Posted by Warren Suh, Ezra Womark and Rachel Gibbons, FW Cook, on

Sunday, November 2, 2025 *

EXECUTIVE SUMMARY

FW Cook’s 2025 Annual Incentive Plan Report provides a comprehensive review of the annual incentive plans of the top 250 largest companies in the S&P 500 by market capitalization. Annual incentive plans are critical tools used to align executive compensation with a company’s short-term goals and support talent attraction, motivation and retention objectives. This report examines trends in financial and non-financial metrics, goal-setting practices, and actual payouts, comparing findings over 3-year and 6-year periods, which coincide with our 2022 and 2019 Annual Incentive Plan Reports. Environmental, Social, and Governance (ESG) trends are analyzed based on findings …

Posted by Warren Suh, Ezra Womark and Rachel Gibbons, FW Cook, on

Sunday, November 2, 2025 *

EXECUTIVE SUMMARY

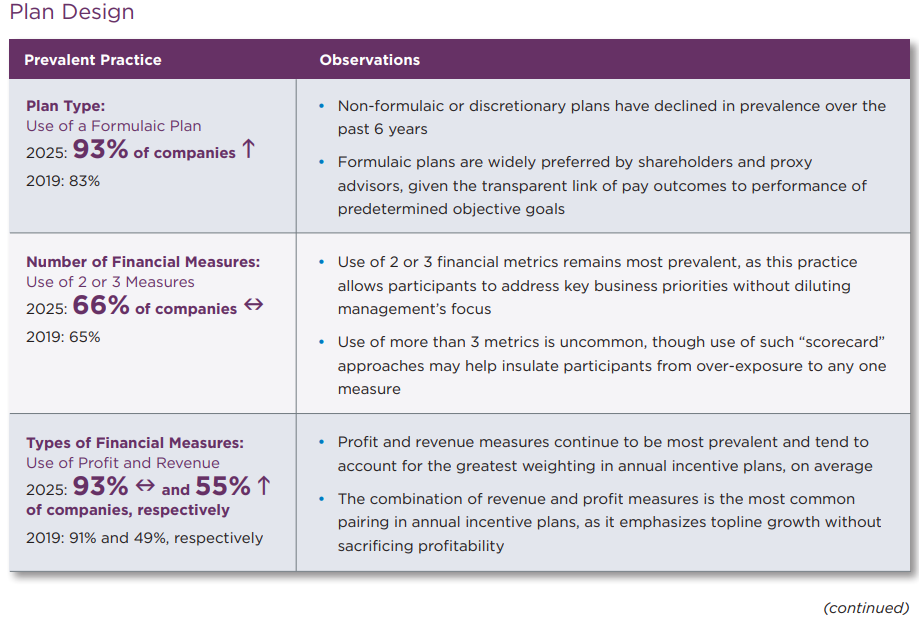

FW Cook’s 2025 Annual Incentive Plan Report provides a comprehensive review of the annual incentive plans of the top 250 largest companies in the S&P 500 by market capitalization. Annual incentive plans are critical tools used to align executive compensation with a company’s short-term goals and support talent attraction, motivation and retention objectives. This report examines trends in financial and non-financial metrics, goal-setting practices, and actual payouts, comparing findings over 3-year and 6-year periods, which coincide with our 2022 and 2019 Annual Incentive Plan Reports. Environmental, Social, and Governance (ESG) trends are analyzed based on findings from the last 3 years, corresponding with FW Cook’s 2025 and 2024 Annual Incentive Plan Reports and FW Cook’s 2023 Use of Environmental, Social, and Governance Measures in Incentive Plans Report.

Please note that while this report references 2025 as the publication year, it primarily reflects 2024 compensation practices. Similarly, references to 2024, 2023, 2022 and 2019 publication years correspond to 2023, 2022, 2021 and 2018 compensation practices, respectively.

Goal-Setting

- Most companies continued to set more challenging target goals in 2025 relative to prior year’s actual results: In 2025, at the median, profit targets were set 6% above actual profits in the prior year and revenue targets were set 5% above actual revenue in the prior year. This approach is largely consistent with goal setting practices observed in prior reports, suggesting companies continue to view mid-single digit growth to be reasonably achievable. Proxy advisors evaluate goal-setting rigor as part of their qualitative review of executive compensation plans and view the practice of setting target goals above prior year actual achievement to be a good indicator of goal rigor.

- Threshold and maximum goal-setting performance ranges remain tied to confidence in forecasting accuracy: Performance ranges around target (threshold to maximum) remain generally consistent in 2025 compared to prior studies. The width of the performance range is directly tied to the level of confidence management has in the goals they set, with narrower ranges suggesting a higher degree of confidence. Companies will often widen ranges if they predict more potential volatility in financial performance in the year ahead. Performance ranges should be set with a realistic view of operational performance, ensuring that targets are set at challenging but achievable levels.

2024 Performance Year Annual Incentive Payouts

- In 2025, most top 250 companies paid above target for their annual incentive payouts, driven by strong performance in 2024: At the median, annual revenue and operating income growth were 6% and 8% in 2024, respectively, and one-year TSR as of December 31, 2024 was 15%. In comparison, the median CEO annual incentive payout for 2024 was 120% of target, demonstrating strong alignment in pay and performance. Notably, the median CEO payout exceeded 100% of target across nearly all industry sectors, reflecting that companies across all industry sectors generally met or exceeded their performance goals for the year. 2024 median CEO payouts were below 2022 levels and on par with 2019 payouts.