According to TrendForce’s latest memory spot price trend report, regarding DRAM, while DDR4 and DDR5 spot prices have been climbing due to sellers holding back, quotes for DRAM chips have already surpassed module quotes, signaling a likely short-term surge in module prices. Meanwhile, in NAND, 512Gb TLC NAND wafer spot prices jumped 17.1% this week to US$6.455. With tight supply expected to persist, price hike momentum could continue into next quarter. Details are as follows:

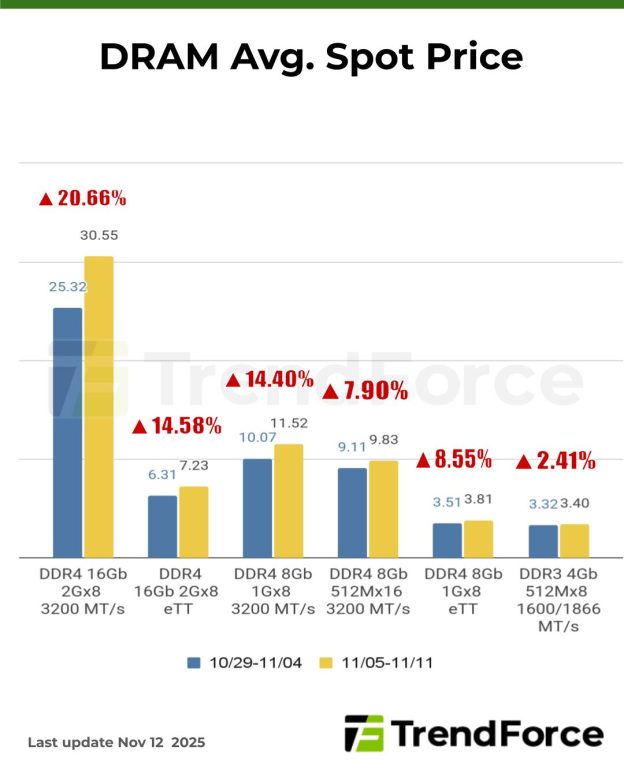

DRAM Spot Price:

In recent weeks, spot prices of DDR4 and DDR5 products have been climbing due to sellers holding back. However, because sellers in the spot market are releasing very …

According to TrendForce’s latest memory spot price trend report, regarding DRAM, while DDR4 and DDR5 spot prices have been climbing due to sellers holding back, quotes for DRAM chips have already surpassed module quotes, signaling a likely short-term surge in module prices. Meanwhile, in NAND, 512Gb TLC NAND wafer spot prices jumped 17.1% this week to US$6.455. With tight supply expected to persist, price hike momentum could continue into next quarter. Details are as follows:

DRAM Spot Price:

In recent weeks, spot prices of DDR4 and DDR5 products have been climbing due to sellers holding back. However, because sellers in the spot market are releasing very limited quantities, transaction volumes have remained relatively low. Notably, quotes for DRAM chips (US$ per Gb) have already surpassed quotes for modules of the same capacity, and the price difference is substantial. TrendForce believes that in the short term, the spot market will see a rapid rise in module prices, narrowing the gap with chip prices. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 7.10% from US$11.071 last week to US$11.857 this week.

