Scan the headlines and you might think that Western economies are on the verge of an ‘inheritance explosion’. Popular narratives warn of a looming ‘great wealth transfer’ as baby boomers pass down trillions, and some commentators fret about a new era of ‘inheritocracy’ in which an idle rich class dominates by virtue of birthright. The storyline is alarming: booming bequests funnel ever more unearned riches to heirs, widening inequality and sapping economic dynamism. This notion fits a broader anxiety of our age, that capitalism is hardening into a hereditary hierarchy, undermining the meritocratic ideal.

Yes, inheritance values are rising across the Western world. But this does not pose an existential threat to the economy, nor is it necessarily a drag on growth. Far from being a fe…

Scan the headlines and you might think that Western economies are on the verge of an ‘inheritance explosion’. Popular narratives warn of a looming ‘great wealth transfer’ as baby boomers pass down trillions, and some commentators fret about a new era of ‘inheritocracy’ in which an idle rich class dominates by virtue of birthright. The storyline is alarming: booming bequests funnel ever more unearned riches to heirs, widening inequality and sapping economic dynamism. This notion fits a broader anxiety of our age, that capitalism is hardening into a hereditary hierarchy, undermining the meritocratic ideal.

Yes, inheritance values are rising across the Western world. But this does not pose an existential threat to the economy, nor is it necessarily a drag on growth. Far from being a feudal relic that cements a permanent aristocracy, inherited wealth has changed in character and scale over time. Its relationship with growth and inequality is more complex than many assume.

For most people, inherited family wealth consists of a parents’ home or long-term savings. Occasionally, it is a family enterprise, and when such firms survive not just a few years but several decades, they reflect a form of entrepreneurship that thinks in generations rather than quarters. Recent research on inequality also suggests that inheritance can, in fact, reduce wealth gaps, as bequests tend to matter far more for less wealthy heirs. Taxing inheritances may seem like a neat solution to curb inequality, but in practice inheritance taxes have often proven inefficient and inequitable. As a result, many countries that once relied on them have quietly abandoned these taxes in favour of more effective capital income taxes targeting profits, dividends and realised gains, rather than wealth stocks and bequests.

In this essay, we take a reflective journey through the latest evidence and historical trends on inherited wealth. We explore how the role of inheritance has evolved over the past century, how bequests affect the distribution of wealth within and across generations, and whether inheritance taxation has a constructive role to play in a modern tax system. A nuanced picture emerges. While inheritance is not without challenges, it often fosters long-term investment and continuity, and attempts to heavily tax or curtail it have frequently backfired. Perhaps instead of fixating on what is passed down, we should focus on expanding who gets to build and eventually inherit wealth, through policies that spur growth, entrepreneurship and broad-based opportunity.

The dominant description of wealth in the late neoliberal era is one of burgeoning dynastic capitalism. In this view, the postwar period of relative equality has given way to a resurgence of inherited wealth. Economists have documented a rise in aggregate inheritance flows, that is, the total value of bequests and gifts each year, relative to national income. In countries such as France and the United Kingdom, inheritance flows that were modest in the mid-20th century have climbed back toward levels last seen in the early 1900s. My own historical data for Sweden show a similar pattern.

To critics, this trend signals a return to an era when economic rank was literally inherited, an age of rentier elites and ossified social mobility. Thomas Piketty, who has generated many of these long-run data series, warns of a revival of ‘patrimonial capitalism’, a society in which inherited fortunes overshadow self-made wealth. The term ‘inheritocracy’, recently highlighted in The Economist, neatly captures the fear of a society governed by heirs rather than merit.

