The second leg of the commodities bull supercycle is just getting started. You can feel it—not just in the charts, but also in the subtle shifts happening across the global economy. Energy costs that refuse to stay down. Supply chains that no longer stretch endlessly. Nations quietly stockpiling metals and minerals as if they’ve remembered something the markets forgot: real wealth comes from things you can’t print.

When I look at the Bloomberg Commodity Index (BCOM), I see a sector that’s right at the point in every supercycle when disbelief starts to fade, curiosity creeps in, and conviction begins to build.

To be clear, we’ve been here before. The same compression, breakout, and expansion rhythm played out during the 1999–2008 bull supercycle. Yet, the difference this time li…

The second leg of the commodities bull supercycle is just getting started. You can feel it—not just in the charts, but also in the subtle shifts happening across the global economy. Energy costs that refuse to stay down. Supply chains that no longer stretch endlessly. Nations quietly stockpiling metals and minerals as if they’ve remembered something the markets forgot: real wealth comes from things you can’t print.

When I look at the Bloomberg Commodity Index (BCOM), I see a sector that’s right at the point in every supercycle when disbelief starts to fade, curiosity creeps in, and conviction begins to build.

To be clear, we’ve been here before. The same compression, breakout, and expansion rhythm played out during the 1999–2008 bull supercycle. Yet, the difference this time lies beneath the surface. The driving forces—scarcity, reindustrialization, fiscal expansion—aren’t short-term catalysts; they’re structural shifts.

Put differently, this is not another “buy the dip” cycle. More accurately, it’s the reawakening of hard assets as a strategic cornerstone. The charts are confirming what global policy, trade dynamics, and capital flows have been hinting at: the second leg of the commodities bull supercycle has officially begun.

So, rather than viewing this as a short-term rally to trade, it’s worth seeing it as something much bigger—a secular transition to own. In the sections ahead, we’ll dive deeper into the technicals, fundamentals, and macros to understand what makes commodities one of the most compelling long-term investment cases of this decade.

The Technical Story Behind Commodities’ Return to Secular Strength

If you trace BCOM far enough back, you can almost feel the rhythm of its rise and fall—like the breathing of a market that never truly dies, only pauses to gather strength. The chart doesn’t just capture price action; it tells a story of time, energy, and market memory. And right now, that memory is speaking loudly: we’ve entered the second leg of a new commodities bull supercycle.

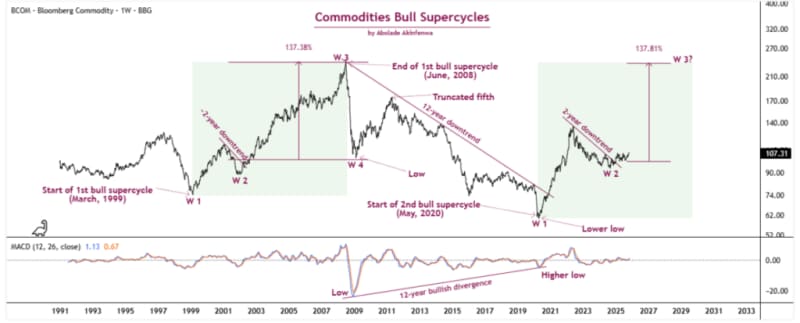

To see how we got here, we need to rewind the tape. The first modern supercycle began in March 1999, when BCOM bottomed near 70 after a bruising 40% drop over two years. From that low, the index advanced in textbook Elliott Wave fashion—five distinct structural phases that together defined both the ascent and exhaustion of the 2000s commodities era.

The opening act, Wave 1, marked the ignition phase. The index rose steadily into early 2001, reaching 115 points before taking a much-needed breather—a sharp 23% correction to 88 points by January 2002. Yet that pullback wasn’t failure; it was fuel. It reset sentiment, built a durable base, and cleared the runway for what would become one of the most powerful expansions in modern commodities history.

Figure 1: Bloomberg Commodity Index shows that commodities’ 2020s bull supercycle begins second leg

Then came Wave 3, the liftoff phase. From 2002 onward, commodities went nearly vertical. BCOM soared from 88 to 238 by June 2008, riding the momentum of China’s industrialization, synchronized global growth, and a generational surge in demand. This was the heartbeat of the 2000s—the “commodities supercycle” everyone still references today.

However, as every experienced investor knows, even the strongest pulse eventually slows. By December 2008, that 238-point peak had collapsed 57% to 106, marking Wave 4, the exhaustion phase. The market attempted one last advance in 2011, but the rally stalled early. Technicians would call it a “truncated fifth wave.” I’d call it the last gasp of a fading cycle—a moment when momentum gave way to fatigue.

