Companies require efficient systems for the processing of documents using AI. Developers find it really tricky to select the right model. It’s very important to select the most efficient model in terms of speed, accuracy and cost. We conduct a comparative study on three well-acknowledged AI models: DeepSeek OCR, Qwen-3 VL, and Mistral OCR.

This review will lead you to better data extraction performance. Advanced Optical Character Recognition systems empower fundamental automation in business. The following review is based on production readiness and true document understanding. Careful model selection is important for correct document analysis. The results confirm which one will be able to yield the best utility now.

Table of contents

- [The Evolution of Optical Character Re…

Companies require efficient systems for the processing of documents using AI. Developers find it really tricky to select the right model. It’s very important to select the most efficient model in terms of speed, accuracy and cost. We conduct a comparative study on three well-acknowledged AI models: DeepSeek OCR, Qwen-3 VL, and Mistral OCR.

This review will lead you to better data extraction performance. Advanced Optical Character Recognition systems empower fundamental automation in business. The following review is based on production readiness and true document understanding. Careful model selection is important for correct document analysis. The results confirm which one will be able to yield the best utility now.

Table of contents

The Evolution of Optical Character Recognition

Traditional OCR systems were aimed only at raw character extraction. They often failed with tables, columns, or complex document layouts. Today, modern AI-native models use vision-language architectures. These systems introduce deep context understanding and better Layout Understanding. They are aware that text lives in a structure, not just a stream. This capability takes the field beyond just simple character error rate counting. According to a recent industry report, 70% of enterprise users seek better structural fidelity in OCR. This change means the models have to master the accurate OCR while preserving form logic.

Why We Chose this Image for the test?

Selecting a test document requires certain challenges. IRS Form 5500-EZ has complex and sensitive data fields. It includes handwritten and printed elements across a dense layout, thereby making it appropriately dual in nature for raw OCR testing. The dotted lines and the various fields force the models to deliver superior Layout Understanding. Accurate field extraction is necessary for correct AI Document Processing. Errors on tax forms have clear, quantifiable business impact. This form provides a rigorous test for true competence in Document Analysis.

DeepSeek OCR vs Qwen-3 VL vs Mistral OCR Overview

DeepSeek-OCR

DeepSeek runs on a large, dedicated model architecture. Its design focuses on speed and efficiency in inference. It uses an innovative Optical Compression of Contexts technique that will enable the effective and efficient processing of visual information. DeepSeek is targeted for enterprise adoption and robust scaling.

Read more: DeepSeek OCR

Qwen-3 VL

Qwen-3 VL is Alibaba’s powerful open-weights multimodal system with an architecture that supports an extremely large context window. This high capacity targets complex, long-document understanding. Such a model ensures high accuracy across varied multilingual Optical Character Recognition tasks and comes with open flexibility for researchers and developers.

Mistral OCR

Mistral OCR is a new, focused vision-text model for production AI document processing, with an emphasis on high accuracy and field-level extraction fidelity. The model is specifically tuned for real-world document challenges. It delivers consistent performance with clear structural output.

Read more: Mistral OCR

Hands-On Test Execution and Analysis

We have accessed each model via its publicly available API or web platform interface. For each model, we pasted the same OCR prompt and submitted the IRS form image. This method ensures that we test the core Optical Character Recognition engine. The prompt demanded exact text extraction while preserving the original structure.

OCR Prompt: *“Perform OCR (Optical Character Recognition) on the provided image or PDF document to extract all visible text exactly as it appears in the document. *

# Steps

1. **Input Handling**: Ensure the input is a supported image format (e.g., JPEG, PNG) or a PDF document.

2. **Image Processing**: If necessary, pre-process the image for better OCR results. This might include adjusting brightness, contrast, or converting to grayscale.

3. **OCR Execution**: Use an OCR tool or library to scan the document and extract the text. Ensure the tool is configured to preserve the text formatting as closely as possible.

4. **Text Extraction**: Retrieve the text from the OCR output, ensuring all text is captured as it appears in the document, including punctuation, capitalization, and line breaks.

# Output Format

– Provide the extracted text in a plain text format.

# Example

– Input: An image of a printed page with text.

– Output: “This is the extracted text, maintaining punctuation and line breaks accurately as seen in the source image.”

# Notes

– Ensure that text extraction maintains the original document’s structure and formatting.”

