Private insurers offer Integrated Shield Plans to help Singaporeans with big medical bills, but experts say overly generous coverage and intense competition have fuelled a vicious cycle that is leading to rising healthcare costs.

The generous benefits offered by IPs are leading patients to over-consume healthcare and doctors to over-prescribe tests and treatments, which then drives up claims. And this then nudges insurers to raise premiums. (Illustration: CNA/Nurjannah Suhaimi)

New: You can now listen to articles.

This audio is generated by an AI tool.

08 Nov 2025 09:30PM

When Ms Grace Tay’s mother was diagnosed with amyotrophic lateral sclerosis (ALS), a progressive neurological disease, her Integrated Shield Plan …

Private insurers offer Integrated Shield Plans to help Singaporeans with big medical bills, but experts say overly generous coverage and intense competition have fuelled a vicious cycle that is leading to rising healthcare costs.

The generous benefits offered by IPs are leading patients to over-consume healthcare and doctors to over-prescribe tests and treatments, which then drives up claims. And this then nudges insurers to raise premiums. (Illustration: CNA/Nurjannah Suhaimi)

New: You can now listen to articles.

This audio is generated by an AI tool.

08 Nov 2025 09:30PM

When Ms Grace Tay’s mother was diagnosed with amyotrophic lateral sclerosis (ALS), a progressive neurological disease, her Integrated Shield Plan (IP) proved crucial in covering the high cost of treatment.

An IP is a private insurance add-on that complements MediShield Life to cover the fees for higher hospital wards or private healthcare. MediShield Life is the basic national health insurance that covers large hospital bills at public hospitals.

Ms Tay, 33, said the IP covered consultations, scans, medication and therapy, significantly reducing the family’s out-of-pocket expenses.

“The medication alone costs about S$3,000 (US$2,298) a month, and she had to take it for life. Thankfully, because of her IP, we were able to claim it almost fully,” said Ms Tay, an associate director at a financial advisory firm.

In her mother’s case, her co-payment was capped at S$3,000 a year. Her mother also went for physiotherapy sessions costing about S$200 each, two to three times a week, along with speech therapy and nutritional supplements that added a few hundred dollars more each month.

Even before treatment began, the bills were piling up: her mother’s diagnosis took a year, with numerous tests and second and third opinions at various private healthcare institutions. If they had chosen to get a diagnosis at a public hospital, it would have taken even longer, Ms Tay said.

The extra coverage from the IP spared her father, the primary caregiver, from the barrage of medical expenses, she said.

“It allowed us to focus on caring for her instead of worrying about bills.

Ms Grace Tay said the IP covered her mother’s consultations, scans, medication and therapy, significantly reducing the family’s out-of-pocket expenses. Her mother was diagnosed with amyotrophic lateral sclerosis (ALS). (Photo: CNA/Raj Nadarajan)

Ms Grace Tay said the IP covered her mother’s consultations, scans, medication and therapy, significantly reducing the family’s out-of-pocket expenses. Her mother was diagnosed with amyotrophic lateral sclerosis (ALS). (Photo: CNA/Raj Nadarajan)

Ms Tay’s story perfectly illustrates why many Singaporeans continue to opt for extra coverage through IPs: They worry about being hit by a sudden and unexpected health crisis such as this, and see an IP as an additional security blanket on top of MediShield Life.

This is despite the fact that statistically, many people do not even make use of their IPs if they have them. Health Minister Ong Ye Kung said in a speech last year that even among patients who have IPs and rider protection, about half still end up using subsidised public healthcare when hospitalised or receiving day surgery.

A rider is an optional add-on to an insurance policy that provides extra benefits or coverage beyond what the main plan offers.

“Strictly speaking, and from an episodic point of view, these patients only needed MediShield Life and they could have saved a lot of premiums,” he said.

At the same time, the tendency to buy more coverage than necessary has created a problem: The generous benefits offered by IPs are leading patients to over-consume healthcare and doctors to over-prescribe tests and treatments, which then drives up claims.

And this then nudges insurers to raise premiums, hence making healthcare more expensive for everyone.