The worry is that capital in the hands of less talented heirs than the original wealth creators could slow productivity

Several macroeconomic forces lie behind these trends. Western societies have grown both older and richer. Longer lifespans and higher accumulated wealth mean that older generations are bequeathing larger sums than their parents did. At the same time, wealth-to-income ratios in advanced economies have risen substantially alongside slower income growth. When total wealth swells, through rising stock markets, housing values and pension assets, even a constant propensity to leave bequests translates into larger inheritances relative to GDP. In this sense, part of the perceived ‘inheritance boom’ is simply a byproduct of prosperity. This nuance, however, is often lost in alarming headlines declaring that trillions will soon be ‘passed on’ to heirs.

Critics argue that rising inherited wealth undermines both fairness and efficiency. The fairness concern is straightforward: large inheritances confer advantages on people who did nothing to earn them, widening the gap between those born into affluence and those born to modest means. The efficiency concern is that capital in the hands of heirs, potentially less talented or motivated than the original wealth creators, could slow productivity. These worries are not new. A century ago, thinkers from Andrew Carnegie to European social democrats warned against concentrated dynastic wealth. Today, similar anxieties have returned, fuelling the belief that unchecked inheritance will entrench a new aristocracy and sap economic dynamism.

Before going further, it is worth clarifying what economists typically mean by ‘inheritance’, and what they do not. In the standard literature, inheritances are defined as the total net-of-tax value of all material transfers received at death, including bequests and life-insurance payouts. If a decedent has a positive net worth, the estate is distributed to heirs according to succession rules that usually reflect legal and genetic relationships. What is included depends on national law, but in most cases the focus is on tangible and financial assets: housing, land, businesses, stocks, bonds, and cash.

This definition deliberately excludes other powerful forms of intergenerational transmission. Trust arrangements that bypass estates, certain foundations, or wealth shifted well before death may fall outside the taxable inheritance base in some countries. More broadly, families transmit advantages that are never counted as inherited wealth at all: education, social norms, personal connections, reputational capital, and ultimately genetic endowments. These forms of transmission can generate substantial economic value for recipients, but they are conceptually distinct from inherited wealth as measured in economic statistics and taxed in fiscal systems. The analysis that follows is therefore concerned with a specific and narrow phenomenon, material wealth transferred at death, not with the full universe of intergenerational advantage.

Turning to what theory and the actual evidence show, a more nuanced picture emerges. While inheritance flows have increased as a share of national income since the mid-20th-century low point, they are not the harbinger of a new Gilded Age that many suppose.

Family legacies still matter but much more wealth today is self-made within a generation

