At the height of the COVID-19 pandemic, bankruptcy filings plummeted as loan payments paused, stimulus money flowed and debt loads lightened.

That’s all over now.

Bankruptcies are up across the U.S., a sign Americans are running out of road as the cost of living continues to rise. Filings in Minnesota have jumped more than 20% each of the past three years, outpacing the country as a whole.

The trend seems unlikely to slow. And after years of consumers propping up the post-COVID economy, a spending slowdown due to ballooning debt could help tip the country into a recession.

Not only are Americans struggling with the rising costs of unavoidable line items like groceries, car insurance and property taxes, but [wages are failing to keep up](https://www.bankrate.com/banking/federal-…

At the height of the COVID-19 pandemic, bankruptcy filings plummeted as loan payments paused, stimulus money flowed and debt loads lightened.

That’s all over now.

Bankruptcies are up across the U.S., a sign Americans are running out of road as the cost of living continues to rise. Filings in Minnesota have jumped more than 20% each of the past three years, outpacing the country as a whole.

The trend seems unlikely to slow. And after years of consumers propping up the post-COVID economy, a spending slowdown due to ballooning debt could help tip the country into a recession.

Not only are Americans struggling with the rising costs of unavoidable line items like groceries, car insurance and property taxes, but wages are failing to keep up, the job market is faltering and social safety net programs are disappearing amid federal budget cuts.

Meanwhile, the growing popularity of online lenders proffering fast cash at sky-high rates is locking more consumers in debt cycles that are hard to escape.

Total U.S. household debt rose $197 billion in the third quarter to $18.59 trillion, according to the Federal Reserve Bank of New York’s latest household debt and credit report. Of that debt, 4.5% was delinquent, up from 3.5% in the same period last year.

LSS Financial Counseling, a program of the nonprofit Lutheran Social Service of Minnesota, is seeing clients with “significantly higher” debt loads compared to the past few years, in part because interest rates have crept up, said Joanne Lundberg, financial counseling supervisor.

The program has recommended bankruptcy legal services to twice as many clients this year as it did in all of 2024, she said.

Debt creeps up

Lakeville resident Margarita Del Real, 59, went through a bankruptcy this summer. Her husband, the primary breadwinner, had to stop working a few years ago because of a disability, and the loss of income coupled with medical bills topping $250,000 became impossible.

“It was a rough experience, I’ll tell you that,” Del Real said. “When you go from having two pretty decent incomes to one income, it’s mind-boggling what just creeps up on you.”

Related Coverage

LegalShield, a legal subscription service that serves millions of customers nationwide, saw a 17% increase in bankruptcy-related inquiries in the third quarter and a 14% bump year over year, according to the company’s latest report.

“We’ve been seeing this stress over seven, eight, nine months, and unfortunately, I think folks have kind of come to the end of the avenues available to them, and they’re starting to think about bankruptcy harder,” said Matt Layton, LegalShield senior vice president of consumer analytics. “We see nothing in our data that would lead us to believe that there’s going to be any improvement or relief in the short-term.”

There were 161 personal bankruptcy filings in Minnesota in the first week of October, with liabilities averaging more than $190,000, according to a Star Tribune analysis of federal courts data.