“I think we may be in a health insurance vicious circle, of overly generous insurance policy design leading to a buffet syndrome and more non-critical or even unnecessary tests and treatments being prescribed, which in turn lead to bigger bills and higher premiums for all,” said Mr Ong in his speech.

Experts told CNA TODAY that this is not an easy problem to solve, as every player in this situation is intertwined.

Associate Professor Alec Morton from the National University of Singapore (NUS) Saw Swee Hock School of Public Health noted that the overconsumption of healthcare exists around the world, wherever private insurance exists, and that any meaningful change requires all parties to move together.

“The dilemma is that any way to break the cycle for good will limit choice and potentially lead to government (and taxpayers) stepping in as universal payers,” said Assoc Prof Morton, referring to a system where the state takes on most healthcare costs.

Such a move, he said, would also reduce individual choice as private insurers would play a smaller role.

Dr Li Yang, a senior lecturer in the finance programme at the Singapore University of Social Sciences (SUSS), noted that the government has made some moves that have helped slow the rise in costs, but achieving a lasting balance will require prudent reforms and collective restraint, supported by greater coordination across the healthcare sector.

HOW THE CYCLE PERPETUATES ITSELF

The problem starts with behaviour, both human and institutional: Patients who hold generous IPs and riders that cover most or even all of their bills tend to agree to more tests or pricier treatments because they ultimately do not have to bear the full cost of these.

As the Health Minister Mr Ong put it, the result is a buffet syndrome: “It is paid for, eat more. It is natural human behaviour, happening all over the world, especially in healthcare.”

Furthermore, under Singapore’s fee-for-service system, doctors are paid for each procedure they perform, which can encourage them to suggest additional tests or treatments even if they do not significantly improve outcomes, said Assistant Professor Cynthia Chen from the NUS Saw Swee Hock School of Public Health.

Mr Ong said there is a tendency for people with comprehensive riders to “use more than necessary”. He noted that such policyholders are 1.4 times more likely to make a claim than those without riders, and their claims are also on average 1.4 times larger.

This drives up the number and size of claims, leaving insurers with premiums that no longer cover their payouts. To stay afloat, they are then forced to raise premiums.

As premiums rise, consumers expect even greater value. This means they expect an even wider choice of treatment options, quicker access and more comfort, thus further straining the system.

Patients who hold generous IPs and riders that cover most or even all of their bills tend to agree to more tests or pricier treatments because they ultimately do not have to bear the full cost of these. (Photo: CNA/Raj Nadarajan)

Patients who hold generous IPs and riders that cover most or even all of their bills tend to agree to more tests or pricier treatments because they ultimately do not have to bear the full cost of these. (Photo: CNA/Raj Nadarajan)

Speaking in parliament in September this year, Minister of State for Health Rahayu Mahzam said that Singapore’s private health insurance market has reached an unsustainable state, caught in a cycle of rising premiums and claims driven by overly generous coverage and intense competition among insurers.

She noted that the problem has not arisen from collusion or anti-competitive behaviour but from “excessive competition that has gone wrong – another type of market failure”.

“Regulation will not loosen this knot; it will make it worse. If we restrict insurers’ claims management practices, we will likely see even larger premium increases,” she said.

Mdm Rahayu added that too much government intervention could stifle market innovation and reduce consumer choice, rather than making insurance more sustainable.

Assoc Prof Morton agreed, noting that while stronger regulation could control costs and reduce inefficiencies, it would also move Singapore’s system closer to a state-run, standardised model, where people have less say in how or where they receive care.

A CONTINUOUSLY LOSS-MAKING PROPOSITION

The current state of rising healthcare costs has, in turn, placed increasing pressure on the government’s budget.

In 2025, the Government allocated S$20.9 billion for healthcare, making it the second-highest expenditure after defence, which has a budget of S$23.4 billion.

The government’s annual healthcare expenditure rose from S$9 billion in 2015 to S$18 billion in 2024, and Mr Ong projected it could grow to “close to S$30 billion a year” by 2030.