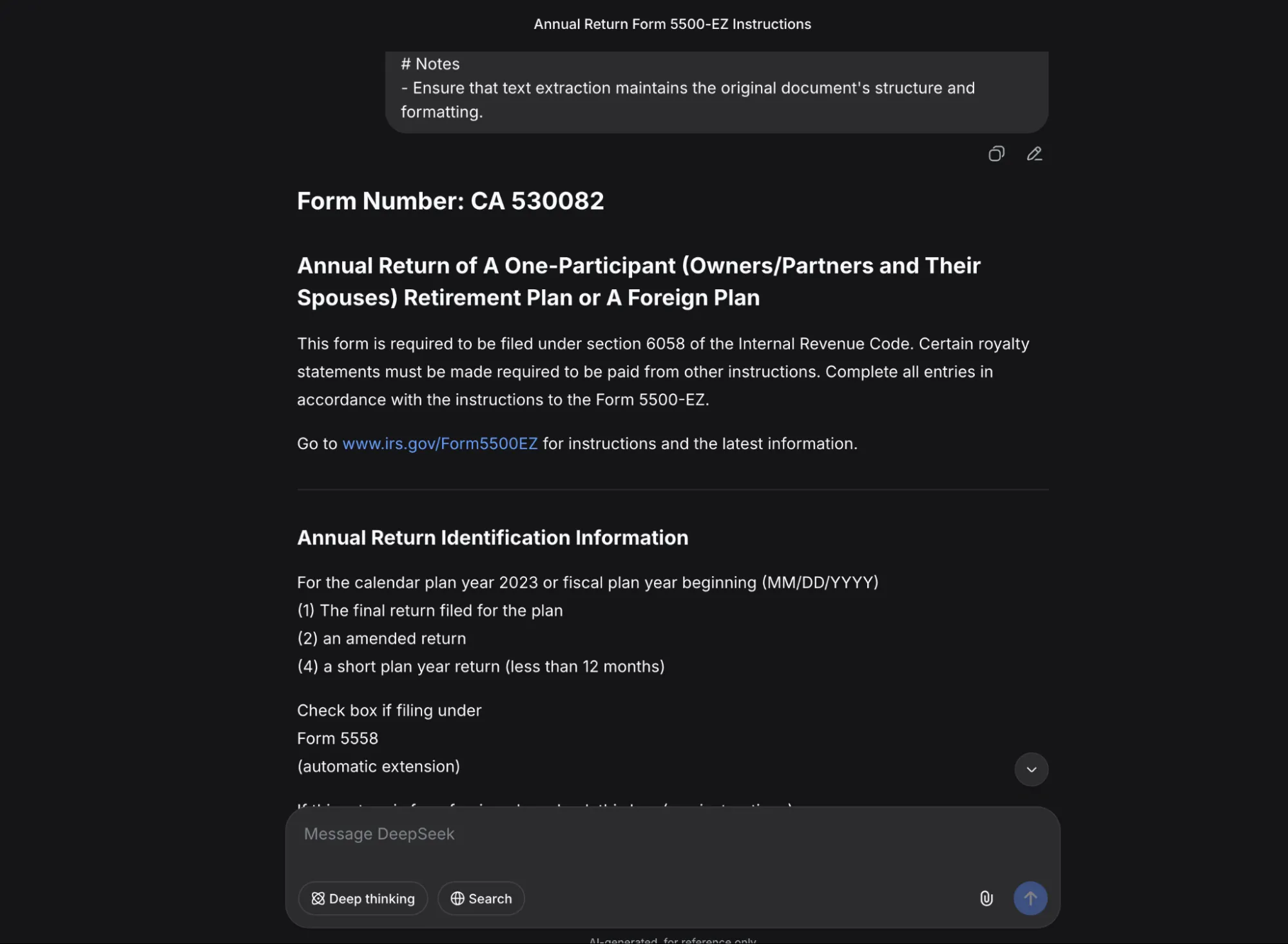

1. DeepSeek-OCR

- Head over to https://chat.deepseek.com

- Paste the OCR Prompt and the IRS form given above.

Response:

# Form Number: CA 530082## Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign PlanThis form is required to be filed under section 6058 of the Internal Revenue Code. Certain royalty statements must be made required to be paid from other instructions. Complete all entries in accordance with the instructions to the Form 5500-EZ.Go to www.irs.gov/Form5500EZ for instructions and the latest information.---### Annual Return Identification InformationFor the calendar plan year 2023 or fiscal plan year beginning (MM/DD/YYYY) (1) The final return filed for the plan (2) an amended return (4) a short plan year return (less than 12 months) Check box if filing under Form 5558 (automatic extension) If this return is for a foreign plan, check this box (see instructions) If this return is for the IRS Late Filer Penalty Relief Program, check this box (Must be filed on a paper Form with the IRS. See instructions). If this is a retroactively adopted plan permitted by SECURE Act section 201, check here . . . ---### Basic Plan Information — enter all requested information.**Name of plan**---### Annual Return Plan- Employer's name - **Aone Corp Software** Trade name of business (if different from name of employer) In care of name Mailing address (room, apt., suite no. and street, or P.O. box) 235, Park Street Avenue, FL City or town, state or province, county, and ZIP or foreign postal code (if foreign, see instructions) FL 6352 Plan administrator's name (if same as employer, enter "Same") In care of name Mailing address (room, apt., suite no. and street, or P.O. box) City or town, state or province, county, and ZIP or foreign postal code (if foreign, see instructions) If the employer's name, the employer's EIN, and/or the plan name has changed since the last return filed for this plan, enter the employer's name and EIN, the plan name, and the plan number for the last return in the appropriate space provided Employer's name ---### Plan name| | (1) Beginning of year | (2) End of year ||---|---|---|| 6a | 5 0000 | 6000 || 6b | 4 000 | 5000 |Net plan assets (subtract line 6b from 6a) ---For Privacy Act and Paperwork Reduction Act Notice, see the instructions for Form 5500-EZ. Catalog Number 62603Z Form 5500-EZ (2023)

DeepSeek returned results in a solid 4-6 seconds. In contrast, its performance on Document Analysis was not very precise. The model missed several important fields in the document header. It also was off on Layout Understanding of the financial tables. Key fields had transcription errors, such as reading “ACME Corp Software” as “Aone Corp Software.” This error rate means DeepSeek’s output requires significant manual correction. Speed does not compensate for major data loss in this application.

2. Qwen-3 VL

- Go to https://chat.qwen.ai/

- Paste the OCR Prompt and the IRS form given above.

Output:

Form Number: CA530082Form 5500-EZAnnual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign PlanDepartment of the TreasuryInternal Revenue ServiceThis form is required to be filed under section 6058(a) of the Internal Revenue Code.Certain foreign retirement plans are also required to file this form (see instructions).Complete all entries in accordance with the instructions to the Form 5500-EZ.Go to www.irs.gov/Form5500EZ for instructions and the latest information.OMB No. 1545-16102023This Form is Open to Public InspectionPart I Annual Return Identification InformationFor the calendar plan year 2023 or fiscal plan year beginning (MM/DD/YYYY) 01/02/2022 and ending 01/10/2023A This return is:(1) ☑ the first return filed for the plan(2) □ an amended return(3) □ the final return filed for the plan(4) □ a short plan year return (less than 12 months)B Check box if filing under□ Form 5558□ automatic extension□ special extension (enter description)C If this return is for a foreign plan, check this box (see instructions) □D If this return is for the IRS Late Filer Penalty Relief Program, check this box(Must be filed on a paper Form with the IRS. See instructions.) □E If this is a retroactively adopted plan permitted by SECURE Act section 201, check here □Part II Basic Plan Information — enter all requested information.1a Name of planAnnual Return Plan1b Three-digit plan number (PN)5861c Date plan first became effective (MM/DD/YYYY)02/05/20222a Employer's nameACME CORP SoftwareTrade name of business (if different from name of employer)In care of nameMailing address (room, apt., suite no. and street, or P.O. box)235, PARK STREET AVENUE, FLCity or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)FL 630522b Employer Identification Number (EIN)(Do not enter your Social Security Number)7352683292c Employer's telephone number0115362592d Business code (see instructions)3a Plan administrator's name (if same as employer, enter "Same")In care of nameMailing address (room, apt., suite no. and street, or P.O. box)City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)3b Administrator's EIN5326783c Administrator's telephone number4 If the employer's name, the employer's EIN, and/or the plan name has changed since the last return filed for this plan, enter the employer's name and EIN, the plan name, and the plan number for the last return in the appropriate space provided.a Employer's name4b EIN57329004c Plan name4d PN5a(1) Total number of participants at the beginning of the plan year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Qwen-3 VL gave the best overall character-level OCR output. It showed excellent structural fidelity, proving strong Layout Understanding. It picked up fine details such as the checkbox mark. However, the system essentially timed out during the processing. It started giving out infinite dots while trying to finalize the extraction. This critical speed failure makes the model unusable for any high-volume AI Document Processing pipeline now. High accuracy is meaningless without low-latency delivery.

