With 2nm mass production just around the corner, speculation had been swirling that TSMC might charge 10–20% more for its next-gen node compared with 3nm. But with advanced-node capacity already stretched thin, industry sources say the foundry giant moved early—reportedly alerting clients as far back as September to its 2026 price hike plans, according to Commercial Times, the Economic Daily News and TechNews.

The reports…

With 2nm mass production just around the corner, speculation had been swirling that TSMC might charge 10–20% more for its next-gen node compared with 3nm. But with advanced-node capacity already stretched thin, industry sources say the foundry giant moved early—reportedly alerting clients as far back as September to its 2026 price hike plans, according to Commercial Times, the Economic Daily News and TechNews.

The reports note that TSMC has been notifying clients since September about a four-year consecutive price hike for its sub-5nm nodes—covering 2nm, 3nm, 4nm, and 5nm—set to begin in January 2026, with average increases of around 3–5%. Commercial Times adds that prices for TSMC’s 3nm family could rise by single digits annually, leading to double-digit cumulative gains over time.

On the other hand, the Economic Daily News, citing institutional investors, suggests a 3-10% price increase in 2026 for advanced nodes otherwise.

Industry sources cited by Commercial Times say TSMC’s early pricing talks are driven by ongoing supply shortages of AI and high-performance computing (HPC) chips. With AI PCs, autonomous vehicles, and industrial robots gaining traction, demand for sub-5nm nodes is set to soar.

As Commercial Times highlights, major clients—NVIDIA, AMD, Qualcomm, MediaTek, and Apple—are all relying on TSMC’s most advanced nodes. Qualcomm and MediaTek are expected to follow Apple, the first 2nm adopter, in ramping up production on the enhanced N2P process, pushing TSMC to speed up its mass production timeline. The report also notes that A16 is expected to enter trial production in March 2026, with NVIDIA’s Feyman likely to be its first adopter.

6/7nm Likely Impacted

However, TechNews notes that following this trend, TSMC has reportedly shifted a large portion of its workforce and resources from mature nodes to its sub-5nm technologies, creating a ripple effect across the production lineup. Output at 6nm and 7nm nodes has reportedly declined, and while major clients like NVIDIA have moved orders to 5nm and 4nm—temporarily freeing older capacity—TSMC’s reallocation of equipment and manpower could leave other, less-connected customers facing supply constraints for mature nodes starting in 2026, the report warns.

According to TSMC’s latest earnings report, advanced technologies already accounted for 74% of revenue in 3Q25, with 5nm at 37% and 3nm at 23%. Analysts forecast that as 2nm enters mass production next year, advanced nodes will contribute more than 75% of the company’s total revenue, as per Commercial Times.

Read more

- [News] TSMC 2nm Reportedly Up 10–20%, Far Below Rumored 50%; 3–7nm to Rise Single-Digit in 2026

- [News] TSMC’s 2nd Arizona Fab Reportedly to Install 3nm Gear in 3Q26, U.S. Price Hikes Likely over 10% Next Year

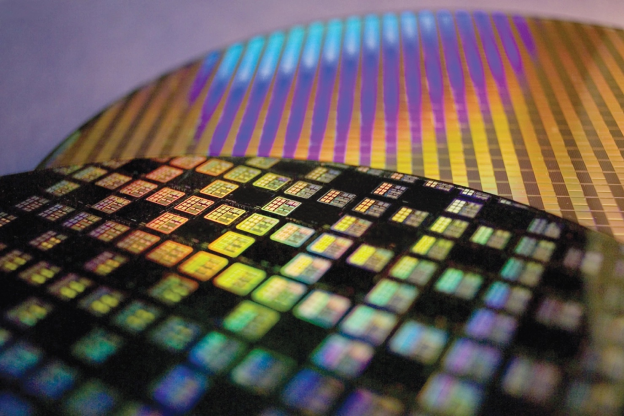

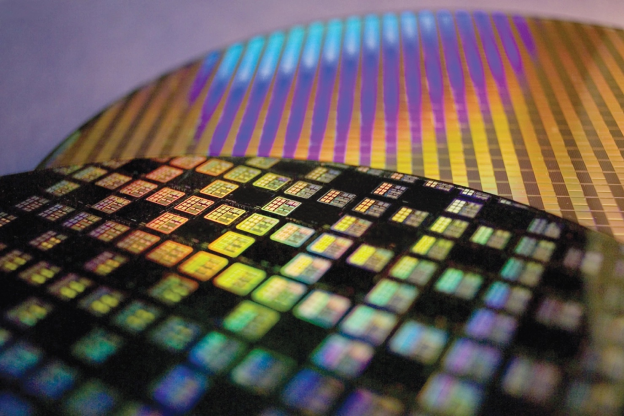

(Photo credit: TSMC)