The Federal Reserve Bank of New York this week released its Quarterly Report on Household Debt and Credit for the third quarter of this year.

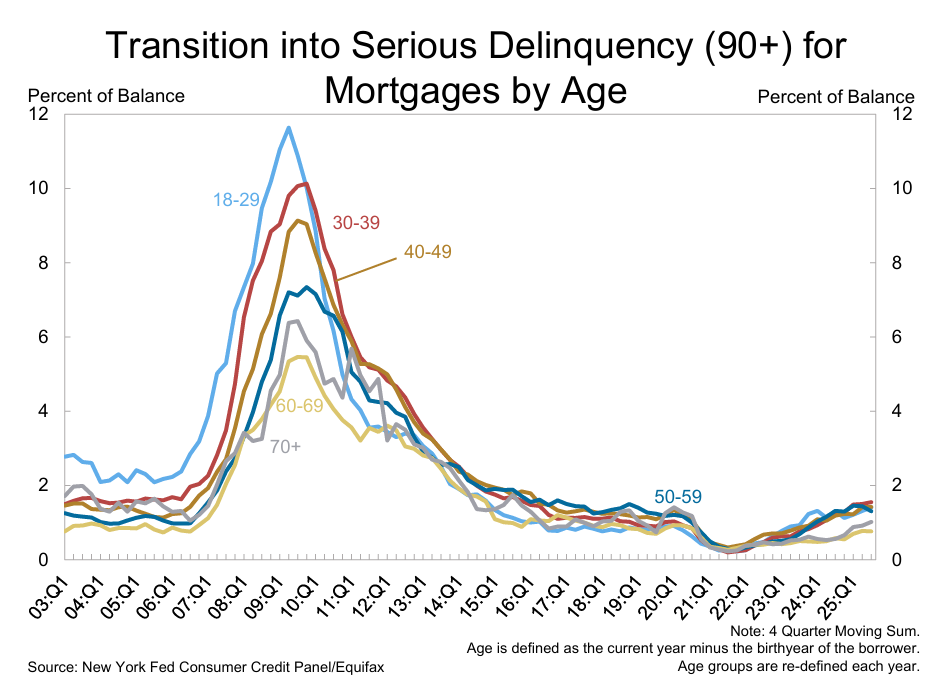

In many ways, the report shows a continuation of what we’ve grown accustomed to seeing for more than a decade: rapidly increasing debt balances for Americans. Yet, the report has also shown rising delinquencies for borrowers since 2023, and in some areas, delinquency rates are now nearly back to where they were during the Great Recession and the Global Financial Crisis—except in the area of mortgage debt.

The Fed’s summary reads:

Aggregate delinquency rates remained elevated in Q3 2025, with 4.5% of outstanding debt in some stage of delinquency. Transitions into early delinquency were m…

The Federal Reserve Bank of New York this week released its Quarterly Report on Household Debt and Credit for the third quarter of this year.

In many ways, the report shows a continuation of what we’ve grown accustomed to seeing for more than a decade: rapidly increasing debt balances for Americans. Yet, the report has also shown rising delinquencies for borrowers since 2023, and in some areas, delinquency rates are now nearly back to where they were during the Great Recession and the Global Financial Crisis—except in the area of mortgage debt.

The Fed’s summary reads:

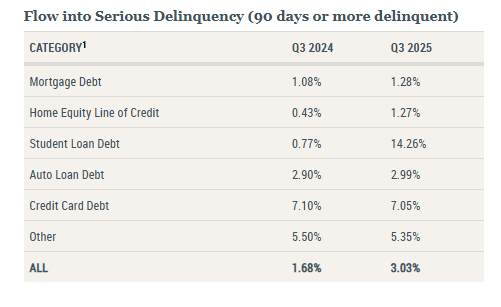

Aggregate delinquency rates remained elevated in Q3 2025, with 4.5% of outstanding debt in some stage of delinquency. Transitions into early delinquency were mixed with credit card debt and student loans increasing, while all other debt types saw decreases. Transitions into serious delinquency mostly increased across debt types, although mortgages saw a slight decrease

.

