IBM said it will acquire data streaming company Confluent in a deal valued at $11 billion. The deal will give IBM an open-source data platform with an annual revenue run rate topping $1 billion that can provide governed data to AI agents.

In a statement, IBM said the deal will add to non-GAAP earnings in the first year and boost free cash flow in year two after the deal closes. IBM CEO Arvind Krishna said the companies will "enable enterprises to deploy generative and agentic AI better and faster by providing trusted communication and data flow between environments, applications and APIs."

Big Blue has been filling in its enterprise software portfolio via acqui…

IBM said it will acquire data streaming company Confluent in a deal valued at $11 billion. The deal will give IBM an open-source data platform with an annual revenue run rate topping $1 billion that can provide governed data to AI agents.

In a statement, IBM said the deal will add to non-GAAP earnings in the first year and boost free cash flow in year two after the deal closes. IBM CEO Arvind Krishna said the companies will "enable enterprises to deploy generative and agentic AI better and faster by providing trusted communication and data flow between environments, applications and APIs."

Big Blue has been filling in its enterprise software portfolio via acquisition with its latest large deal being the $6.5 billion purchase of HashiCorp.

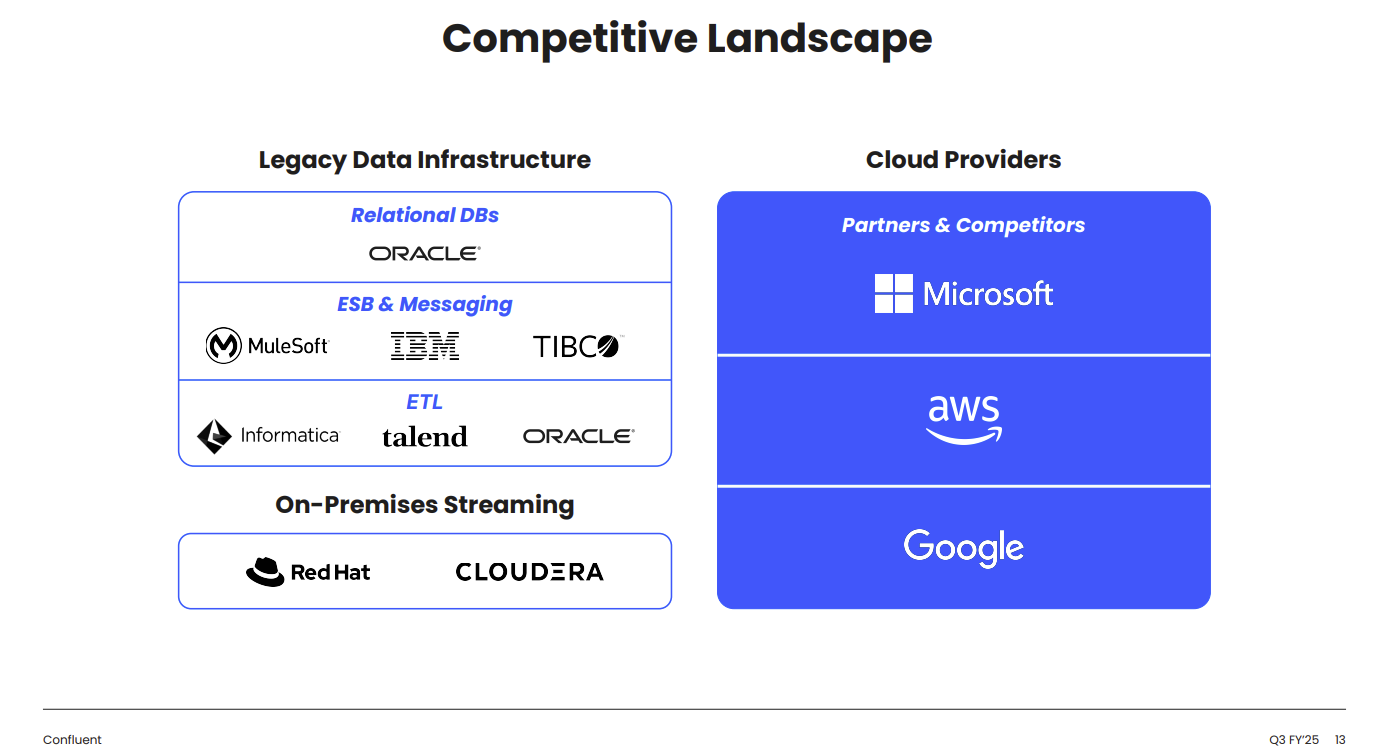

Confluent gives IBM a platform that will connect and reuse data for applications notably AI agents. In many ways, Confluent will be to IBM what MuleSoft and Informatica is to Salesforce–data connection and integration engines that provide the information that AI agents will need to make decisions. Confluent has said that AI will drive the company’s next phase of growth due to the need for real-time data streaming.