Meanwhile, IP premiums have risen steadily over the years. In September 2022, Mr Ong noted that private hospital IP premiums had risen by around 20 per cent over the previous few years.

Premiums rose again last year, when a two-year moratorium the Ministry of Health (MOH) had placed on IP premium increases ended on Aug 31, 2024. Several insurers announced they would raise their IP premiums soon after.

Yet, even as premiums rise, about 70 per cent of Singaporeans have IPs and more than one million people also pay for riders in cash, Mr Ong noted.

Experts said this reflects Singaporeans’ natural prudence and risk aversion; many would rather pay higher premiums for peace of mind than risk being caught off guard by an unexpected illness or medical emergency.

AIA Singapore’s chief marketing and healthcare officer Irma Hadikusuma said that while MediShield Life provides basic coverage for treatment in subsidised wards, IPs offer “greater choice and control” over the type and level of healthcare coverage individuals prefer.

IPs and riders also allow individuals to tailor their protection to their healthcare preferences, comfort levels and financial means, she added.

And, indeed, for consumers who can afford it, an IP can feel like a reasonable expense that provides comfort in the worst moments.

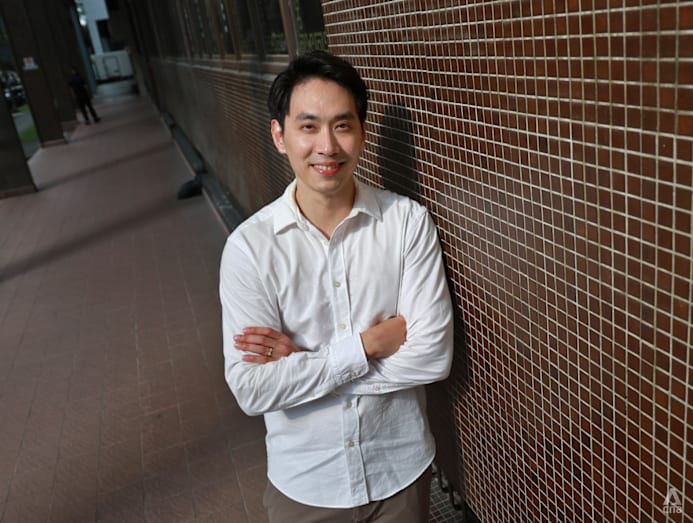

Financial services manager Clyde Chye, 34, was extremely grateful that he had invested in an IP last week, when he developed a sudden viral fever. His temperature spiked to 39 degrees Celsius at one point and stayed at that level for a whole day.

“It was very painful, and I didn’t know what was happening,” he said.

Having experienced long wait times at public hospitals before, he decided to head straight to a private hospital in the middle of the night.

“They checked me in immediately, put me on an IV drip and gave me an injection to bring down the fever. That night, I finally managed to sleep,” he said.

Mr Chye’s two-night stay and treatment were fully covered by his IP.

“I was discharged without paying anything,” he said. “I pay a few thousand dollars a year in premiums, but it gives me peace of mind. Even if I don’t use it, I know my costs are controlled no matter what.”

Financial services manager Clyde Chye, 34, was extremely grateful that he had invested in an IP last week, when he developed a sudden viral fever. (Photo: CNA/Raj Nadarajan)

Financial services manager Clyde Chye, 34, was extremely grateful that he had invested in an IP last week, when he developed a sudden viral fever. (Photo: CNA/Raj Nadarajan)

But for insurers, this generosity hurts. Executive director of the Life Insurance Association, Singapore (LIA Singapore), Mr Chan Wai Kit, said that in specific years, despite rising premiums, the industry has seen single-digit profit margins in health insurance portfolios and some IP insurers are even incurring losses.

LIA Singapore is the not-for-profit industry body representing life insurance companies in Singapore.** **

Of the seven Integrated Shield Plan insurers, four – Income Insurance, Singlife, HSBC Life and Raffles Health Insurance – posted underwriting losses in 2024, as rising claims outpaced premium growth.

Across the six major IP insurers, net claims rose between 9 per cent and nearly 28 per cent in 2024, far exceeding medical inflation of about 10 to 11 per cent.