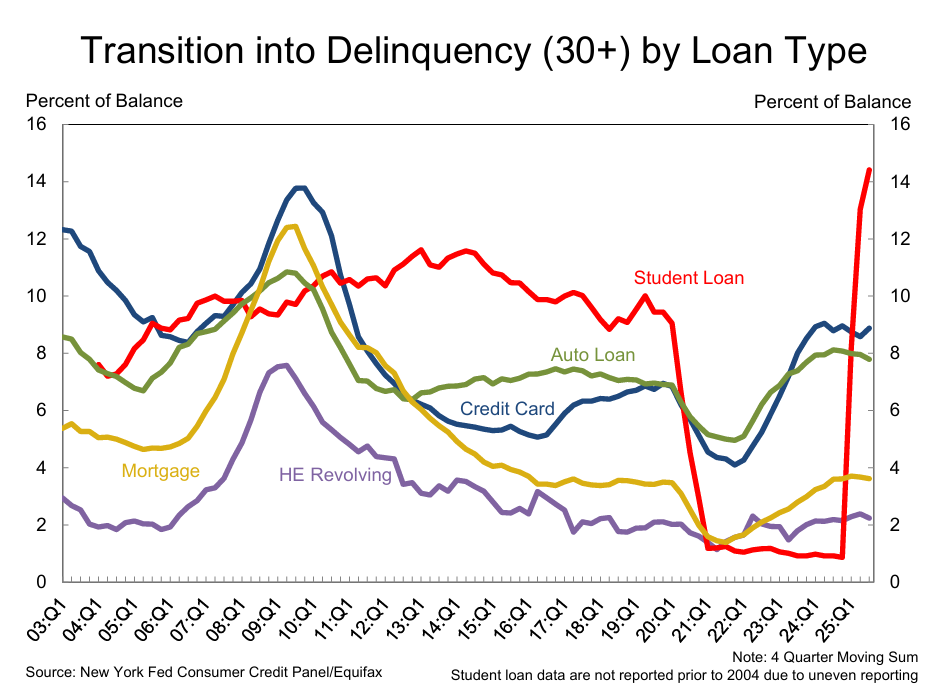

30-day delinquencies in student loans, auto loans, and credit card debt are rising near 15-year highs:

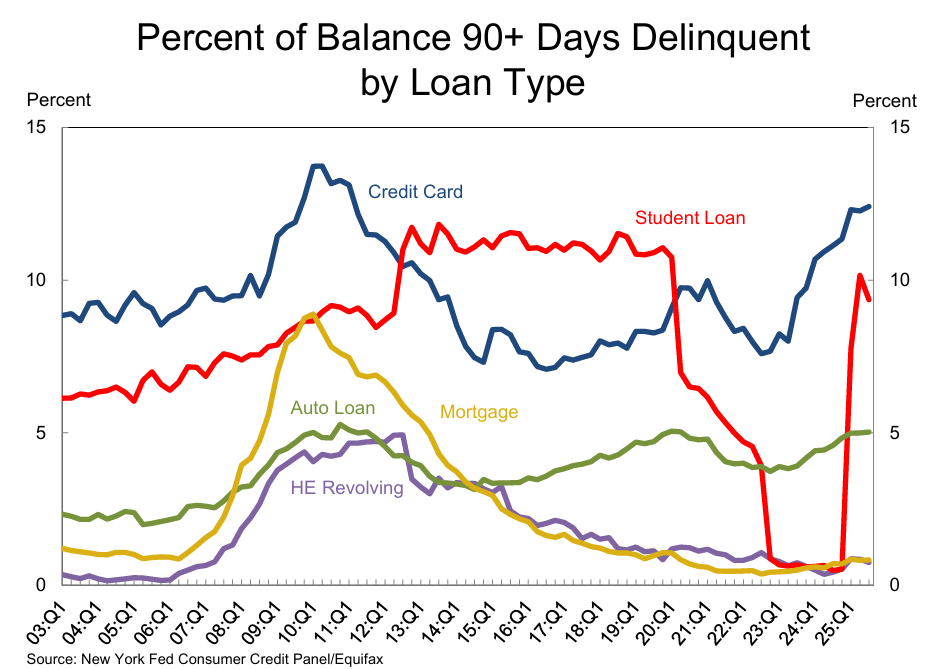

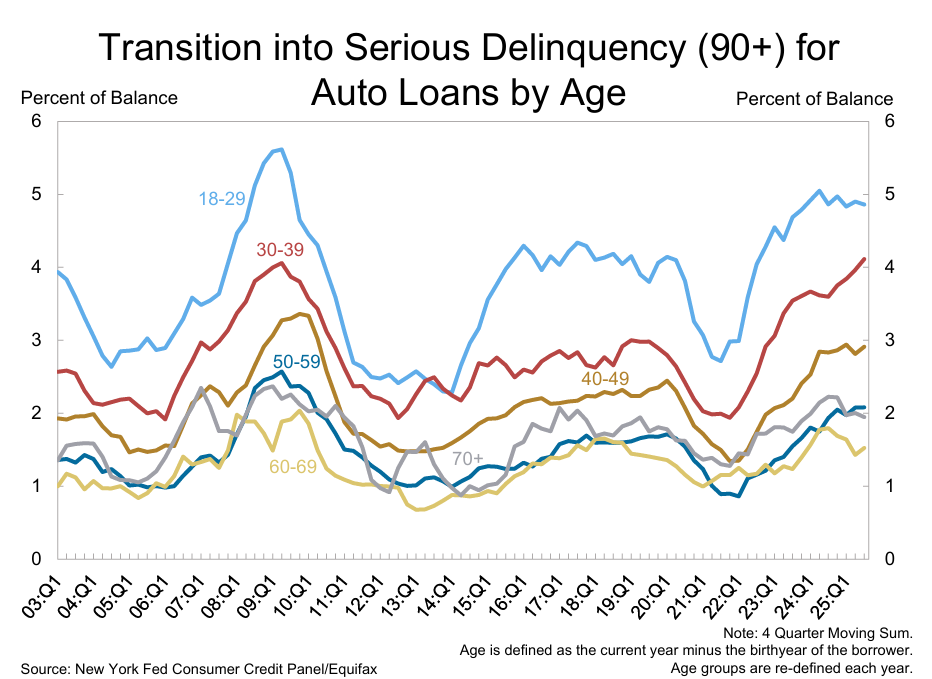

90+-day delinquencies are behaving similarly with auto loans now near the highest levels they’ve been* in decades*.