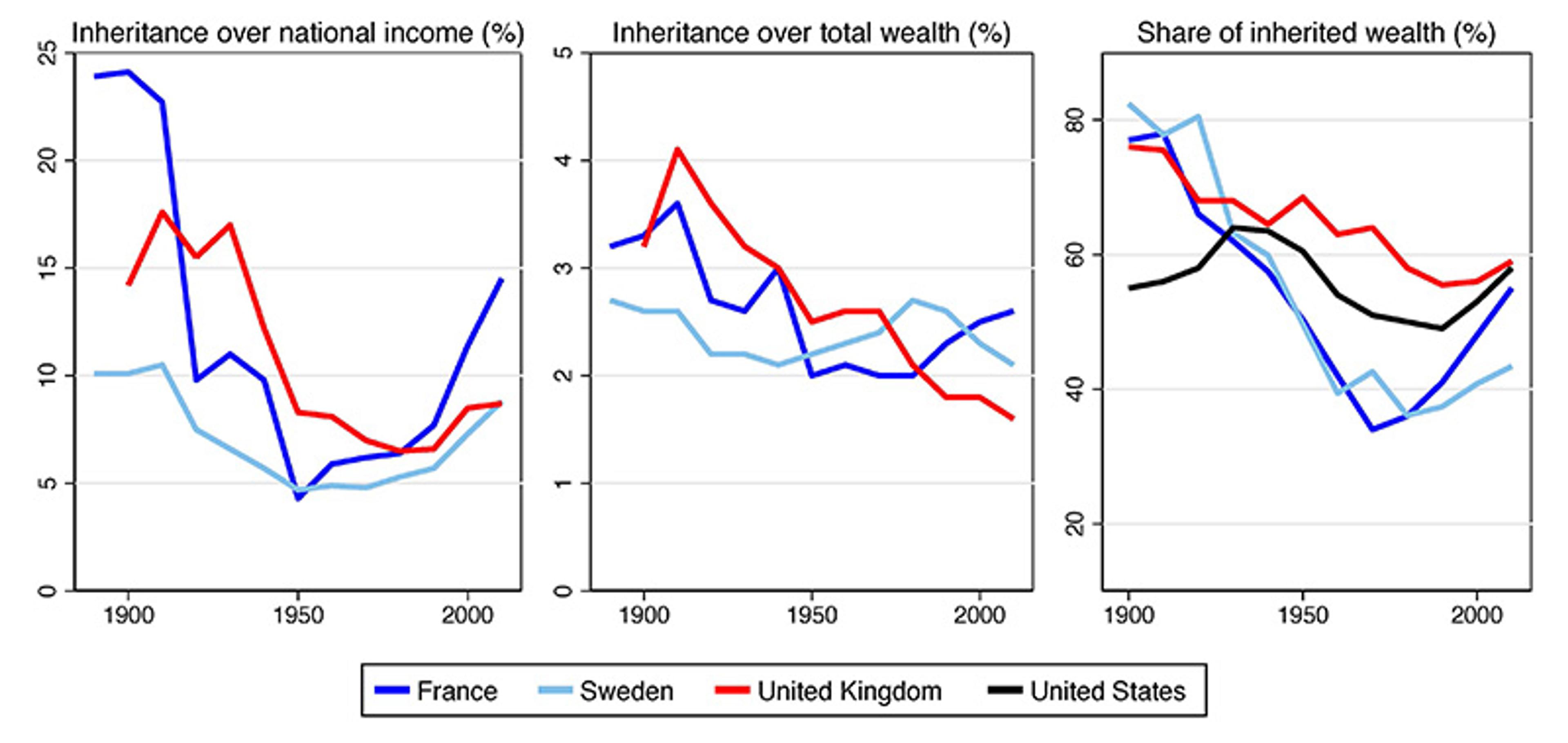

Figure 1 below illustrates this complexity using long-run data for France, Sweden and the UK. Around 1900, inheritance flows amounted to roughly 15-25 per cent of national income, compared with 10-15 per cent today. Meanwhile, inheritance flows relative to total private wealth have declined steadily over the past century, with no recent reversal. Most strikingly, while roughly 80 per cent of private wealth in early 20th-century Europe was inherited, that share has fallen to between 40 and 60 per cent, whereas the US has maintained a similarly lower level throughout the past century. In other words, a far greater share of wealth is now accumulated over individual lifetimes through work, saving, and entrepreneurship.

This evidence tells a dual story. Inheritance remains economically significant in advanced economies, about 10 per cent of national income is transferred annually from the dead to the living, and roughly half of private wealth has inherited origins. Family legacies still matter. Yet, compared with a century ago, modern economies are markedly more dynamic. Much more wealth today is self-made within a generation, reflecting new savings, business formation, and the democratisation of asset ownership. This shift from old capital to new capital has been more pronounced in some countries than others, but the general direction is clear.

Figure 1: The historical evolution of inheritance in Western economies. From ‘Inherited Wealth over the Path of Development: Sweden, 1810-2016’ (2020) by Henry Ohlsson, Jesper Roine and Daniel Waldenström, Journal of the European Economic Association and, for the US, ‘On the Share of Inheritance in Aggregate Wealth: Europe and the USA, 1900-2010’ (2017) by Facundo Alvaredo, Bertrand Garbinti and Thomas Piketty, Economica