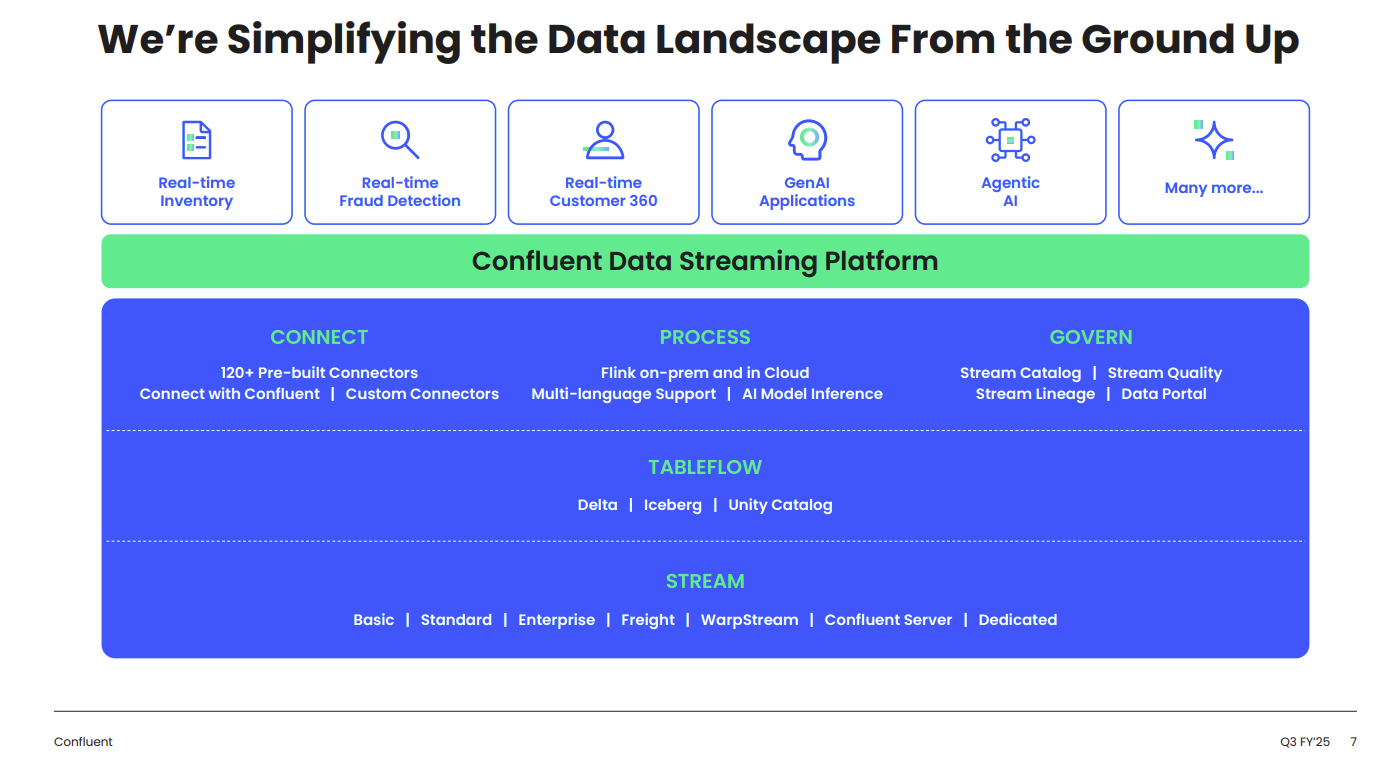

Here’s a look at the Confluent stack that has multiple deployment options such as Confluent Cloud, a managed data streaming platform, Confluent Platform, a self-managed deployment, WarpStream, a hybrid deployment model, and a private cloud offering.

Confluent CEO Edward Kreps said IBM’s scale will accelerate its strategy and boost go-to-market efforts. IBM will use Confluent to advance its hybrid cloud and AI strategy, enhance efforts across the company’s portfolio and give it a growth engine. IBM said Confluent will also complement Red Hat and its data and automation portfolio.

Confluent is also based on Kafka and offers managed open source data streaming. That approach fits in with IBM’s open source cred, but also appeals to enterprises looking to avoid lock in. Confluent’s value prop was outlined by Kreps at a November investor conference:

- Managed open source data platform and focusing on what’s needed for cloud engineering and running distributed data systems.

- Real-time data streaming via a "broad platform where all the parts work together" including connectivity, governance and real-time processing with Confluent’s Flink compute offering.