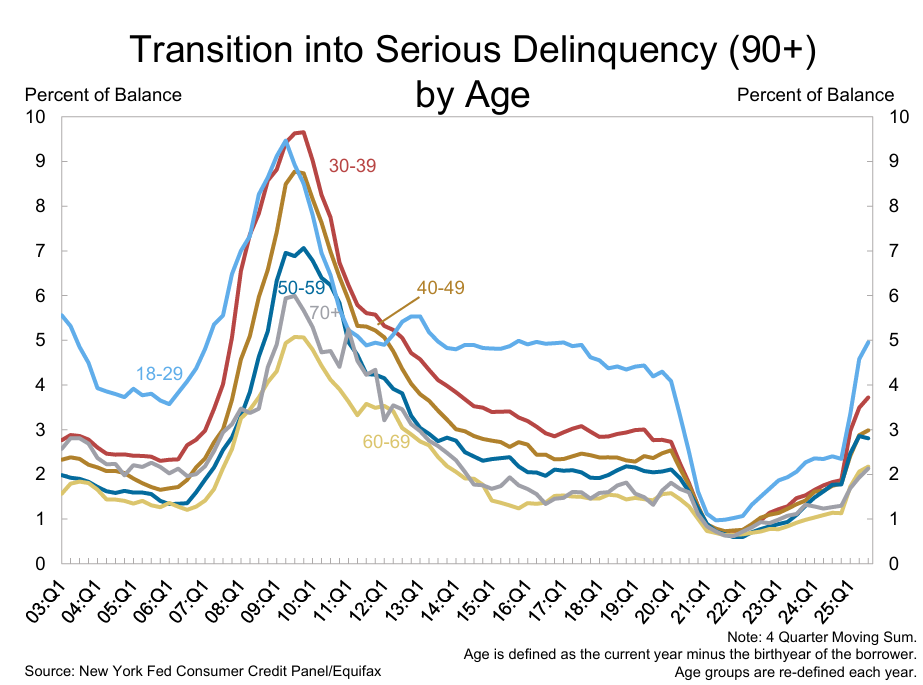

The youngest cohort is the most deeply impacted with 90+ day delinquencies in the 18-29 age group at the highest they’ve been in over a decade:

Nearly five percent of auto loans among younger borrowers are now delinquent:

This is reflected in recent news from Edmunds which reports:

- More than one in four new vehicle trade-ins are underwater, a four-year high. 28.1% of trade-ins toward new-car purchases had negative equity, up from 26.6% in Q2 2025 and 24.2% in Q1 2025. This is the highest share Edmunds has on record since Q1 2021, when 31.9% of new-car trade-ins were upside down.

- Americans with upside-down car loans owe more than ever. The average amount owed on upside-down loans hit a record $6,905 in Q3, edging past the previous high of $6,880 set in Q1 2025.

- Nearly one in three underwater car owners owe between $5,000 and $10,000 in debt — a new record high. 32.9% of negative-equity trade-ins fell into this range in Q3, up from 32.6% in Q2 and continuing a steady climb since last year.

- A record share of underwater car loans are carrying five-figure debt. Nearly one in four (24.7%) trade-ins with negative equity carried more than $10,000 in debt in Q3, surpassing the previous high of 24.6% set in Q4 2024. Another 8.3% of trade-ins with negative equity carried more than $15,000 in debt, up from 7.7% in Q2 2025.

Why are delinquencies surging now? It is a combination of rising prices and stagnant job markets. Although the BLS is not releasing its monthly job reports during the federal partial shutdown, the most recent BLS reports showed repeated downward revisions and outright job losses during the summer of this year. The most recent private ADP employment reports have also shown very weak hiring, plus significant job losses in some areas, especially for white-collar workers. Bloomberg reported this week that US manufacturing has shrunk for 8 months.

This is indeed a “frozen” job market, as was admitted at last week’s FOMC press conference when Jerome Powell noted that it is increasingly difficult for workers to find jobs, and that the unemployment rate would be higher were it not for deportations and a falling labor participation rate. This is a “no fire-no hire” economy. Those who have jobs are able to hold on for now, but those looking for work are finding job openings to be increasingly rare.

Meanwhile, price inflation continues to rise. Measured year-over year, September’s core CPI was up by 3.0 percent, and has been above three percent for three months. Indeed, core CPI year-over-year inflation has only dipped below 2 percent during three months of the past 53 months. Core CPI growth has not gone down, month over month, in 64 months.

So, many workers are caught between price inflation and job stagnation. Even older workers are seeing rising delinquency rates as insurance and taxes are rising and are driving up monthly home costs for older homeowners:

This is also likely a factor in the slowdown in consumer spending we’ve seen in recent months. This has been reflected in spending at restaurants. A recent report from YouGov found “Simply put, 37% of American diners are eating out less frequently than they did a year ago. Among lower-income diners, this share rises to 44%. Just 8% of diners say they are eating out more than they were last year.”

After years of bubble-fueled “prosperity” funded by monetary inflation to the tune of five trillion dollars, American consumers appear to be running out of money.

Note: The views expressed on Mises.org are not necessarily those of the Mises Institute.