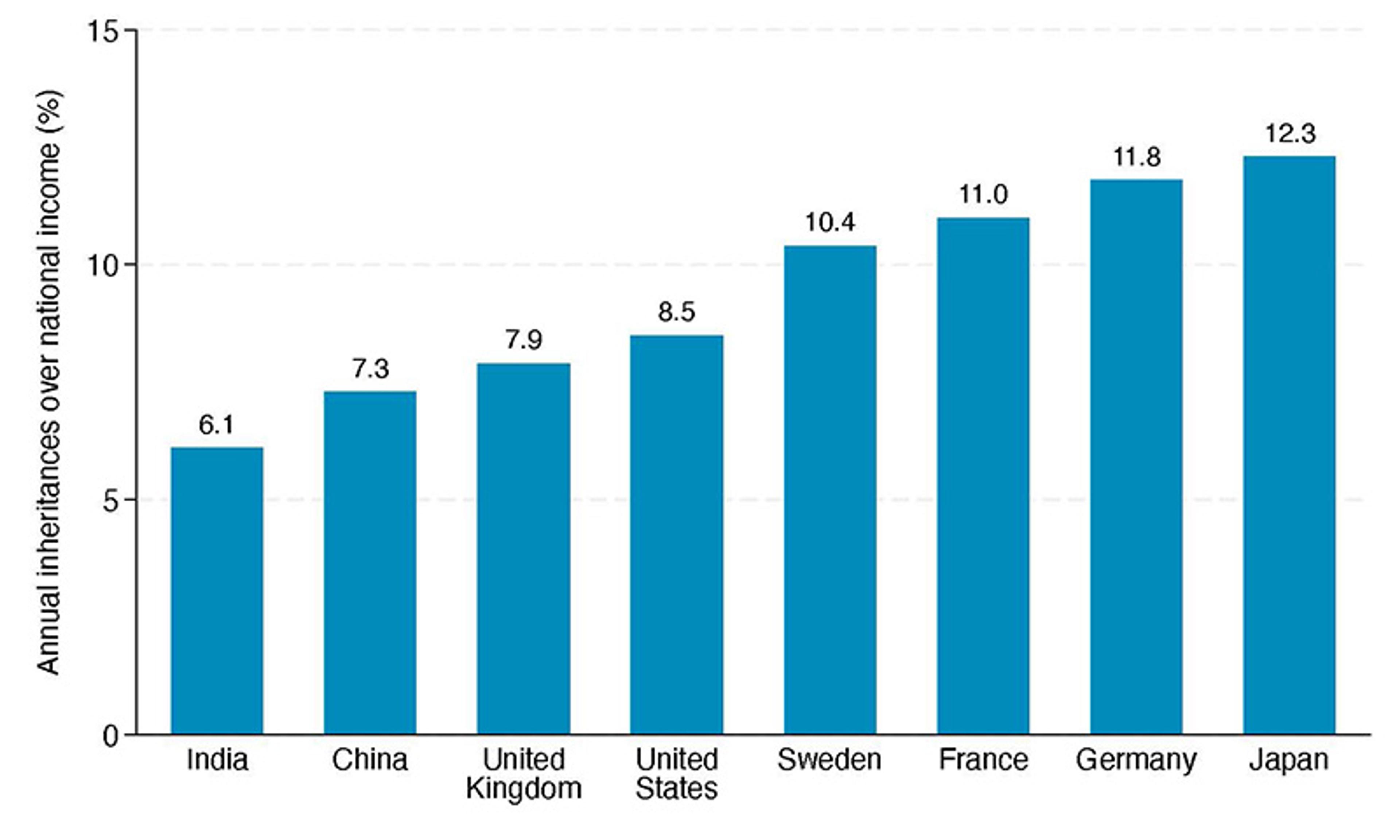

Going beyond Western countries, Figure 2 below presents newly estimated ratios of annual inheritance flows to national income for Japan, China and India, alongside selected Western economies. These Asian estimates are constructed using the same methodology and publicly available macroeconomic data. In fast-growing, lower-wealth economies such as China and India, inheritance flows amount to a relatively modest 6-7 per cent of national income. By contrast, in richer but more slowly growing economies like Japan, Germany and France, inheritance flows are nearly twice as large, at around 11-12 per cent.