- A cloud-native system that works across all environments. "The role of the technology is to kind of act as like a central nervous system that plugs together all the applications and parts of the company," said Kreps.

Here’s what IBM is getting with Confluent:

- A data platform that can be used to not only wrangle data but offer point-in-time queries on static data that can better automate decisions. Confluent has argued that companies are software and data will enable continuous action.

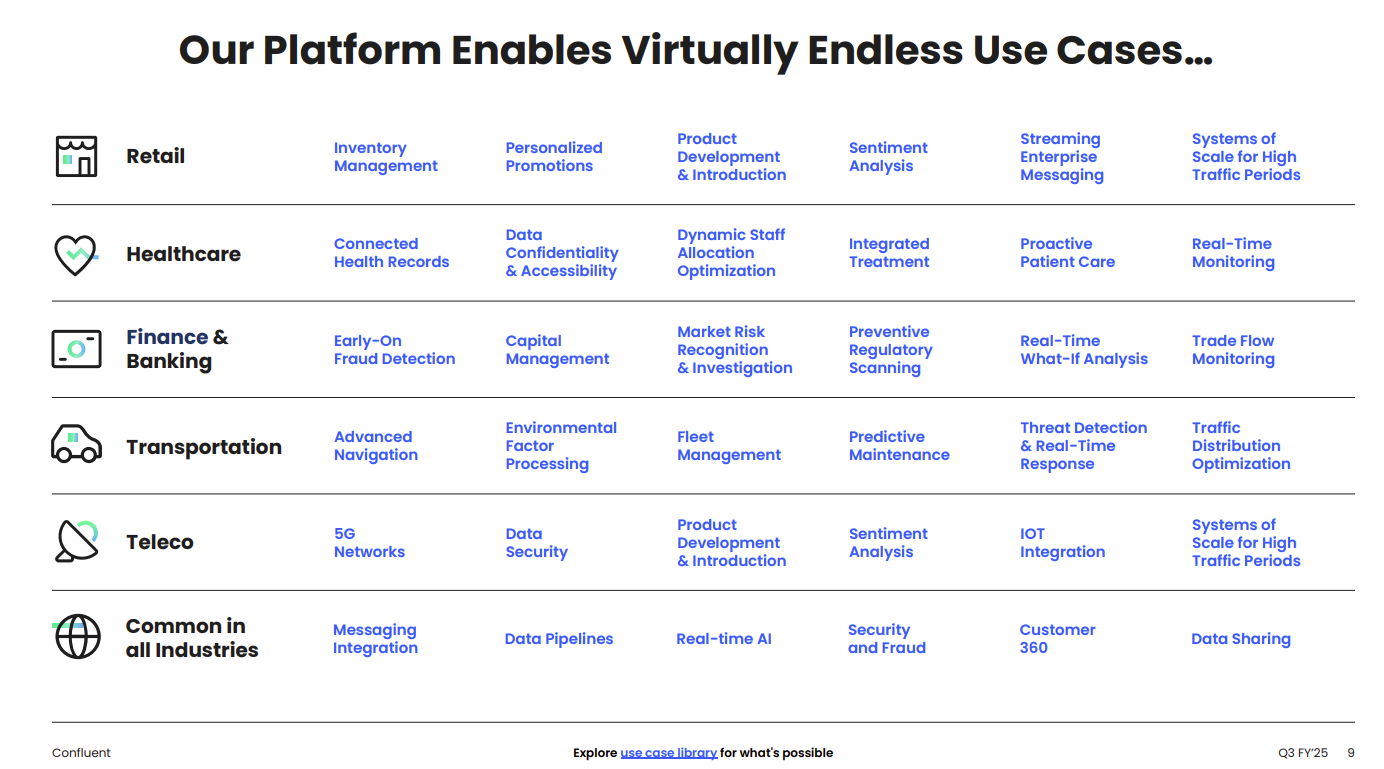

- Permission to play in a hot market. Confluent competes with a range of players including hyperscalers like AWS and its Kinesis.

- Connectors and governance that will collapse enterprise systems with an AI layer that turns into the user interface. Kreps said: "We’ve conceived software applications as being primarily these little islands of UI. And if you think about how these systems are going to work together, that’s become less true over the years and AI is probably making it even less true. The access to the data and APIs that drive the functionality is going to be as important as the thing you see on your phone or web browser."

- Solid revenue growth and non-GAAP profitability. Confluent went public in June 2021 and through its third quarter report in October topped a $1 billion annual revenue run rate. Cloud revenue in the third quarter was up 24% to $161 million.

- Industry data plays that can be scaled with IBM’s vertical focus and IBM Consulting.