That failure set the stage for what became the defining technical feature of the next decade: a 12-year downtrend stretching from 2011 to 2020. It formed a psychological and structural ceiling over the market. I still remember drawing that resistance line and thinking, there’s your decade of disbelief. Every rally attempt—2012, 2014, 2018—hit the same wall. The result was textbook compression: lower highs, weaker momentum, and fading conviction. The longer the pattern persisted, the more it seemed like commodities would never break free again.

Yet beneath that lifeless surface, something critical was brewing. Between 2008 and 2020, the MACD indicator—a measure of trend momentum—quietly carved out a 12-year bullish divergence. Prices kept making lower lows, but the MACD refused to confirm them. That’s strange, I remember thinking. Price exhaustion without momentum collapse? That’s accumulation. And in hindsight, that’s exactly what it was.

Figure 2: Bloomberg Commodity Index shows 12-year MACD bullish divergence

Then came the decisive shift. For the first time since 2008, BCOM broke above its 12-year descending resistance in December 2020. That breakout wasn’t just technical; it was symbolic. It confirmed that the long bear hibernation had ended and that a new secular bull supercycle had begun.

From there, Wave 1 of this new supercycle lifted prices from 60 to 136 by May 2022, before entering a two-year corrective phase that saw the index decline 30% to 94 by September 2024—a textbook Wave 2 retracement. Then came January 2025, and with it, the next defining signal: a breakout above the two-year downtrend, confirming that Wave 3—the second and strongest leg of the new bull supercycle—is now officially underway.

When I look at the Bloomberg Commodity Index today, I don’t see randomness or luck. I see sequence—five historical waves of rise and exhaustion, twelve years of compression, a 12-year bullish divergence, and now, a two-year consolidation breaking higher. The first commodities bull supercycle ended in fatigue. The second began in disbelief. And as of January 2025, that disbelief has evolved into acceleration—the unmistakable signature of a secular trend coming fully alive again.

Why This Commodities’ Bull Supercycle Is Built to Last

If the last section mapped how this new supercycle formed technically, this one explains why it’s built to last. After all, charts never move in isolation—they respond to the macro regimes shaping them. And this time, the environment surrounding commodities looks nothing like the one that powered the 1999–2008 boom.

To put things in perspective, I went back to the early 2000s (via market data, not time traveling) to pinpoint what really fueled the first modern commodities supercycle. The answer, unsurprisingly, was globalization. Back then, the global economy was entering its expansionary adolescence. China had just joined the WTO, factories were multiplying across Asia, and supply chains were lengthening, not snapping. Capital was cheap, labor was abundant, and optimism about an interconnected world ran high. The 2000s bull market was demand-driven—an era when the world’s manufacturing engine devoured steel, copper, oil, and coal as fast as it could produce them.

That said, it’s worth recalling that the 2000s were also deflationary by design. Productivity gains absorbed inflationary pressures, and central banks could inject liquidity with little fear of overheating the system. Money was easy because everything else was easy: cheap capital, cheap labor, cheap energy—the “holy trinity of abundance.” Commodities, though booming, were still supporting actors in a growth story led by financial expansion, not physical scarcity.

Fast-forward twenty years, and the contrast couldn’t be sharper. The 2020–2030 cycle is unfolding in a world running low on easy money, easy energy, and easy supply. The globalization wave that once stretched production networks across continents is giving way to localization and resilience. Abundance has yielded to scarcity. Efficiency is giving way to redundancy. These subtle but powerful shifts have completely rewritten the commodity playbook.

We’ve now entered what I’d call a resource-anchored regime—a macro environment where value and power flow back toward the physical rather than the financial. The forces that once suppressed commodities—strong dollar cycles, relentless tech deflation, and capital chasing digital assets—are reversing. In their place are chronic underinvestment, aging infrastructure, shrinking inventories, and geopolitically fractured supply chains.

The energy complex tells the story best. Oil and gas capex remains roughly 30% below pre-2014 levels, even as global demand continues to climb. Meanwhile, “green transition” metals like copper, nickel, and lithium are entering multi-year deficits. Why? Because the world underestimated how much old energy it still needs to build new energy. Even agriculture—long considered stable and dull—is now vulnerable to climate shocks, fertilizer shortages, and trade restrictions.

In parallel, policy has evolved. Central banks, once fiercely committed to defeating inflation, are now content to manage it. Governments, meanwhile, are spending aggressively on reindustrialization, defense, energy transition, and infrastructure spending, all of which reinforce real-asset demand. This is fiscal dominance in practice: central banks tightening rhetorically while governments quietly reflate the real economy.