“It cannot remain a loss-making proposition indefinitely, because that’s just not economically viable,” said Mr Chan.

Mr Chan said insurance design must evolve to stay sustainable, with IP insurers balancing premiums, benefits and customer needs.

“It isn’t as simple as saying, if you make a loss, just increase premiums by a certain percentage. Insurance doesn’t work that way. It’s a commitment to customers, protecting them over the years and decades to come.”

Chief customer officer at Income Insurance, Mr Dhiren Amin, said insurers are “careful and calibrated“ about making changes to IPs, as they have to maintain a delicate balance to maintain claims sustainability, cost discipline and alignment with national healthcare priorities.

Additionally, insurers also face the challenge of having to keep up with medical innovations, which tend to be expensive.

Prudential Singapore’s chief health officer, Dr Sidharth Kachroo said the number and size of claims that the company has seen have increased steadily, with claim volumes rising by more than 15 per cent in 2024 from the year before.

“Medical inflation is a complex issue,” said Dr Kachroo. “Advancement of medical technology and manpower costs contribute to increasing healthcare delivery costs, leading to increases in insurance costs and corresponding premiums.”

For doctors, the pressures are equally complex. Dr Peter Chow, the chief executive officer of IHH Healthcare Singapore, said doctors must balance patient expectations with medical necessity in an increasingly competitive environment.

IHH Healthcare Singapore operates four private hospitals in Singapore: Gleneagles Hospital, Mount Elizabeth Hospital (Orchard), Mount Elizabeth Novena Hospital, and Parkway East Hospital.

And the solution is not as easy as capping prices on certain items, Dr Chow said, adding that if such a move were made, some doctors might make up the difference by ordering more scans or prescribing extra medication, as patients often lack the knowledge to question these decisions.

“Doctors have to earn a living, hospitals need to be sustainable, insurers need to keep going – it’s not necessarily a conflict, but everyone must play their part responsibly.”

Many would rather pay higher premiums for peace of mind than risk being caught off guard by an unexpected illness or medical emergency. (Photo: iStock)

Many would rather pay higher premiums for peace of mind than risk being caught off guard by an unexpected illness or medical emergency. (Photo: iStock)

UNTANGLING THE KNOT, BIT BY BIT

Over the past three years, MOH has implemented several measures to curb overconsumption and rising healthcare costs, driven by generous insurance coverage.

In response to queries from CNA TODAY, an MOH spokesperson said the ministry is actively addressing complex challenges in Singapore’s healthcare landscape through targeted measures that preserve quality care while ensuring sustainability and accessibility for all Singaporeans.

To exercise regulatory oversight of IP insurers and products, MOH is working with the Monetary Authority of Singapore to regulate key IP parameters, ensuring deductible and co-payment requirements are met while avoiding over-regulation that could stifle innovation.

The spokesperson added that MOH’s general practice is to avoid intervening in premiums and service quality, which are integral to market competition.

“This balanced approach sets appropriate guardrails while preserving market benefits.”

Additionally, the ministry has also been urging insurers to redesign their “overly generous” policies to strike a better balance between protection and prudent consumption.

“We encourage products with higher co-payments but lower premiums that still provide meaningful protection against large bills,” said the spokesperson.

To manage increased patient loads at public hospitals, MOH said it is strengthening infrastructure, introducing alternative care models like MIC@Home, and focusing on value-based care to deliver better outcomes and maintain affordable, high-quality treatment for patients for the long-term.

A claims management office (CMO) was established in 2022 to manage claims for MediShield Life appropriately.

Last year, two doctors had their MediSave and MediShield Life accreditation suspended, while another four were required to undergo mandatory training after they were found to have made inappropriate MediShield Life claims.

IHH’s Dr Chow noted, however, that the role of the CMO is very specific – it looks for fraudulent claims by doctors.

“That’s only a very small pool of errant cases and doesn’t have a major impact on overall costs.”

What has been more impactful is the MOH’s introduction in 2018 of surgeon fee benchmarks for 200 common surgical procedures, which listed the recommended fee range for these procedures. This gives healthcare providers and insurers a reference guide they can use to set fees and review reimbursements.

