Andrii Yalanskyi/iStock via Getty Images

The third quarter of 2025 marked an important turning point for the Federal Reserve and the broader fixed income landscape. Inflation has steadied, but the labor market is clearly softening, and the Fed has pivoted to easing policy. Markets continue to digest a mix of fiscal and geopolitical developments, including uncertainty around U.S. trade policy, a spiraling budget deficit, and slowing labor economy. And now the fourth quarter begins with the U.S. government shut down. Despite these headwinds, fixed income returns were positive across most sectors as Treasury Yields declined on the pricing in of further interest rate cuts.

Labor Market Weakness Takes Center Stage

A string of weaker jobs reports set the tone for the quarter.…

Andrii Yalanskyi/iStock via Getty Images

The third quarter of 2025 marked an important turning point for the Federal Reserve and the broader fixed income landscape. Inflation has steadied, but the labor market is clearly softening, and the Fed has pivoted to easing policy. Markets continue to digest a mix of fiscal and geopolitical developments, including uncertainty around U.S. trade policy, a spiraling budget deficit, and slowing labor economy. And now the fourth quarter begins with the U.S. government shut down. Despite these headwinds, fixed income returns were positive across most sectors as Treasury Yields declined on the pricing in of further interest rate cuts.

Labor Market Weakness Takes Center Stage

A string of weaker jobs reports set the tone for the quarter. June’s Non-Farm Payroll print of just 14,000 was followed by similarly soft readings throughout the summer. The most recent jobless claims reaching their highest level since 2021 is further evidence that labor conditions are deteriorating.

Inflation, on the other hand, remained stable, with the caveat that tariff-induced price hikes may still be forthcoming. Combined with signs of softening labor demand, this gave the Fed clearance to cut rates by 25 basis points (bps) in September and signal an additional 25 bps of cuts in October and December. We would caution, however, that this path of easing is far from a certainty. While a cooling labor market may have reduced the appetite for restrictive policy, Fed officials will be hesitant to cut if inflation does not continue moving toward their 2% target.

The near-term challenge the data-dependent Fed must now contend with is a lack of data. The ongoing federal government shutdown halted several key releases, including the August monthly employment report.

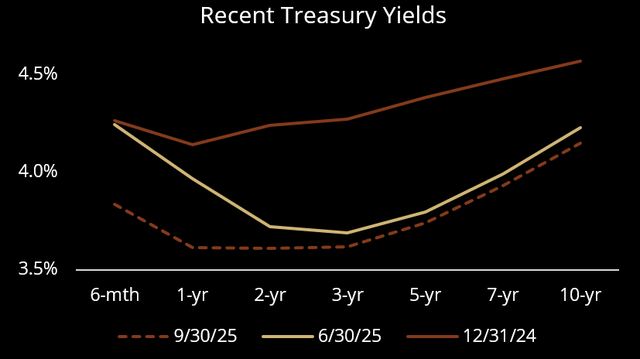

Modest Bull Steepener

The 10-year Treasury yield, which peaked near 4.8% in January, fell steadily toward the key technical and psychological level of 4% by quarter-end. If yields break below that threshold and recession fears intensify, we believe further downside movement is likely. Shorter maturities rallied at a faster pace as expectations for additional Fed cuts firmed. Over the quarter, the 2-year yield fell 11 bps, the 5-year 6 bps, and the 10-year 8 bps, contributing to modest curve steepening.

Markets continue to price a neutral rate in the 2.75-3.00% range, suggesting that investors see policy remaining somewhat restrictive relative to history, even after multiple cuts. We think the story of elevated inflation is not yet over, and to maintain price stability, the neutral rate will need to settle at a higher level.

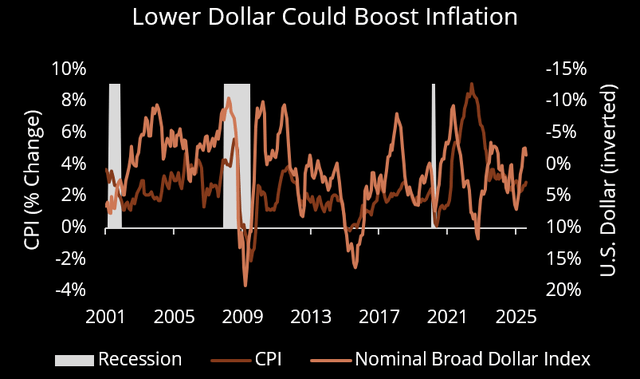

Tariffs and a Weaker Dollar Add to Inflation Risk

Despite elevated tariffs, import prices have remained contained as many companies have absorbed higher costs through lower margins. However, a nearly 7% decline in the trade-weighted U.S. dollar this year threatens to reverse that stability. A weaker dollar makes imported goods more expensive, adding inflationary pressure even as domestic demand cools.

Tariffs have, however, become a meaningful fiscal lever. The effective U.S. tariff rate now stands around 10%, compared with a long-term average near 2%. Tariff collections added nearly $30 billion to federal coffers in August alone, accounting for more than 8% of monthly government receipts. While these revenues strengthen the near-term fiscal position, the long-term impact on growth remains uncertain. Persistent trade uncertainty has led many businesses to delay investment decisions, which has the potential to dampen productivity and hiring, complicating the Fed’s task of sustaining growth while cooling inflation.

