Getty Images

SPDR S&P Regional Banking ETF (NYSEARCA:KRE) presents itself as a passive investment solution focused on the regional bank segment. And it is here that it finds room to stand out as a thematic ETF among investors’ interests. Its characteristics make it an attractive instrument to fit into a portfolio. At the same time, it presents critical elements that cannot be overlooked lightly. Here’s what you absolutely need to know about the KRE ETF.

Introduction And Definition

Launched on June 19, 2006, by State Street Investment Management (formerly SSGA), KRE replicates the total performance of the [Regional Banks …

Getty Images

SPDR S&P Regional Banking ETF (NYSEARCA:KRE) presents itself as a passive investment solution focused on the regional bank segment. And it is here that it finds room to stand out as a thematic ETF among investors’ interests. Its characteristics make it an attractive instrument to fit into a portfolio. At the same time, it presents critical elements that cannot be overlooked lightly. Here’s what you absolutely need to know about the KRE ETF.

Introduction And Definition

Launched on June 19, 2006, by State Street Investment Management (formerly SSGA), KRE replicates the total performance of the Regional Banks segment within the S&P Total Market Index. It is therefore a passively managed fund, with AUM of about $3.4 billion, that tracks the S&P® Regional Banks Select Industry Index using a modified equal-weighted criterion.

KRE - Fund Profile (Seeking Alpha)

The result is a diversified exposure but with a bias toward mid-size regional banks, more sensitive to local credit cycles. It does this with an expense ratio of 0.35%, high, but well offset by the dividend flow, which, according to the 30-day SEC yield, amounts to about 2.40% (distributed quarterly).

KRE - Dividend Grade (Seeking Alpha)

What Does KRE ETF Do?

In SPDR’s documents on KRE, it is clearly noted that the objective of the KRE ETF is to offer investors pure exposure to the U.S. regional banking sector, more so than other broad-based financial ETFs.

It is therefore clearly a thematic ETF, 100% focused on the U.S. regional banking segment, belonging to the small- and mid-cap category, with a value tilt (due to the nature of the holdings).

KRE - Fund details (Seeking Alpha)

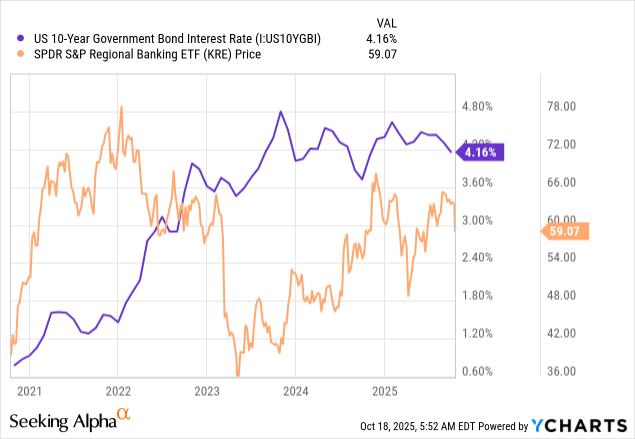

This makes it strongly correlated with the sector’s average net interest margin and the 2s10s curve, and this is key information to understand its role in an investment portfolio. Since regional banks borrow short and lend long, Fed rate cuts increase the net interest margin (NIM). For this reason, KRE theoretically benefits more than traditional financials from a steepening yield curve.

Data by YCharts

Data by YCharts

Putting these considerations into context, according to SPDR’s Spotlight, historically, rate cuts (excluding recessionary periods) have led to a steeper curve and an average performance of the financial sector of +6.8% over the following six months (vs. market +0.6%).

This, of course, applies under expansionary conditions. An economic deterioration would not play in favor of this segment, both because of the predominantly small-cap nature of KRE’s holdings and because the credit quality of KRE’s holdings is heterogeneous.

Who Is KRE ETF For?

For this reason, it can be categorized as a tactical/strategic portfolio ETF; its nature as a thematic ETF, particularly sensitive to the financial cycle, with a beta relative to the S&P 500 greater than 1, makes it potentially a satellite vehicle to overweight the financials exposure without creating overlaps.

It’s a niche ETF in the small-cap value segment of the banking sector, which doesn’t make it suitable as a typical core portfolio position (those being oriented toward large-cap segments).

Be careful when allocating to KRE, since its volatility is heavily correlated to changes in financial cycles and monetary policy. In reality, KRE has a standard deviation above 26 and an annualized volatility of 31%, compared to around ~19% annualized for the S&P 500 at the time of writing.

KRE: Risk Grade (Seeking Alpha)

Similarly, the size factor does not necessarily add a contribution to the portfolio’s CAGR, and today it also lacks momentum, with a total 3-year return just above 2%.

KRE - Momentum Grade (Seeking Alpha)

In institutional portfolios, however, it seems to assume a different role today, as a hedging or shorting vehicle for the sector (not by chance, it has very high volumes). This is demonstrated by the short interest, which in KRE is generally higher than the average of other ETFs, at least currently. In fact, it is often used as a proxy for the domestic banking cycle and credit sentiment.

How Is It Built?

In KRE’s top holdings, the average weight is 2%, a factor that confirms the modified equal-weighted nature of the ETF’s composition.

KRE - top 10 holdings (Seeking Alpha)

There are about 148 holdings, with the top 10 accounting for just over 20% of the total, and naturally, they are 100% U.S. regional banks. From the reading of the holding distribution, one can clearly perceive the presence of mid- and small-cap banks, with higher volatility but also rebound potential.