Since then, the ministry has developed and published fee benchmarks for more hospital charges, such as room rates, surgical facilities and consumables including medication.

Speaking on CNA’s Deep Dive podcast in October, Mr Ong said benchmarking surgeon fees has proven quite effective, with most charges now falling within the recommended range.

The average annual growth in private surgeon fees has slowed dramatically – from 3 per cent between 2010 and 2018 to just 0.4 per cent from 2019 to 2023, he said.

He announced earlier this month that MOH will benchmark more private hospital charges, such as professional fees, room charges, surgical facilities and equipment, and medication.

Dr Chow of IHH Healthcare Singapore said greater data transparency would help hospitals and regulators monitor care patterns and manage excessive billing.

“Beyond doctors’ professional fees, a patient’s total bill also includes hospital facility fees and other charges by doctors,” he said, adding that current systems make it difficult to distinguish between these components.

Prudential Singapore’s Dr Kachroo agreed, saying that having clearer data from private hospitals would provide insurers with more transparency, allowing them to conduct a more thorough claims assessment, which can then help them control costs while enhancing the customer experience and improving data for analytics.

Going forward, Dr Chow said MOH should continue bringing all players – insurers, doctors and hospitals – together to develop a “proper blueprint and master plan” that clearly sets short and long-term goals for the system.

“If you use the knot analogy, there’s no way you can just move one string and untie it. You actually need to remove all the pieces at the same time,” he said.

Agreeing, Mr Chan of LIA Singapore said insurers must continually redesign products to remain sustainable without compromising essential protection, while regulators and stakeholders work collectively to encourage transparency and data sharing across the system.

“It’s not about who moves first or second,” Mr Chan said. “The willingness to all work together, to untie that knot, that is the meaningful way to do it.”

One of the next moves MOH should make is to set precise parameters so that both insurers and healthcare providers are incentivised to focus on treatments that genuinely improve patients’ health, rather than increasing the number of procedures, said Asst Prof Chen from NUS Saw Swee Hock School of Public Health.

Over the past three years, the Ministry of Health has implemented several measures to curb overconsumption and rising healthcare costs, driven by generous insurance coverage. (Photo: CNA/Raj Nadarajan)

Over the past three years, the Ministry of Health has implemented several measures to curb overconsumption and rising healthcare costs, driven by generous insurance coverage. (Photo: CNA/Raj Nadarajan)

FROM FEAR TO UNDERSTANDING

Patients and caregivers play a critical role as well. Asst Prof Chen said that they should, for example, ask whether an extra scan or test is truly necessary, which can help prevent duplication and reduce costs.

“Ultimately, Singapore needs a cultural shift towards value-based care, where policymakers, providers, insurers and patients are all aligned around the same goal of achieving better health outcomes for every dollar spent,” she said.

Independent financial adviser Ian Lee said while many people are not really over-insured but “not optimising what they pay versus what they get”.

He suggested seeking advice from an independent adviser who can compare options across insurers to ensure coverage remains sustainable.

“Everyone’s financial situation is different – what matters is whether the premium you’re paying is a comfortable percentage of your income,” he said.

While her insurance premiums were a comfortable percentage of her income, Ms Charmaine Tay still felt that she was overinsured in her twenties.

Then, she signed up for multiple plans, upgraded her health insurance so it covered stays at better wards, increased her payouts in the event of her death and added on cancer coverage.

“My parents often talked about how it was important to get insurance, to guard against what-ifs. To be honest, now it feels like paranoia,” said the 32-year-old civil servant.

“At the time I had no idea what was sufficient for my lifestyle,” she said. “I just thought it was better to have more than less.”

She later realised much of it didn’t fit her needs and there was an overlap in her plans. For example, some of her investment policies already included death benefits but she had opted for increased death payouts in other plans.

Now, she reviews her policies about four times a year and has decided to stop buying new ones.

“It’s really important for people to step out of that social pressure and scaremongering and think critically about their life – what do they need right now and what can they afford?” she said.

Source: CNA/nl/yy