Junk bonds look like trash again.

Yes, this is something the market loves to “cry wolf” about. But as I see it, having been through the Great Recession in 2008, the lasting lesson was clear:

If you want to know what could cause an outsized breakdown in the stock market, look at the junk bond market.

Credit conditions are not ideal, to say the least. Consumer debt has piled up, and the only reason defaults on car loans, student loans, and home loans are not a bigger drag on market sentiment is that we still have favorable borrowing terms. That historically delays a “selling event” in lower-quality parts of the stock market, until the last straw breaks. Often, it is not…

Junk bonds look like trash again.

Yes, this is something the market loves to “cry wolf” about. But as I see it, having been through the Great Recession in 2008, the lasting lesson was clear:

If you want to know what could cause an outsized breakdown in the stock market, look at the junk bond market.

Credit conditions are not ideal, to say the least. Consumer debt has piled up, and the only reason defaults on car loans, student loans, and home loans are not a bigger drag on market sentiment is that we still have favorable borrowing terms. That historically delays a “selling event” in lower-quality parts of the stock market, until the last straw breaks. Often, it is not new information, but rather some hedge fund or otherwise significant investor being over-leveraged. And that can only last so long.

Buy HYG Now, Pay the Price Later?

In retail, the trendy way to buy some consumer goods is via an arrangement known as “buy now, pay later.” As the expression goes, what could possibly go wrong?

In the corporate bond market, traders can survive quite nicely on above-average yields on bonds that are not as credit-worthy as other companies.

At one point in the late 20th century, those rated below BBB were known as “junk bonds.” The companies issuing such bonds back then tended to be very speculative. Then, that industry helped stoke a few financial market crashes, and Wall Street decided they’d better start accentuating the positive. Poof, the “high-yield bond ETF” became very popular.

It has done so with good reason. Using the biggest of the lot, the iShare Iboxx High Yield Corporate Bond ETF (HYG) as a proxy, high yield has delivered a low rate of defaults and competitive returns for a while. So, what’s the problem?

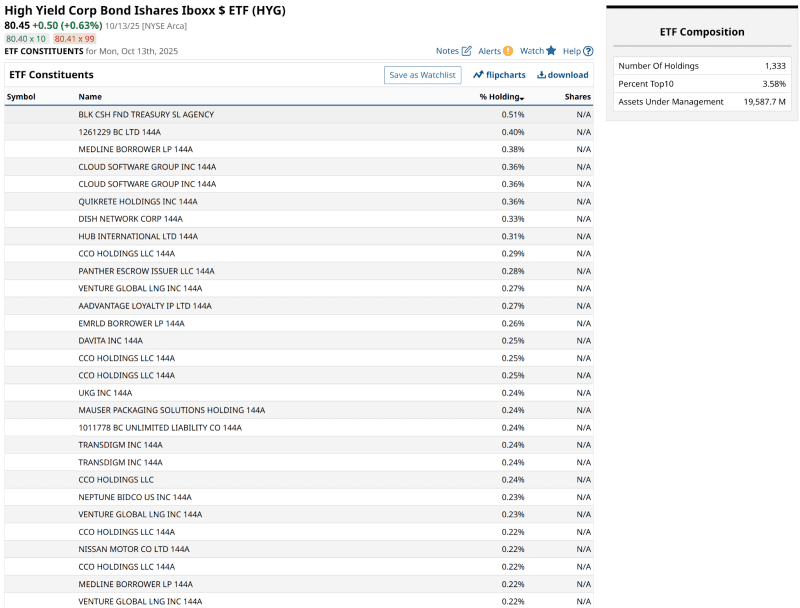

It is likely the businesses themselves, the ones that make up part of the nearly $20 billion in assets in the ETF. The fund holds more than 1,300 bonds, but increasingly they trade like one unit, one market.

www.barchart.com

One bond – or even a dozen bad apples within that bunch – might not cause disruption in this part of the market. However, HYG and its peers have become a single trade for some big money investors, who used to buy bonds individually. Increasingly they just buy something like HYG in a single click. Even the Federal Reserve bought HYG and other junk bond ETFs when it needed to support the market a few years ago. That is a nice “put option” underneath this market segment. Until it stops.

The other issue is company quality. The Russell 2000 Index (IWM) is often referred to as having about 40% of its member stocks at the point where they need to refinance at lower rates next year, in order to continue operating. This so-called “debt cliff” has been looming for a few years, but next year it really starts to get going.

These are many of the companies that issue a lot of high yield bonds. The type that ends up in HYG.