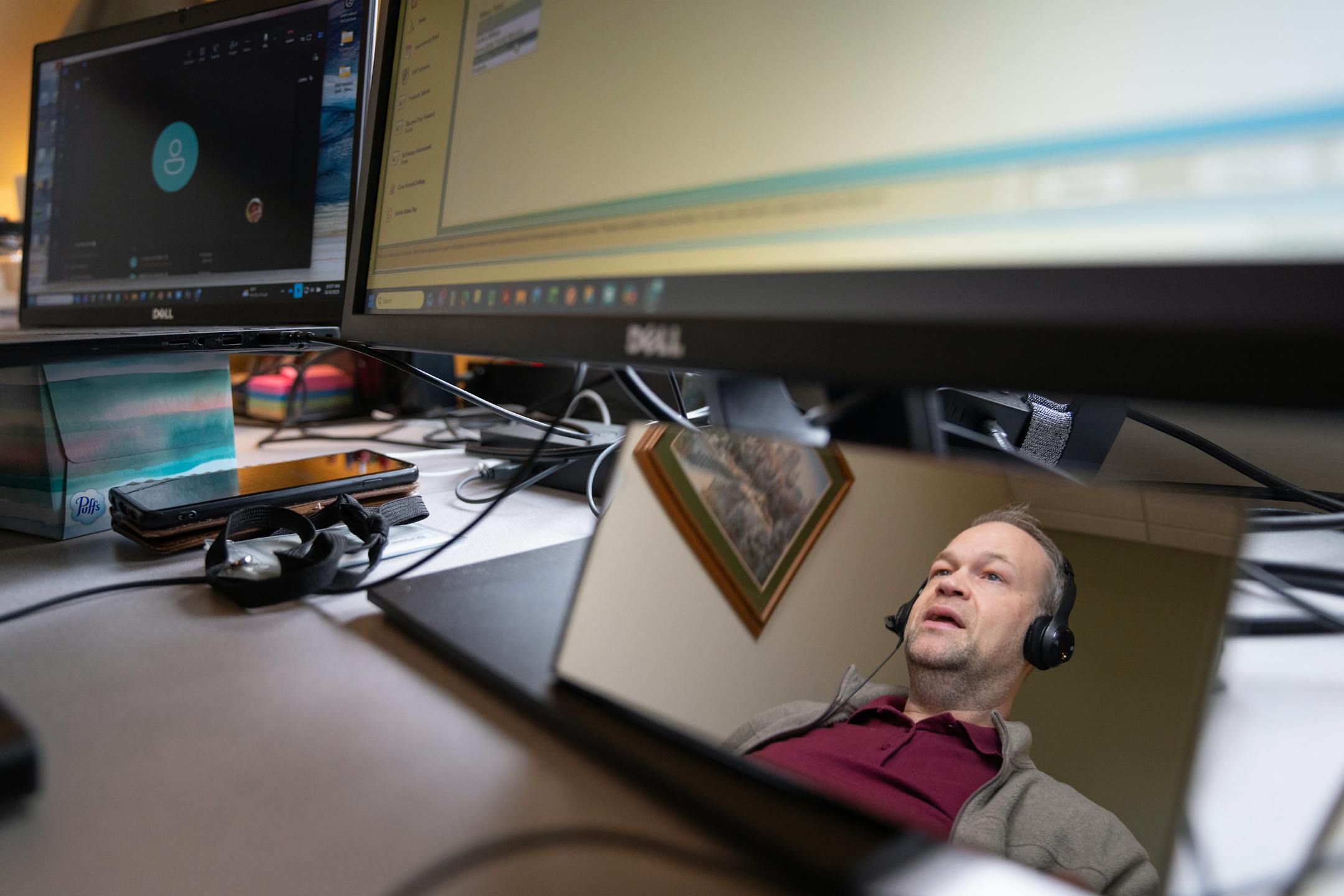

Dan Park, a financial counseling supervisor at LSS Financial Counseling, conducts a call with a client at Lutheran Social Service in St. Paul on Thursday. (Alex Kormann/The Minnesota Star Tribune)

Online loans starting to spiral

Bankruptcy filers that week listed credit cards and medical bills most frequently. Loans from financial technology, or fintech, companies such as OneMain Financial, Reach Financial and Prosper appeared in dozens of filings, about as often as student loans.

Online loan providers, which offer quick cash to pay bills or consolidate debt, have largely replaced brick-and-mortar payday lenders, Lundberg said. Fintech lenders typically won’t agree to the repayment plans that programs like LSS negotiate, she said, leaving debt-holders with few options.

“It’s like, ‘Well, I can spit on this campfire.’ But the forest fire behind you is the fintech loans,” Lundberg said.

Also increasingly popular are buy-now-pay-later loans from providers such as Affirm, Afterpay and Klarna, which FICO announced in June it will start factoring in to credit scores this fall. For many consumers, these loans have shifted from a discretionary spending tool to a means of covering basics like groceries and medical bills, according to a September LegalShield report.

“The old layaway system has changed completely,” said Rebecca Carter, an attorney with LegalShield, in a statement. “This isn’t just a simple purchasing arrangement with minimal risk. There are hidden terms and conditions, potential interest charges and a reliance on credit that can be difficult to navigate and control.”

Costs keep rising

The Minnesota Debt Fairness Act, which Gov. Tim Walz signed into law last year, limits wage garnishment and collections along with other consumer protections, especially related to medical debt.

A key provision of Minnesota’s law is a ban on medical debt reporting to credit bureaus, which more than a dozen other states have also instituted. While the Biden administration allowed states to implement these bans, the Trump administration is moving to override them.

Medical debt “is always a problem,” said Ron Lundquist, a bankruptcy attorney based in Eagan. Consumers under financial pressure tend to pick high-deductible plans, which can quickly spiral into tens of thousands of dollars in debt, he said.

Though completing the bankruptcy has lifted a weight for Del Real, of Lakeville, she’s waiting for the other shoe to drop.

She received her own life-altering medical diagnosis last year, but between caring for her husband and working her retail job, she has little time for herself or anything else. The couple’s former life — filled with travel and time outdoors — has ended.

“Now,” Del Real said, “it’s just dealing with everyday life.”

She will work, she said, until she no longer can.