This cross-country comparison reinforces the broader mechanism underlying inherited wealth. Sustained capital accumulation raises wealth stocks and, over time, the volume of bequests. In China and India, mortality rates are comparatively low while income growth is rapid, limiting inheritance flows relative to income. In mature economies, higher accumulated wealth and slower income growth generate larger inheritances. The UK stands somewhat apart, with a lower inheritance ratio reflecting both subdued wealth levels and weak income growth. Overall, what appears as an ‘inheritance boom’ is largely a reflection of where countries sit along the development path.

Figure 2: Inheritance flows around the world (per cent of national income). Note: inheritance-income ratios are calculated using data on aggregate wealth, population mortality and an assumed average wealth ratio of the diseased to the living, following the stylised model framework presented in ‘On the Long-Run Evolution of Inheritance: France, 1820-2050’ (2011) by Thomas Piketty, Quarterly Journal of Economics

What is the actual impact of inheritance on economic inequality? Does it entrench divides, or could it even help narrow them? At this point, some concrete magnitudes help anchor the discussion. What counts as ‘wealthy’ varies widely across countries. In the United States, households in the top 10 per cent of the wealth distribution hold net assets of roughly $1.6 million or more, while entry into the top 1 per cent requires around $11 million. In France, Germany and Sweden, the top decile threshold is closer to €600,000-750,000. Median household wealth, by contrast, is below €200,000 in most European countries, and closer to $190,000 in the US. In Asia, data on wealth thresholds are more uncertain and partly missing, but recent estimates point to lower average wealth levels overall. In Japan, the top decile may begin at roughly $300,000, while in China and India the top 10 per cent typically hold wealth measured in the low hundreds of thousands of dollars rather than in the millions.

The same variation applies to what counts as ‘large’ inheritances across countries. In Sweden, the median inheritance is roughly equivalent to half a year’s average disposable income, while inheritances in the top decile are often five to 10 times that amount. In the US, most inheritances are modest, with around half of heirs receiving less than $50,000, while estates exceeding $500,000 account for the majority of total inherited value. In France and Germany, inheritances above €500,000 are uncommon but economically significant, placing heirs immediately in the upper tail of the wealth distribution.

A common assumption, prominently associated with Piketty, is that declining inheritance paved the way for meritocracy, while rising inheritance reverses that progress. The logic seems intuitive: rich parents leave large bequests, poor parents leave little, and wealth disparities persist or grow across generations.

For heirs lower in the distribution, smaller bequests often double or triple net worth

