bizoo_n/iStock Editorial via Getty Images

By Mark Pilipczuk and Oliver Andrews

The U.S. approval of spot Bitcoin and Ether ETFs in January 2024 and July 2024, respectively, represented a significant development in the cryptocurrency market. These products provide investors with a more regulated and accessible way to gain exposure to digital assets, which has encouraged greater institutional involvement in the sector.

The introduction of spot Solana and the potential for XRP ETFs suggest a forthcoming expansion in the scope of basis trading. As shown in the chart below, the front-month SOL and XRP futures contracts saw annualized basis readings spike to 50% in July 2025.

Basis Trade: What Is It and Why Is It Important?

A basis trade is a strategy that involves taking simult…

bizoo_n/iStock Editorial via Getty Images

By Mark Pilipczuk and Oliver Andrews

The U.S. approval of spot Bitcoin and Ether ETFs in January 2024 and July 2024, respectively, represented a significant development in the cryptocurrency market. These products provide investors with a more regulated and accessible way to gain exposure to digital assets, which has encouraged greater institutional involvement in the sector.

The introduction of spot Solana and the potential for XRP ETFs suggest a forthcoming expansion in the scope of basis trading. As shown in the chart below, the front-month SOL and XRP futures contracts saw annualized basis readings spike to 50% in July 2025.

Basis Trade: What Is It and Why Is It Important?

A basis trade is a strategy that involves taking simultaneous, opposing positions in the spot and futures markets to capture the price difference between them.

Basis = Futures Price − Spot Price

The strategy aims to establish a delta-neutral position, where the combined exposure is insulated from the underlying asset’s directional price movements. Instead, the profit or loss is determined by the “locked-in” basis as the two prices converge at the future contract’s expiration.

Below is a common scenario where the futures price is higher than the spot price, known as contango or a positive basis.

Consider a hypothetical trading situation where a spot Bitcoin ETF is trading at $100,000. Simultaneously, the lead-month CME Group Bitcoin futures contract is trading at $101,000. This creates a positive basis of $1,000.

To capture this basis, a trader could:

Go long the spot asset: Buy the Bitcoin ETF at $100,000. 1.

Go short the futures contract: Sell the CME Group Bitcoin futures contract at $101,000.

By executing both trades at the same time, the trader has locked in a gross profit of $1,000 per contract, irrespective of bitcoin’s price direction, before accounting for transaction costs.

To see how, assume that by the time the futures contract expires, the prices have converged at a new price of $105,000.

Spot position: The ETF purchased at $100,000 is now worth $105,000, yielding a profit of $5,000.

Futures position: The futures contract shorted at $101,000 must be settled at $105,000, resulting in a loss of $4,000.

The net result is a $1,000 profit ($5,000 profit - $4,000 loss), matching the initial basis.

Conversely, if the futures price were lower than the spot price (backwardation or a negative basis), the trade would be inverted: the trader would sell the spot asset and buy the futures contract.

The efficiency of this trade is enhanced by the alignment of price benchmarks. Several of the largest spot Bitcoin ETFs use CME CF Reference Rates to calculate their daily net asset value (NAV). As CME Group Bitcoin futures also expire to these CME CF Reference Rates, this means both sides of the trade are anchored to an identical price benchmark. This synchronization minimizes tracking errors and ensures a more reliable price convergence, creating a robust foundation for executing basis trades.

Basis Trading Rises Post-ETF Launch

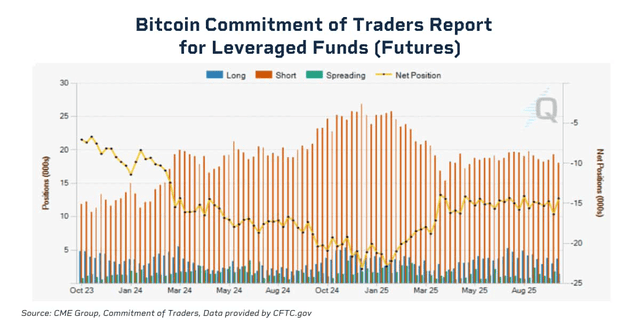

The ETF structure provided institutions with a regulated and liquid spot leg, making basis trading more scalable. Following the launch of spot Bitcoin ETFs in January 2024, leveraged funds increased their net short positioning in CME Bitcoin futures (see chart below).

This implies the growing use of basis trades, where futures are sold short to hedge long exposure in spot markets, rather than a directional view against bitcoin.

Following the spot Ether ETF approvals in July 2024, net short exposure by leveraged funds in CME Ether futures was also evident (see chart below).

As shown in the chart below, CME Group Bitcoin futures open interest climbed from roughly 30,000 contracts in early 2024 to 45,000 in November 2024, before easing back to the low-30,000s by May 2025. Expansions in open interest coincided with a widening of the annualized front-month basis. Price momentum reversed in February 2025 and the basis briefly dipped below zero, with CME Group Bitcoin futures open interest falling at the same time.

What Makes Crypto Basis Different?

Unlike physical commodities, where the basis reflects the cost to deliver the asset at a future date - which includes financing, transport and storage costs - the bitcoin basis is driven by price momentum, market sentiment and financing costs.

Several structural features distinguish the crypto basis from that of traditional assets:

**Increased Retail Participation: **Based on recent 13F filings, institutional ownership in the largest spot Bitcoin ETF (28%) is significantly lower than in more traditional products like the S&P 500 ETF (58%), meaning the retail footprint may make market flows more sensitive to sentiment.

24/7 Markets: Unlike traditional markets, cryptocurrency operates 24/7 without daily resets. This continuous activity allows further price discrepancies between spot and futures markets to emerge. In early 2026, CME Group Cryptocurrency futures and options will be available to trade 24/7 (pending regulatory review), providing market participants with enhanced trading flexibility.

Looking Ahead

Digital asset markets have a unique structure, heavily influenced by a high proportion of retail traders and the outsized impact of social media. This environment can amplify price momentum, triggering waves of buying or selling that can lead to significant price dislocations.

Traders are, in turn, systematically developing strategies to capture these sentiment shifts, and the introduction of new regulated products is creating fresh opportunities for basis trading.

This suggests the sentiment-driven basis in digital asset markets isn’t just a temporary anomaly. Instead, it appears to be an enduring, structural feature of the market itself.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.