Extreme Positive Sentiment Returns

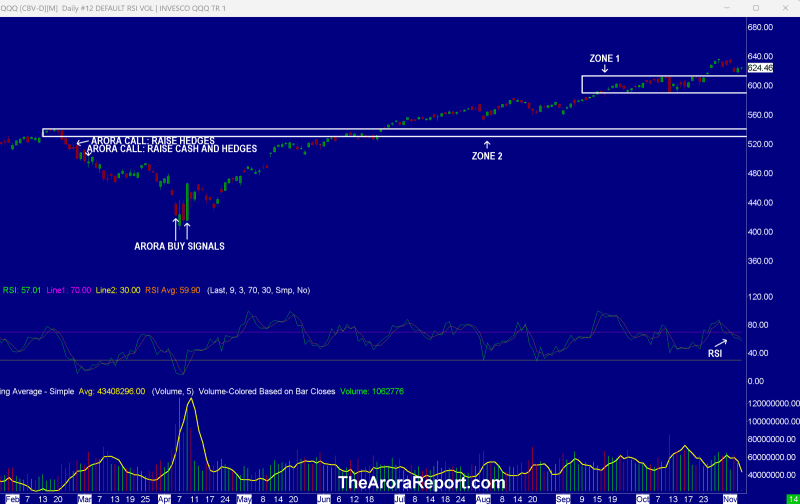

Please click here for an enlarged chart of Invesco QQQ Trust Series 1 (NASDAQ:QQQ).

Note the following:

- The chart shows QQQ almost touched the upper band of zone 1 (support).

- The chart shows that today QQQ is bouncing.

- It is a positive for the stock market that QQQ did not dip into the support zone.

- Yesterday, oral arguments in the Supreme Court case on Trump tariffs were heard. With the justices asking tough questions of President Trump’s attorney, the likelihood of a rul…

Extreme Positive Sentiment Returns

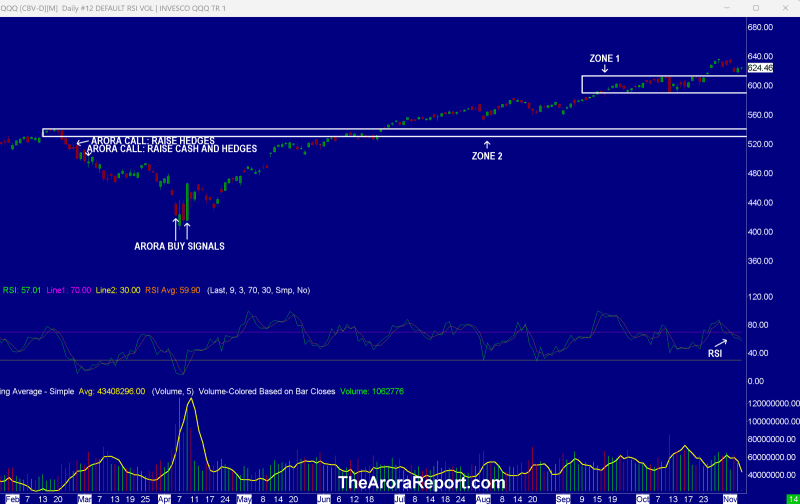

Please click here for an enlarged chart of Invesco QQQ Trust Series 1 (NASDAQ:QQQ).

Note the following:

- The chart shows QQQ almost touched the upper band of zone 1 (support).

- The chart shows that today QQQ is bouncing.

- It is a positive for the stock market that QQQ did not dip into the support zone.

- Yesterday, oral arguments in the Supreme Court case on Trump tariffs were heard. With the justices asking tough questions of President Trump’s attorney, the likelihood of a ruling in favor of the tariffs has decreased. At a low during oral arguments, on the betting market Polymarket placed the likelihood of Trump winning at 18% and Kalshi at 20%.

- Investors celebrated by buying stocks on the reduced likelihood of a favorable ruling on Trump tariffs. The Supreme Court ruling is expected in a matter of weeks.

- As we shared with you in yesterday’s Morning Capsule, it is important to remember:

If President Trump loses, there will be two crosscurrents. One one side, interest rates could rise because the bond market is counting on tariff revenue. On the other side, inflation may come down and profitability of corporations may go up.

- As we have been sharing with you, prudent investors need to keep in mind if President Trump loses, he has many other avenues to impose tariffs available to him under the law.

- **In our analysis, in a market that is not staying down for long, the celebration of a potential ruling against tariffs shifted the sentiment from very positive back to extreme positive. **

- October this year saw more job losses than any other October in two decades. The primary reason is AI. Right now, the stock market does not care. However, prudent investors need to ask this question: With more and more people losing jobs, isn’t it going to start impacting corporate earnings?

- NVIDIA Corp (NASDAQ:NVDA) CEO Jensen Huang said that China will win the AI war. He back tracked when a backlash erupted. No one in the U.S. wants to hear China will win in AI.

- Yesterday, hedge funds aggressively bought stocks that are favored by the retail momo crowd. Knowing that the retail momo crowd buys on momentum and media pump without doing any legitimate analysis, hedge funds are simply front running, hoping to sell these stocks to the retail momo crowd at higher prices.

- **Prudent investors should note that some AI pioneers are claiming that human level artificial general intelligence (AGI) is already here. Investors should keep a keen eye as this has major implications for the stock market. AGI will cause significant job losses, leaving fewer people to pay taxes and spend money to fuel the U.S. economy. One idea that is floating around is to start taxing AI agents. **

England

The Bank of England left interest rates unchanged, which is inline with consensus.

Magnificent Seven Money Flows

Most portfolios are now heavily concentrated in the Mag 7 stocks. For this reason, it is important to pay attention to early money flows in the Mag 7 stocks on a daily basis.

In the early trade, money flows are positive in Alphabet Inc Class C (NASDAQ:GOOG), Meta Platforms Inc (NASDAQ:META), Nvidia (NVDA), and Tesla Inc (NASDAQ:TSLA).

In the early trade, money flows are neutral in **Apple Inc **(NASDAQ:AAPL), Amazon.com, Inc. (NASDAQ:AMZN), and **Microsoft Corp **(NASDAQ:MSFT).

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust (NYSE:SPY) and Nasdaq 100 ETF (QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (GLD). The most popular ETF for silver is **iShares Silver Trust **(SLV). The most popular ETF for oil is United States Oil ETF (USO).

Bitcoin

Bitcoin (CRYPTO: BTC) is range bound.

What To Do Now

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

**It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. **When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

**

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

**

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.