There’s a pivot happening right now

Toyota, Honda, and Suzuki are transforming their manufacturing footprint with over $11 billion in new investments, and the destination has caught many by surprise. These Japanese automotive giants are rapidly building production capacity in India, marking one of the most significant strategic pivots in the global auto industry.

Toyota and Suzuki have committed $11 billion to expand manufacturing and export capabilities, while Honda announced it will make India the production base for one of its planned electric vehicles starting in 2027. Japan's annual direct investment in India has gone up ove...

There’s a pivot happening right now

Toyota, Honda, and Suzuki are transforming their manufacturing footprint with over $11 billion in new investments, and the destination has caught many by surprise. These Japanese automotive giants are rapidly building production capacity in India, marking one of the most significant strategic pivots in the global auto industry.

Toyota and Suzuki have committed $11 billion to expand manufacturing and export capabilities, while Honda announced it will make India the production base for one of its planned electric vehicles starting in 2027. Japan's annual direct investment in India has gone up over seven times between 2021 and 2024, currently sitting at $1.92 billion. Meanwhile, Japanese investment in China dropped 83% over the same period, to just short of $300 million.

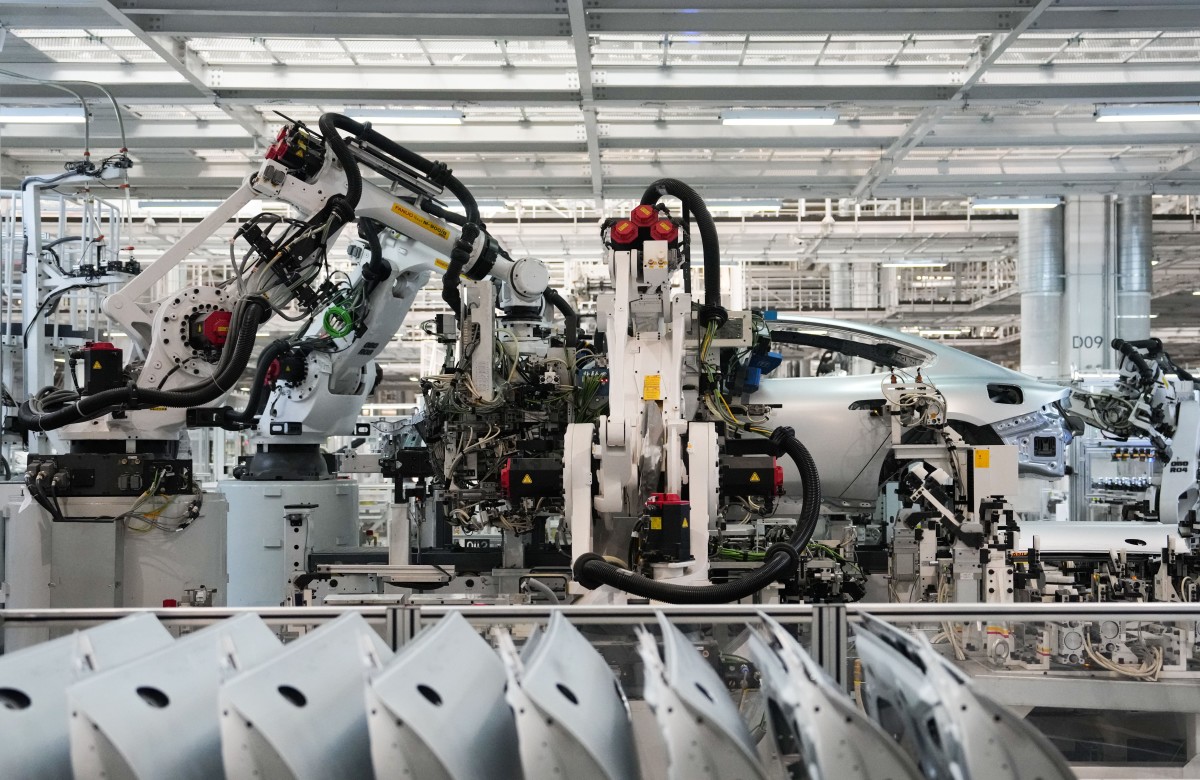

Getty Images

Why India makes strategic sense

India offers Japanese manufacturers something China no longer can: lower costs, a vast labor pool, and protection from Chinese EV competitors who face restrictions in the Indian market. The manufacturing expansion is aggressive. Toyota announced more than $3 billion to expand its existing southern India factory and build a new plant, taking capacity to over 1 million vehicles. Suzuki is investing $8 billion to expand production capacity to 4 million cars annually, up from 2.5 million currently.

India's export power is growing rapidly. The country produced 5 million passenger cars in fiscal year 2024, with approximately 800,000 exported. Total automobile exports surged 19% in 2024, reaching over 5.3 million units, driven by strong shipments to Latin America and Africa. While China produced over 26 million cars in 2023, India's momentum tells a different side to the story. The clincher? Passenger vehicles and part exports from India are excluded from tariffs in the US, at least at the moment.

The race for third place is heating up

India has established itself as the world's third largest car market, overtaking Japan in 2023 with 4.27 million units sold versus Japan's 4.25 million. That said, India is still well behind China and the United States, which produced approximately 26 million and 10.6 million total vehicles in the same year. But while American automakers have doubled down on trucks and SUVs, Japanese brands are positioning themselves to dominate the affordable car segment globally through Indian manufacturing.

The demographic advantage is enormous. India's car industry has grown 60% since 2015, rising from 2.6 million to 4.2 million units. Yet with only 44 vehicles per 1,000 people compared to Japan's 502 and China's 251, India has massive room for expansion. For US buyers watching car prices soar, India's emergence as a low-cost manufacturing hub could eventually provide relief at the dealership.