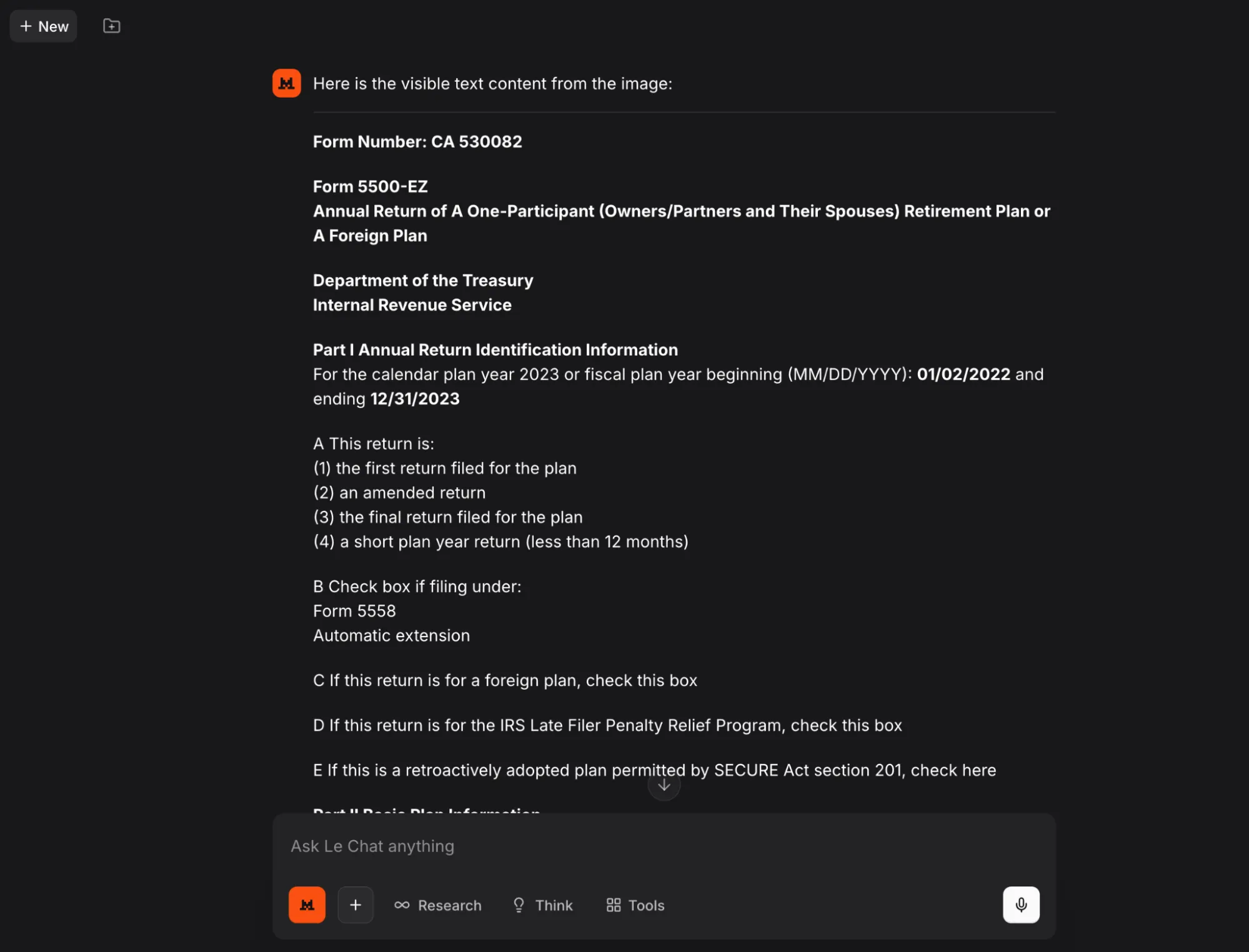

3. Mistral OCR

- Go to https://chat.mistral.ai

- Paste the OCR Prompt and the IRS form given above.

Response:

Here is the visible text content from the image:Form Number: CA 530082Form 5500-EZ Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign PlanDepartment of the Treasury Internal Revenue ServicePart I Annual Return Identification Information For the calendar plan year 2023 or fiscal plan year beginning (MM/DD/YYYY): 01/02/2022 and ending 12/31/2023A This return is: (1) the first return filed for the plan (2) an amended return (3) the final return filed for the plan (4) a short plan year return (less than 12 months)B Check box if filing under: Form 5558 Automatic extensionC If this return is for a foreign plan, check this boxD If this return is for the IRS Late Filer Penalty Relief Program, check this boxE If this is a retroactively adopted plan permitted by SECURE Act section 201, check herePart II Basic Plan Information1a Name of plan: Annual Return plan1b Three-digit plan number (PN): 5861c Date plan first became effective (MM/DD/YYYY): 02/05/20222a Employer’s name: ACME Corp Software2b Employer Identification Number (EIN): 7352683292c Employer’s telephone number: (011) 5382593a Plan administrator’s name (if same as employer, enter “Same”): Same3b Administrator’s EIN: 5326783c Administrator’s telephone number:4 If the employer’s name, the employer’s EIN, and/or the plan name has changed since the last return filed for this plan, enter the employer’s name and EIN, the plan name, and the plan number for the last return in the appropriate space provided4b EIN: 57329004d PN: 5865a(1) Total number of participants at the beginning of the plan year: 1.05a(2) Total number of active participants at the beginning of the plan year: 15b(1) Total number of participants at the end of the plan year: 15b(2) Total number of active participants at the end of the plan year: 15c Number of participants who terminated employment during the plan year with accrued benefits that were less than 100% vested: 2Part III Financial Information6a Total plan assets: (1) Beginning of year: $50,000 (2) End of year: $60,0006b Total plan liabilities: (1) Beginning of year: $4,000 (2) End of year: $5,0006c Net plan assets (subtract line 6b from 6a): (1) Beginning of year: $46,000 (2) End of year: $55,000Catalog Number 63283R **Form 5500-EZ (20

In this exhaustive comparison, Mistral OCR had the fastest response time. It completed the entire extraction in 3-4 seconds. Its output format was neat and well-structured. It achieved very high recognition accuracy across all handwritten and printed fields. Most importantly, its Layout Understanding allowed easy consumption of the extracted data. Mistral successfully provided the most complete and usable final structure. This model also showed a unique instance of inferring the line 6c Net plan assets total, which indeed shows strong internal consistency beyond raw text.

Establishing Robust OCR Models Comparison Metrics

| Category | Metric | Mistral | DeepSeek | Qwen-3 VL |

|---|---|---|---|---|

| Speed | Latency (sec/image) | 3 to 4 sec | 4 to 6 sec | Infinite |

| Recognition Accuracy | Word or Character Accuracy | Very High | Moderate | Excellent |

| Layout Understanding | Structure F1 | Excellent | Fair | Excellent |

| Semantic Consistency | Meaning Similarity | Good with inference | Poor | Excellent |

| Output Usefulness | Field Extraction Quality | Excellent | Poor | Excellent |

Final Verdict: DeepSeek OCR vs Qwen-3 VL vs Mistral OCR

Practical application demands a trade-off between accuracy and speed. In real-world situations, theoretical high performance is not enough to ensure success. Hands-on testing makes this fact very clear.

Mistral OCR offered the best balance for this specific document analysis task: it combined high accuracy, excellent layout understanding, and the fastest processing speed. The minor issue with outputting the calculated value is a trade-off for overall usefulness.

Qwen-3 VL was strong in recognition but couldn’t pass the latency test. DeepSeek OCR was fast, but its poor Optical Character Recognition performance disqualifies it for complex forms. For robust AI document processing, select an architecture that has proven speed and structural fidelity. Industry trends are moving away from pure brute-force accuracy alone toward fast, accurate, and context-aware extraction.

Conclusion

Modern OCR choices come down to balancing accuracy with real production speed. Benchmark scores matter, but real-world reliability matters more. Mistral stands out because it delivers fast results with strong layout understanding, which makes it the safest pick for serious document-processing work. DeepSeek is quick but struggles with consistent OCR quality, and Qwen-3 VL reads well but fails on latency, which makes it risky for enterprise use. When delay can break a workflow, dependable speed and structural fidelity outweigh theoretical accuracy. Choose the tool that proves it can perform under real conditions.

Frequently Asked Questions

Q1. Which model in the test was the most accurate on a character level?

A. Qwen-3 VL delivered the best character-level Optical Character Recognition. However, its slow speed made the output delivery unsuccessful.

Q2. Why is field extraction quality more important than raw accuracy?

A. Field extraction just assures that the structured data is correct and prepared for automation. High accuracy means very little without Layout Understanding behind it.

Q3. Was there an error on the financial calculation by Mistral OCR?

A. Mistral inferred the value of Net Plan Assets from the other lines. Though correct, strict OCR requires capture of only text visible.

Harsh Mishra is an AI/ML Engineer who spends more time talking to Large Language Models than actual humans. Passionate about GenAI, NLP, and making machines smarter (so they don’t replace him just yet). When not optimizing models, he’s probably optimizing his coffee intake. 🚀☕