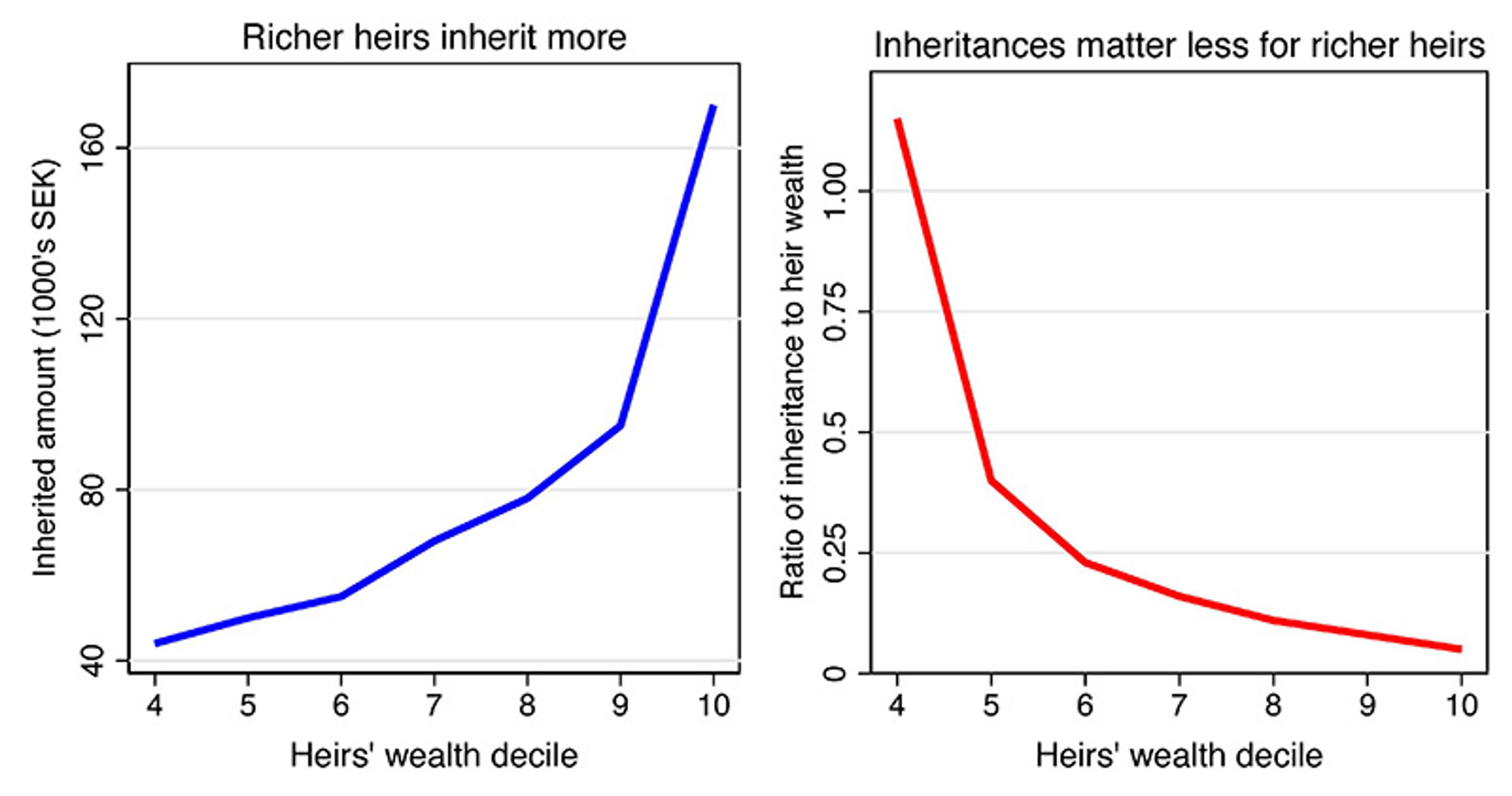

There is truth in this, but it is incomplete. Wealthy heirs do inherit more in absolute terms. Yet those inheritances often represent only a small addition to already large asset holdings. By contrast, when middle- or lower-wealth individuals inherit, the bequest can be transformative. Inheriting $100,000 barely matters for someone with $10 million, but it can be life-changing for someone with $50,000.

Empirical studies across several countries, including the US, Denmark and Sweden, confirm this pattern. Figure 3 below, based on comprehensive Swedish register data, shows that, while heirs in the top wealth decile receive the largest inheritances in kronor terms, these sums constitute only a modest fraction of their existing wealth. For heirs lower in the distribution, smaller bequests often double or triple net worth. As a result, inheritance compresses the wealth distribution among heirs. In Sweden, inheritances reduced the Gini coefficient of wealth inequality by around 7 per cent during the study period, an effect comparable to that of a major stock market downturn.

