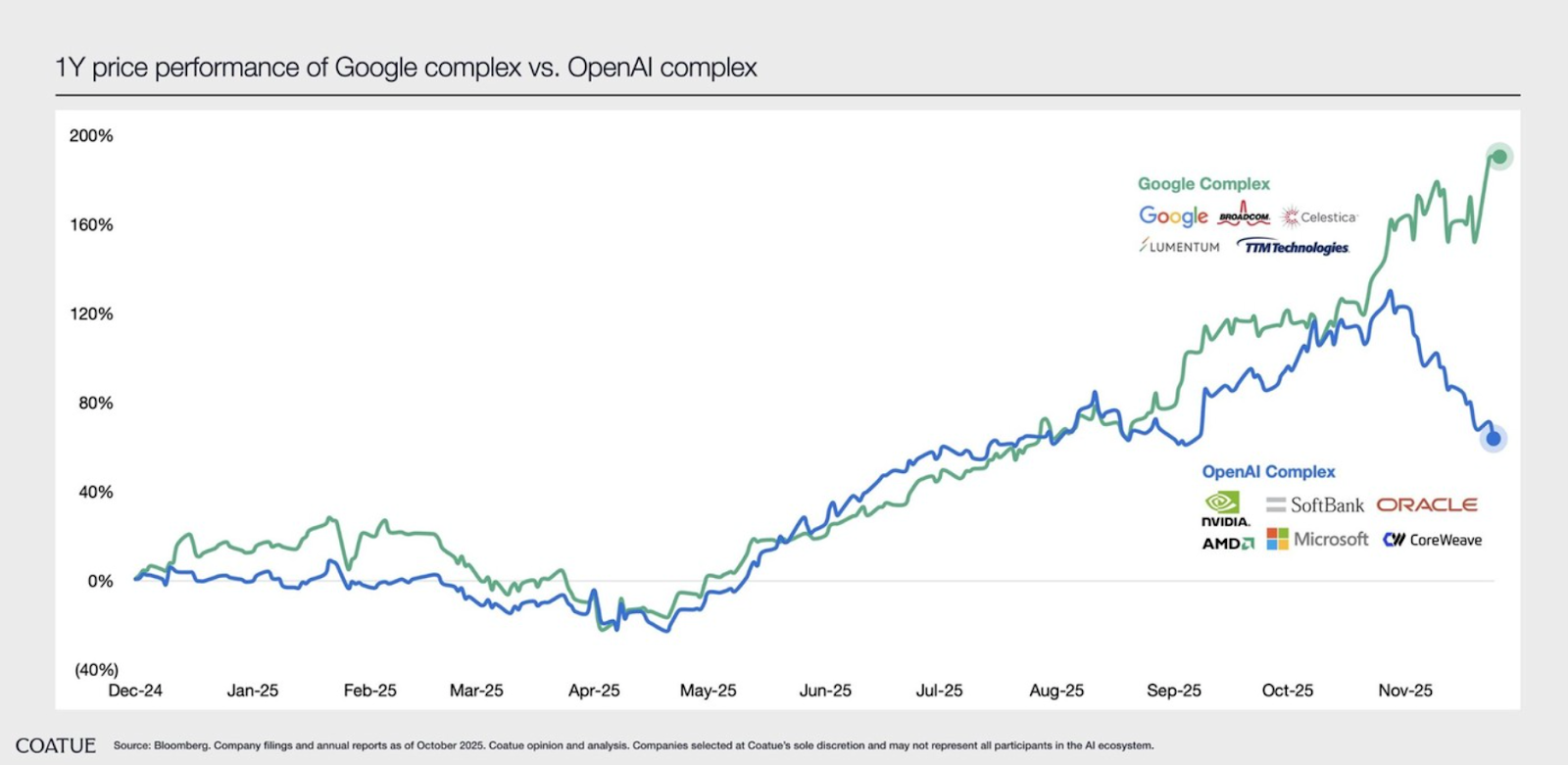

Google vs. ChatGPT: Sam Altman issues an AI code red.

Source: Longbridge.

Source: Longbridge.

Opportunities & Events

📅 Climate Board Games & Dinner: Want to help tackle climate change but don’t have the time to become a climate scientist? Join Climate Fresk to play a climate board game and share a dinner made by refugee chefs in Chelsea Market, NY on Wednesday, December 10 from 5:30-8:30pm.

💡 AI for Canadian Energy Innovation: Canada is funding high-impact projects that catalyze national expertise to develop and use novel AI solutions to accelerate domestic energy innovation. Apply by Thursday, December 11.

📅 Green & Smart Networking Night: Join Business Networking London on **Friday, December 12 from 6:30-9pm **for a networking event bringing together entrepreneurs, tech innovators, and sustainability experts to explore the transformative power of AI and technology in addressing environmental challenges.

📅 Creative Visioning Workshop: Envision climate transformations and explore relationships in the arts and culture sector at a creative visioning workshop in London, UK on Wednesday, December 13 from 11am-1pm.

Jobs

Head of Trading @Restoration Climate

Finance Lead @Frontier & Stripe Climate

People Director @Climate X

Senior Enterprise Account Executive @Climate X

Summer Intern @Fervo Energy

Full-Time Investor @G2 Venture Partners

Summer Intern @G2 Venture Partners

Mid Market Account Executive @AssetWatch

*📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead! *