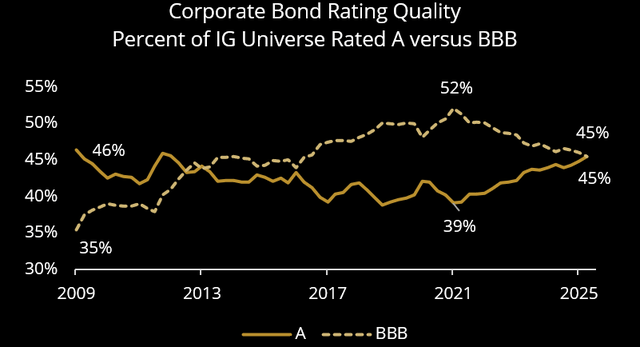

Corporate Creditworthiness Endures

Corporate credit remained a bright spot in Q3, as investment-grade issuers continued to demonstrate financial strength. Since 2021, corporate upgrades have outpaced downgrades, leading to a larger share of A-rated bonds within the investment-grade universe. Banks accounted for over half of recent upgrades thanks to solid capital positions and supportive regulation, while insurers and utilities saw more downgrades due to underwriting headwinds and energy-related challenges.

Spreads tightened roughly 9 basis points during the quarter as investors sought the above-treasury yield. Financials and Industrials performed broadly in line. Lower quality BBB bonds outperformed higher quality amid the risk-on sentiment. Following the strong performance, corporate credit spreads are now at extremely tight levels. Not only is further upside price appreciation limited, but any scare to growth, inflation, or the consumer could send spreads sharply wider.

Given this valuation backdrop, we are emphasizing higher-quality issuers while maintaining exposure to sectors we view favorably, particularly Financials.

Outlook

Policy remains a key driver of market direction as tariffs, fiscal spending, and interest rates intersect. While tariffs have yet to meaningfully raise prices for U.S. consumers, the threat remains top of mind for a Federal Reserve balancing risks to both inflation and growth. The latest Summary of Economic Projections shows that under the hood there is a wide range of views among FOMC members, reflecting uncertainty around the timing and pace of rate cuts. Two more 25 bps cuts this year are expected, but not guaranteed.

We believe fixed income markets are at an inflection point. With the 10-year yield near 4% and the belly of the curve already repriced, further upside price potential may be limited. We expect continued curve volatility as policy evolves, but ultimately a continued steepening as the Fed cuts rates.

Against this backdrop, we are emphasizing quality and flexibility. We continue to capture carry-through high-quality credit exposure while managing interest rate risk through active curve positioning. While yields have compressed and valuations are less compelling, opportunities remain for selective duration extension should yields back up or spreads widen. With all-in yields still attractive relative to history and inflation expectations contained, fixed income continues to offer meaningful income and diversification potential heading into 2026.

“Madison” and/or “Madison Investments” is the unifying tradename of Madison Investment Holdings, Inc., Madison Asset Management, LLC (“MAM”), and Madison Investment Advisors, LLC (“MIA”). MAM and MIA are registered as investment advisers with the U.S. Securities and Exchange Commission. Madison Funds are distributed by MFD Distributor, LLC. MFD Distributor, LLC is registered with the U.S. Securities and Exchange Commission as a broker-dealer and is a member firm of the Financial Industry Regulatory Authority. The home office for each firm listed above is 550 Science Drive, Madison, WI 53711. Madison’s toll-free number is 800-767-0300.

Any performance data shown represents past performance. Past performance is no guarantee of future results.

Non-deposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of, or guaranteed by, any financial institution. Investment returns and principal value will fluctuate.

This website is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security and is not investment advice.

In addition to the ongoing market risk applicable to portfolio securities, bonds are subject to interest rate risk, credit risk and inflation risk. When interest rates rise, bond prices fall; generally, the longer a bond’s maturity, the more sensitive it is to this risk. Credit risk is the possibility that the issuer of a security will be unable to make interest payments and repay the principal on its debt.

Bonds may also be subject to call risk, which allows the issuer to retain the right to redeem the debt, fully or partially, before the scheduled maturity date. Proceeds from sales prior to maturity may be more or less than originally invested due to changes in market conditions or changes in the credit quality of the issuer. In a low-interest environment, there may be less opportunity for price appreciation.

A basis point is one hundredth of a percent.

Bond Spread is the difference between yields on differing debt instruments of varying maturities, credit ratings, and risk, calculated by deducting the yield of one instrument from another.

Carry refers to the income generated from holding a bond or other fixed-income security over time, not accounting for changes in price.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. Duration measures how long it takes, in years, for an investor to be repaid the bond’s price by the bond’s total cash flows.

The federal funds rate is the target interest rate range set by the Federal Open Market Committee (FOMC) for banks to lend or borrow excess reserves overnight. It influences monetary and financial conditions, short-term interest rates, and the stock market.

Diversification does not assure a profit or protect against loss in a declining market.

Yield Curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity. There are three main types of yield curve shapes: normal (upward sloping curve), inverted (downward sloping curve) and flat. Yield curve strategies involve positioning a portfolio to capitalize on expected changes.

Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only, and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance.

Consumer Price Index (CPI) measures changes in the price level of a weighted average market basket of consumer goods and services purchased by households.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.