Figure 3: Inheritance and heirs’ wealth: larger gaps and smaller inequality. From ‘Inheritance and Wealth Inequality: Evidence from Population Registers’ (2018) by Mikael Elinder, Oscar Erixson and Daniel Waldenström, Journal of Public Economics

Let’s be clear: not everyone receives an inheritance. Those who lack wealthy parents, of course, will not get this boost. This is one reason inheritance can be seen as creating inequality of opportunity between people who come from different family circumstances. But, among those who do inherit, the evidence suggests inheritance tends to even out the distribution a bit, rather than skewing it further. It’s a reminder that most parents, not just the super-rich, leave something to their kids, and those modest bequests, maybe a paid-off house, a small stock portfolio or a bit of savings, can significantly improve the financial security of the less-wealthy majority of heirs.

There is, however, another side to the coin. Common sense, and plenty of data, tell us that wealthy parents tend to have wealthier-than-average children. Recent research also quantifies this, finding that a substantial portion of that parent-child wealth correlation is due to inheritances themselves. One study of Swedish multigenerational data found that half or more of the persistence of wealth from one generation to the next can be attributed to inheritances and gifts. In other words, if you remove inheritances from the equation, the resemblance between a rich person’s rank and their child’s rank in the wealth distribution would drop by more than 50 per cent. This is a striking confirmation that inherited capital is a key mechanism by which family financial privilege is maintained. For those who worry about equality of opportunity, this fact is understandably concerning: it implies that the ‘birth lottery’– being born into a wealthy family – still carries a big advantage, primarily because of the legacy of wealth passed down.

Is the role of bequests in intergenerational wealth mobility a reason to condemn inheritance as socially harmful? One could certainly argue so. If our goal is a society where everyone truly starts at the same line, inheritances are an obvious head start for some and not for others. Philosophers and economists who champion equal opportunity often cite this as the core justification for inheritance taxes. The idea is that large unearned windfalls violate the meritocratic ideal – why should someone get a million dollars just because of their parents, when others get nothing? This line of reasoning led thinkers from John Stuart Mill to modern policymakers to advocate taxing or even capping inheritances in the interest of fairness.

A more targeted way to promote equality of opportunity might be to focus on the beginning of life, not the end. The median age of heirs in Sweden is 55 years, a stage in life when most choices have been made and circumstances are no longer pivotal. Instead, opportunity-equalising policies aim at the beginning of life, like those investing in quality education and universal healthcare. These measures empower individuals lacking family wealth without punishing the act of inheritance per se.

The US statesman Benjamin Franklin stated in 1789 that nothing in life is certain except death and taxes. The idea of a levy on inherited wealth has a long pedigree: from ancient times through the modern era, rulers have seen death as a taxable event, and progressives have seen inheritance taxes as a way to prevent the formation of an idle rich. In practice, however, inheritance or estate taxes have repeatedly disappointed on both fairness and efficiency grounds. Around the world, these taxes tend to raise little revenue, distort economic decisions, and often end up riddled with exemptions that undermine their egalitarian intent. The result is a tax that manages to be both unpopular and ineffective, a rare double dud in policy terms. Let’s examine the key issues.

As revenue instruments, they yield little. In OECD countries that levy them, inheritance taxes raise around 0.5 per cent of GDP, a trivial sum in tax systems collecting 30-40 per cent of national income. The low yield is partly due to policy design: lawmakers, aware of the tax’s unpopularity, usually set high exemption thresholds and carve out loopholes for certain assets.

Valuation and liquidity problems further complicate matters. Heirs to family businesses or illiquid assets may face large tax bills without the cash to pay them, forcing sales that destroy productive enterprises. To avoid this, governments carve out exemptions for businesses and certain assets. These carve-outs, in turn, create inequities and avoidance opportunities. The result is a tax that often misses the largest fortunes while burdening middling estates, an outcome that appears regressive and corrosive to trust.