And that’s where the defining difference between these two supercycles lies. The 1999–2008 supercycle was built on abundance meeting demand—a world expanding outward. The 2020–2030 cycle, in contrast, is powered by scarcity meeting necessity—a world turning inward, rebuilding the foundations it once outsourced, and revaluing what’s tangible. This isn’t a liquidity-driven upswing chasing growth; it’s a scarcity-driven repricing commanding respect.

So, when I say this commodities bull supercycle is built to last, I mean it literally. The market is finally adjusting to the physical constraints of the real world. It’s not just technical energy being released—it’s macro energy being redirected. What we’re witnessing is a structural revaluation of tangible assets in a world rediscovering a timeless truth: wealth isn’t preserved by what can be printed—it’s preserved by what can be mined, refined, and stored.

Technical and Sentiment Alignment Support a Structural Upswing in the 2020s Commodities Supercycle

At this stage of the analysis, it’s clear that while macro forces have laid the groundwork for this new commodities supercycle, the deeper conviction comes from what the charts are quietly signaling beneath the surface. Structure, momentum, and sentiment are aligning in ways that rarely unfold within a single decade—let alone converge across multiple market generations.

To make this easier to digest, I’ve broken this section into four parts. Each unpacks a core driver—fractal behavior, energy transfer, multi-decade alignment, and sentiment transition—that together explain why the 2020s commodities bull supercycle isn’t a passing act, but the main show.

Fractal Behavior

To begin, one of the most compelling reasons it’s logical to expect commodities to extend the second leg of their bull supercycle lies in the fractal behavior emerging on the BCOM chart. Since 2020, the index has been tracing an almost mirror image of its 1999–2003 structure. The slope of ascent, the retracement depth, and even the two-year pause before liftoff—all align with uncanny precision. That kind of symmetry rarely happens by accident. Instead, it signals that the market is once again responding to the same internal rhythm that defined the last secular expansion.

Moreover, markets—much like natural systems—tend to repeat familiar behaviors when faced with familiar pressures. They don’t invent new patterns arbitrarily; they return to equilibrium through repetition. In both eras, the same foundational ingredients converged: deep secular lows, prolonged disbelief, and years of chronic underinvestment. These conditions compress price action into a tightly coiled spring, storing potential energy that inevitably releases in a decisive upward surge once sentiment shifts and liquidity returns.

Therefore, this fractal structure isn’t just a technical curiosity—it’s a roadmap. If historical geometry holds, and no major macro shock interrupts the setup, the logical destination for this wave sits at least around the price region that capped the 1999–2008 bull supercycle. In simple terms, the market has unfinished business. It’s completing Wave 3 of a pattern that began a generation ago. Until that equilibrium is achieved, the path of least resistance for commodities remains up.

Energy Transfer Across Cycles

Another major factor reinforcing the case for a structural upswing in the 2020s commodities bull supercycle is the transfer of energy across market cycles—a dynamic that’s often overlooked but critical to grasping how long-term trends unfold. The 2008–2020 bear market, for example, wasn’t merely a protracted decline; it was a compression phase in disguise. Beneath the surface, potential energy was quietly building as sentiment eroded and speculative capital migrated elsewhere. Each successive lower low didn’t weaken the structure—it tightened the coil, storing momentum like a spring under increasing tension.

Then, as expected in cyclical markets, that compressed energy began to unwind. When BCOM decisively broke above its 12-year downtrend in December 2020, it wasn’t just another technical breakout—it marked the release of long-dormant potential. However, as is often the case with structural transitions, the release wasn’t explosive at first; it was measured. The 2022–2024 correction, often misinterpreted as weakness, actually functioned as a relay phase, transferring long-term compression energy into a short-term consolidation that primed the market for acceleration.

By January 2025, when BCOM surged above its two-year downtrend, the move wasn’t simply technical—it was kinetic. Seventeen years of stored energy, accumulated through neglect, exhaustion, and underinvestment, had finally converted into forward motion. This is what gives the current setup its durability: it’s not emerging from a vacuum but continuing a chain reaction that began more than a decade ago.

Ultimately, the energy of the past cycle hasn’t vanished—it’s been inherited. That inheritance acts as fuel for structural upswings, allowing markets not just to recover, but to reprice entire sectors as they realign with underlying fundamentals. And that’s why, in my view, the 2020s commodities bull supercycle carries staying power reminiscent of the early 2000s: it isn’t a reactionary move; it’s the unfolding of stored potential finally finding its outlet.

Technical Consensus Across Decades

Another powerful reason the 2020s commodities bull supercycle appears structurally durable lies in what I call a technical consensus across decades. It’s not often that trend, momentum, and market memory converge in the same direction. Yet right now, that’s exactly what the charts are showing.