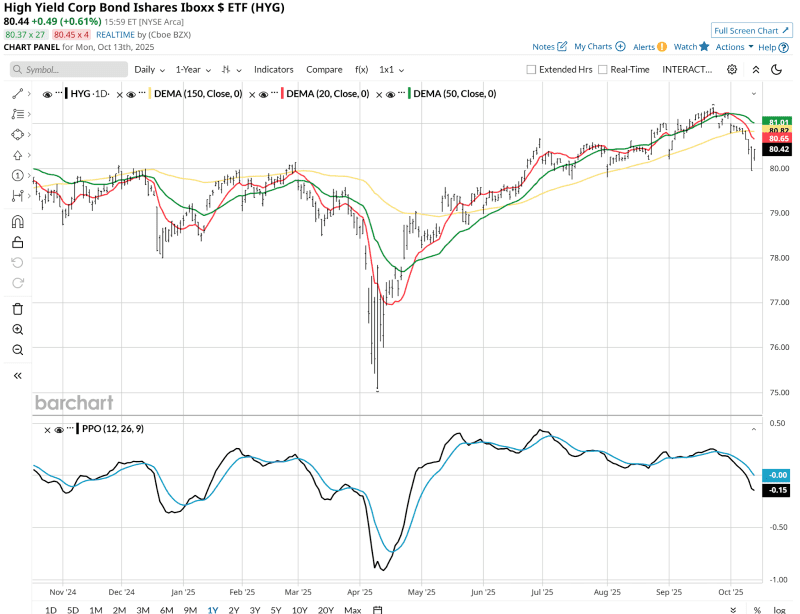

HYG’s Price Chart Could Be Tipping Off a Bigger Drop

Charting bond ETFs is not as straightforward as doing so for stocks and equity ETFs, but we can see in this picture below that there’s a rolling over starting to occur.

www.barchart.com

Based on what’s happened during past crises, this is one market area that can go from hero to zero in a very short span of time. So recently, I did something I’ve done in small position sizes several times over the years.

To summarize:

- Invest a relatively small amount of money

- Buy put options to cap my potential loss at what I put up in dollars

- Give it just enough time to keep that out of pocket cost reasonable, but long enough to succeed if HYG plummets later this year, not just later this week or month.

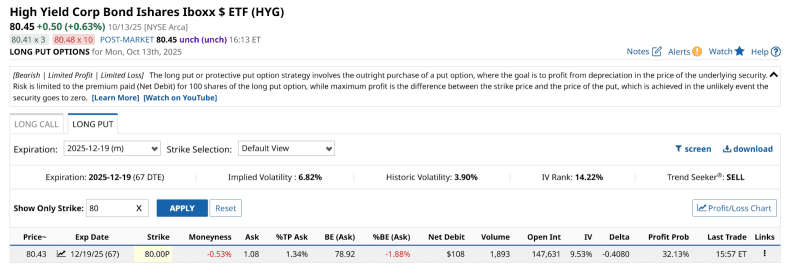

Here’s how I tried to take risk out of betting against high-yield bonds. Note how low the volatility is here. And not only is it a fraction of the stock market’s in that regard, it is low even compared to its own 12-month history. That’s indicated by that IV Rank of 14%.

www.barchart.com

This is a trade, and while there’s a good chance nothing will happen between now and Dec. 19 with HYG, if it does, I am placing my chips on the table with it now. It cost me $108 per contract ($1.08 a share) to potentially profit if HYG drops below $80 during that time. It is just above that mark as of Monday’s close.

This is more of a “homerun or strikeout” scenario. I say that because earlier this year, that ETF fell by about $5 a share, and in 2022 when inflation returned, it dropped $18 a share from peak to trough. Those declines were offset in part by bond income, but only to a modest degree.

The Big Short, Part 2?

And, while I’m no Michael Burry, I will note that back in the “Big Short” days of 2008, HYG lost about $40 a share, more than 30% of its value, over about an 18-month time span. All I need to make a nice profit on this trade is for HYG to fall to about $78. That would be nearly a double for that put option purchase.

This is not an “investment” to me, nor is it a core part of my portfolio. It is akin to a lottery ticket, or a longshot. I can live with seeing the value of the put options go to zero, which would occur if HYG does not sink below $80 during the next 9 weeks. Oh, but if there is trouble brewing in the high-yield bond space, as the chart is hinting at, just a bit, then there’s a nice reward to risk tradeoff here.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 ‘Lottery Ticket’ Options Strategy That Lets You Bet on a ‘Big Short 2.0’ Crash in Junk Bonds

- Shorting Microsoft Out-of-the-Money Put Options Works Well for Defensive Investors

- Chevron’s (CVX) Distributional Probability Curve Offers a Tempting Bullish Options Trade

- Turn Market Volatility Into Income This Earnings Season