Fewer countries are taxing inheritance now than in the 1960s, and those that do collect far less from it

A telling case was Sweden in the late-20th century. Historically, the country had a steep inheritance tax, but it included exemptions for family businesses and other carve-outs. This situation eroded political support across the spectrum. Indeed, Sweden abolished its inheritance tax entirely in 2004, in a reform enacted by a Social Democratic government that faced virtually no opposition from the Left or the Right.

The Swedish experience is not unique: many countries that once had inheritance or estate taxes have repealed them over the past few decades, often with broad public approval. For example, Canada already abolished its federal inheritance tax in the 1970s, Australia did the same by the early 1980s, while Austria and Norway scrapped theirs in the 2000s and 2010s, respectively. Germany and France still have inheritance taxes, but they come with so many deductions and with such moderate rates that they are far less onerous than in the past. The US dramatically raised its federal estate tax exemption (now only multimillion-dollar estates pay) and reduced the number of taxable estates to a few thousand per year. The overarching movement is clear: fewer countries are taxing inheritance now than in the 1960s, and those that do generally collect far less from it. Even where the tax remains on paper, it often survives in a hollowed-out form, with numerous exclusions.

This does not mean capital should go untaxed. On the contrary, taxes on capital income – profits, dividends, and realised capital gains – have proven to be far more effective at raising revenue with fewer distortions. In all OECD countries, capital income taxes account for much more than 90 per cent of total capital tax revenues, indicating that these are the taxes that work in practice and align with taxpayers’ ability, and their demonstrated willingness, to pay. By contrast, taxing the stock of wealth or imposing a one-time levy at death tends to generate limited revenue while creating substantial distortions, including valuation problems for rarely traded assets and liquidity constraints for taxpayers whose taxable wealth is not linked to cash flows. Research in public finance consistently finds that capital income taxation avoids many of these practical and economic difficulties, making it a more robust instrument for taxing wealth in modern economies.

Inheritance sits at a crossroads of human aspirations and social justice. It is at once a deeply personal practice, a final gift from one generation to the next, and a phenomenon with broad economic consequences. We have seen that the role of inherited wealth in Western economies is significant but not overwhelming, and in many respects it has been tempered by modern growth. We’ve also seen that inheritance can have conflicting effects: helping some less-wealthy heirs climb the ladder even as it helps wealthy families stay on top. Inheritance taxes, conceived as a remedy to the inequality that inheritances might foster, have largely failed to live up to their promise and have been cast aside by many countries after decades of frustration.

So where does this leave us? Perhaps with the realisation that inherited wealth is a natural byproduct of a healthy, growing economy, not an aberration to be eliminated. People build and pass on wealth for the same reasons they engage in any long-term enterprise: to better their family’s condition, to create a legacy, to contribute to their loved ones’ futures. These motivations drive productive activities that benefit society at large – investments, businesses, philanthropy. Curtailing them too harshly could sap that vitality. And when wealth does get passed down, the outcome is not uniformly pernicious; often it spreads capital to places it’s needed, financing new opportunities.

Of course, none of this is to deny that large inherited fortunes can give undue advantages. But there are more direct and constructive ways to address that concern than by taxing inheritances across the board. For instance, ensuring high-quality education for all helps level the playing field at the start of life, so that even those without wealthy parents have the skills to prosper. Encouraging entrepreneurship and home ownership for a broad swath of the population gives more people a chance to accumulate assets within their own generation, which eventually also give them something to bequeath. In essence, the key to a fairer society is not to tear down the wealth of the past, but to empower more people to build the wealth of the future.

The Western world has seen trends of the past century showing broad-based growth and democratisation of capital through homeownership, pension systems, and broader stock ownership. These have done more to reduce inequality than any inheritance tax ever has. Countries became more equal when ordinary citizens gained wealth, not when a few rich heirs were taxed a bit more. This is a crucial lesson. It suggests that if we want to continue the progress toward a prosperous and equitable society, we should focus on policies that expand opportunities and enable the many to share in wealth creation, rather than fixating on slicing up the estates of the few.