To put it simply, a 12-year downtrend, a 12-year MACD divergence, and a 2-year consolidation have all resolved simultaneously to the upside. That kind of convergence isn’t just noteworthy—it’s statistically exceptional. The last time we saw this degree of alignment was between 2001 and 2003, when similar conditions preceded a 137% rally that defined the 2000s supercycle. This time, however, the foundation feels even stronger. The prior compression phase was longer, the macro backdrop is tighter, and the supply-demand constraints are far more acute.

More importantly, this alignment has triggered what I’d describe as multi-decadal agreement—a rare moment when the short-term traders, medium-term participants, and long-term capital allocators all begin to sense the same directional truth. That kind of consensus is self-reinforcing: as capital rotates in, momentum expands, and structural conviction deepens, the technical architecture validates itself in real time.

In practical terms, this isn’t a setup driven by short-term optimism—it’s a regime shift underpinned by layered confirmation. The alignment of technical structure, long-term momentum, and investor memory creates a base that’s both durable and self-sustaining. When technical consensus is that strong, the signal doesn’t just stand out—it endures. And that endurance, in my view, is precisely what gives the 2020s commodities bull supercycle its staying power and long-term credibility.

Sentiment Transition

Another defining element that reinforces the case for a structural upswing in the 2020s commodities bull supercycle is the emotional evolution unfolding within the market’s technical structure. Every long-term trend, after all, isn’t just a story of price—it’s a story of belief. And on the BCOM chart, that belief is visibly reawakening.

For more than a decade leading up to 2020, commodities existed in what I’d call the “age of disbelief.” The 12-year downtrend stretching from 2008 to 2020 didn’t merely suppress prices—it dismantled conviction. Investors had migrated to intangible assets like tech, crypto, and AI, leaving hard assets neglected. That emotional fatigue, paradoxically, became the perfect foundation for renewal. Then came the spark: December 2020’s breakout above that long downtrend. It marked the first psychological signal that disbelief was giving way to curiosity. The market wasn’t euphoric yet, but it had started to look again, to wonder, “Could this really be the turn?”

From there, curiosity gradually evolved. The 2022–2024 correction, a 30% pullback from 136 to 94 points, acted as a cleansing phase. It flushed out late speculation and forced investors to confront their own convictions. Then came January 2025, when BCOM broke above its two-year downtrend. That breakout didn’t just confirm the start of Wave 3—it marked an emotional pivot point: the shift from curiosity to conviction. In market psychology, that’s the moment disbelief transforms into acceptance—the point where “maybe” becomes “yes.”

This emotional transition matters because it’s the precursor to capital rotation. The sequence is always the same: disbelief (no one cares), curiosity (quiet accumulation), and conviction (broad participation). What makes this stage of the supercycle so powerful is that we’re right at that inflection point—where the technicals confirm what market psychology is only beginning to accept.

At the moment, positioning remains light, ownership is still low, and institutional exposure to commodities is nowhere near prior-cycle levels. Yet, sentiment is unmistakably healing. And in markets, that’s often all it takes—a subtle shift from indifference to engagement—to ignite a structural upswing. When conviction begins to compound, participation follows. And when participation follows, the cycle doesn’t just sustain itself—it accelerates.

Final Thoughts

Ultimately, when I connect every piece of evidence—the technical breakout, the macro regime shift, and the sentiment transition—the conclusion becomes increasingly difficult to ignore: this commodities bull supercycle isn’t starting; it’s accelerating. The January 2025 breakout didn’t emerge in isolation. Instead, it validated what the 12-year MACD divergence and two-year consolidation had been telegraphing for months—that structure, momentum, and conviction are finally moving in sync.

Furthermore, it’s crucial to understand that today’s setup bears little resemblance to the liquidity-fueled rally of the 2000s. Back then, easy credit and speculative leverage inflated asset prices. This time, the engine is entirely different—it’s scarcity, not speculation, that’s driving the revaluation. The world is shifting from abundance to constraint, and that pivot is reshaping the entire investment landscape. When sustained underinvestment converges with tightening supply and confirmed technical strength, the outcome isn’t a fleeting rally—it’s a secular repricing of hard assets.

Consequently, I view this as a long-term transition to own, not a short-term trade to time. Investors who establish positions early—through diversified commodity ETFs such as DBC or BCI, targeted metals funds like GLD, SLV, or COPX, and high-quality resource producers with strong balance sheets and low AISC—will benefit most from the compounding effects of conviction capital.

All in all, the tide has already turned, and the current is gaining strength. You can either chase it later or wade in now. Because once conviction compounds, the wave doesn’t wait—it carries forward those who recognized the shift early, rewarding foresight over reaction.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.