KRE - Holdings Breakdown (Seeking Alpha)

Its small-to-mid-cap tilt is demonstrated by an average market cap of just $8 billion and a P/E in line with the small- and mid-cap financials segment at around 12x. This also confirms its value traits, especially considering an EPS growth of 13.25%.

To better analyze the profitability of KRE’s holdings, it makes sense to focus on the Non-Depository Financial Institution (NDFI) segment. This is because, for years, there has been a progressive and growing exposure of regional banks to private credit (through NDFI), and this has direct and indirect impacts on the expected EPS growth of the companies within KRE.

In fact, loans to NDFI and co-financing in private credit offer higher spreads, and this temporarily increases the Net Interest Margin (NIM) and therefore EPS, especially in a phase of still high rates. It’s worth noting that among KRE’s holdings, exposure to NDFI loans has grown significantly in some regional banks.

On average, over 11% of total loans are directed to these funds, with peaks exceeding 300%. But these borrowers are also more cyclical. Therefore, the risk of downward revisions on earnings increases in the event of funding deterioration or higher credit losses.

This element makes it truly difficult to estimate a fair value for regional banks today, and therefore also the fair value of KRE. In this sense, it makes sense to monitor the evolution of charge-off and CECL levels to understand EPS sustainability.

Risks

A first risk factor is the fact that KRE is naturally overexposed to a very narrow segment, that of regional banks, which is particularly susceptible to technical stress. This is worsened by its equal-weight nature, with quarterly rebalancing that indirectly tends to give more space in the portfolio to smaller and lower-quality stocks. Therefore, they are more sensitive to funding stress, deposit beta, and local shocks.

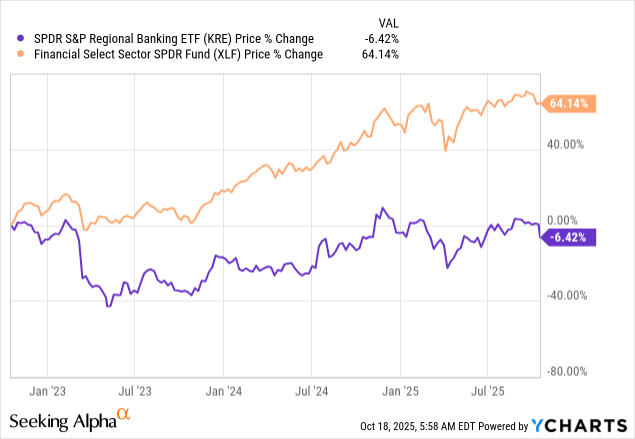

Data by YCharts

Data by YCharts

A second point to remember is regulatory, considering the nature of regional banks, which are still exposed to potential capital revisions and changes in liquidity requirements, elements that affect banking business models.

A case study by S&P Global Market Intelligence highlights precisely this complexity. The test on models such as Probability of Default (PD) and Loss Given Default (LGD) showed that in the regional banking segment, even small variations in risk parameters can significantly affect capital requirements and banks’ profit margins. This is a key difference from large-cap banks, showing that the banks included in KRE operate with a lower capacity to absorb losses or inefficiencies in credit risk management processes. This is why they are also more sensitive to recessionary phases.

Considering the Silicon Valley Bank case and the issue of Bancorporation (ZION) and Western Alliance Bancorp (WAL), the regulatory context becomes even more important.

Peer Comparison

In the following peer comparison, I include a couple similar ETFs: the SPDR® S&P Bank ETF (KBE) and the Invesco KBW Regional Banking ETF (KBWR).

- All three have an expense ratio of 0.35%.

KRE - KBE - KBWR: profile (Seeking Alpha)

- The 5-year performance of KRE is lower than that of its competitors, a trend also observed over longer timeframes such as 10 years.

KRE - KBE - KBWR (Seeking Alpha)

- There are no major differences in terms of dividends; the 4-year average yield is around 2.7% for all three.

KRE - KBE - KBWR: dividends (Seeking Alpha)

- KRE is the most liquid fund, not by chance used as a proxy by institutional investors, with an average daily dollar volume at least 8 times higher than that of its peers.

KRE - KBE - KBWR: Liquidity (Seeking Alpha)

KRE is also the most diversified, having more holdings than its competitors, but a critical element is also higher turnover.

KRE - KBE - KBWR: Concentration & Riks (Seeking Alpha)

Pros And Cons

To sum up, KRE has several advantages:

- It offers “pure” exposure to the U.S. regional banking sector.

- It presents high liquidity and good diversification, thanks to modify equal weight method used to build its benchmark.

- It has diversifying characteristics compared to a classic core component, especially due to its size factor and its value characteristics.

But it also has disadvantages, or characteristics to watch, that cannot be overlooked:

- It has high volatility and large sensitivity to credit cycles. The increase in the percentage of NDFI loans makes EPS growth unstable, and the fair valuation of KRE is highly uncertain.

- A structural bias toward categories more vulnerable to funding stress.

- And, KRE has had a lower historical performance than peers (KBE, KBWR).

This article aims to answer three questions about KRE:

- What characterizes KRE’s holdings?

- What risks accompany KRE?

- How can KRE fit into a portfolio?

Editor’s note:* This article is intended to provide a general overview of the ETF for educational purposes only and, unlike other articles on Seeking Alpha, does not offer an investment opinion about the ETF.*