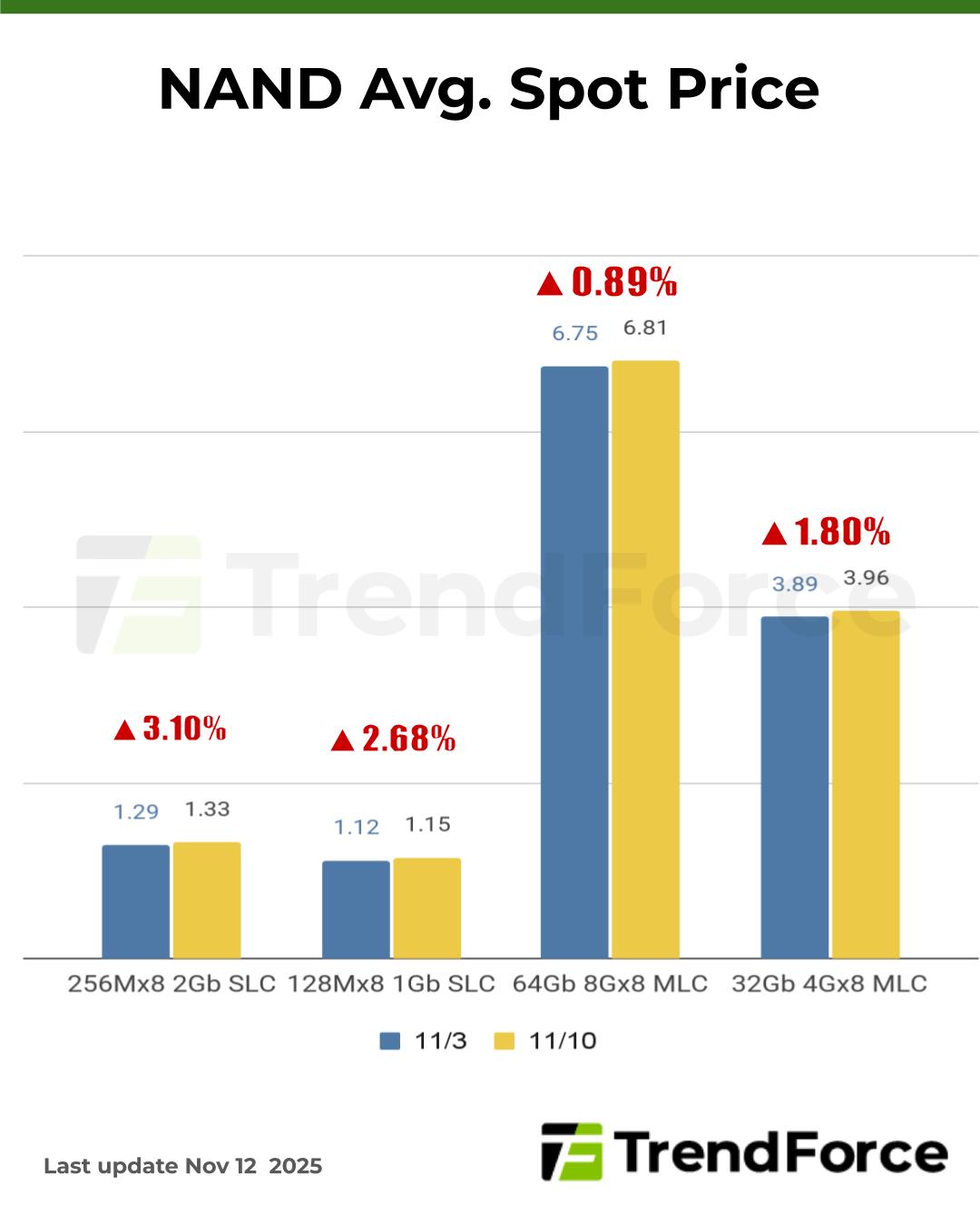

**NAND Flash Spot Price: **

The spot market has further intensified in sentiment from the strong pull of the contract market, followed by significant increases in price hikes and frequency of quotations. Small and medium-sized buyers, who are unable to acquire products from suppliers, are starting to procure from the spot market. With that said, spot traders are postponing shipment and becoming reluctant in sales due to scarcity of spots, thus resulting in restricted transactions but ongoing increment of prices. Spots of 512Gb TLC wafers rose by 17.07% this week, arriving at US$6.455. The spot market is expected to remain constrained for the short term, and the momentum of price hikes could last until the next quarter. However, prospect of spots could somewhat drop in early 2026 if contract prices surge expeditiously or if end demand defers.